Market Brief

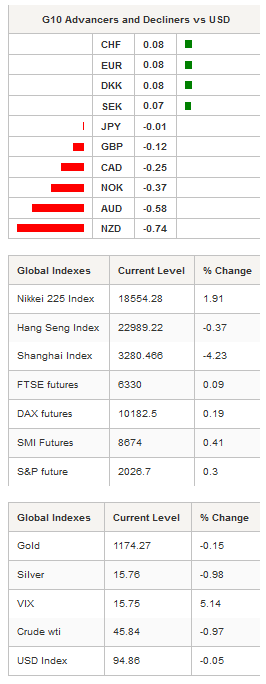

The Japanese trade deficit narrowed to ¥114.5bn in September from a revised deficit of ¥569.4bn in the previous month. However, disappointment was running high in the market as a trade surplus of ¥87bn was expected, according to a Bloomberg survey. Export growth eased down to 0.6%y/y from 3.1% in August, below the median forecast of 3.8%. Imports contracted less-than-expected by 11.1%y/y versus 12% consensus. As a result, the Japanese yen lost ground against the US dollar as economic data from Japan cast a cloud over recovery. USD/JPY is now heading towards the centre of its monthly range at around 120. We expect the yen to remain offered as bad news keeps piling up, with the 122 level as the next target. The local equity indices, the Nikkei and the Topix index, are up 1.91% and 1.84% as traders price in a potential increase of the BoJ’s stimulus.

In Australia, the Westpac leading index confirmed that the Aussie economy bottomed and is successfully adjusting to the low commodity prices environment. The index rose 0.1%m/m in September after having contracted -0.3% in the previous month. However, the Aussie is not immune to a further drop in commodity prices. The pressure from China on iron prices remains elevated and will likely persist into the foreseeable future. This morning, AUD/USD escaped the symmetrical triangle on the downside and is now heading toward $0.72. The closest support stands at 0.7199 (low from October 14th).

On the equity front, traders are struggling to find a clear direction in Tokyo. Chinese mainland stocks dropped sharply with the Shanghai Composite down 4.23% and the Shenzhen Composite down 6.07%. In Australia, the S&P/ASX is up 0.24% while in New Zealand the S&P/NZD rose 0.39%.

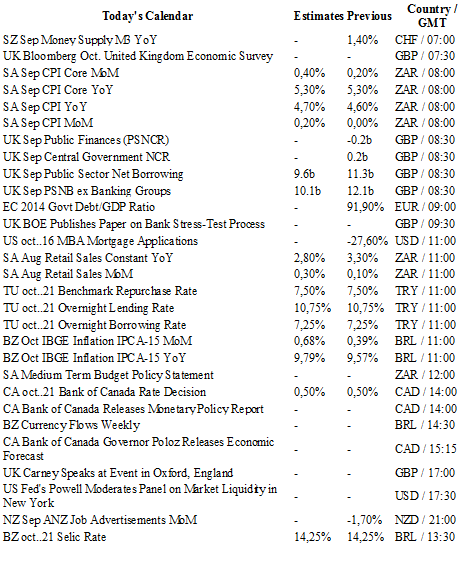

Today will be a busy day for central bankers. The bank of Turkey, the BoC and the BCB will release their rate decision later today. All of them are expected to leave rates unchanged. In Turkey, the benchmark repurchase rate, the overnight lending rate and the overnight borrowing rate stand at 7.50%, 10.75% and 7.25%, respectively. In Canada, the overnight lending rate is at 0.50%, while in Brazil, the Selic rate remains at 14.25% since July 2015.

Currency Tech

EUR/USD

R 2: 1.1714

R 1: 1.1561

CURRENT: 1.1353

S 1: 1.1106

S 2: 1.1017

GBP/USD

R 2: 1.5819

R 1: 1.5659

CURRENT: 1.5424

S 1: 1.5202

S 2: 1.5089

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 119.84

S 1: 118.07

S 2: 116.18

USD/CHF

R 2: 0.9844

R 1: 0.9741

CURRENT: 0.9557

S 1: 0.9384

S 2: 0.9259