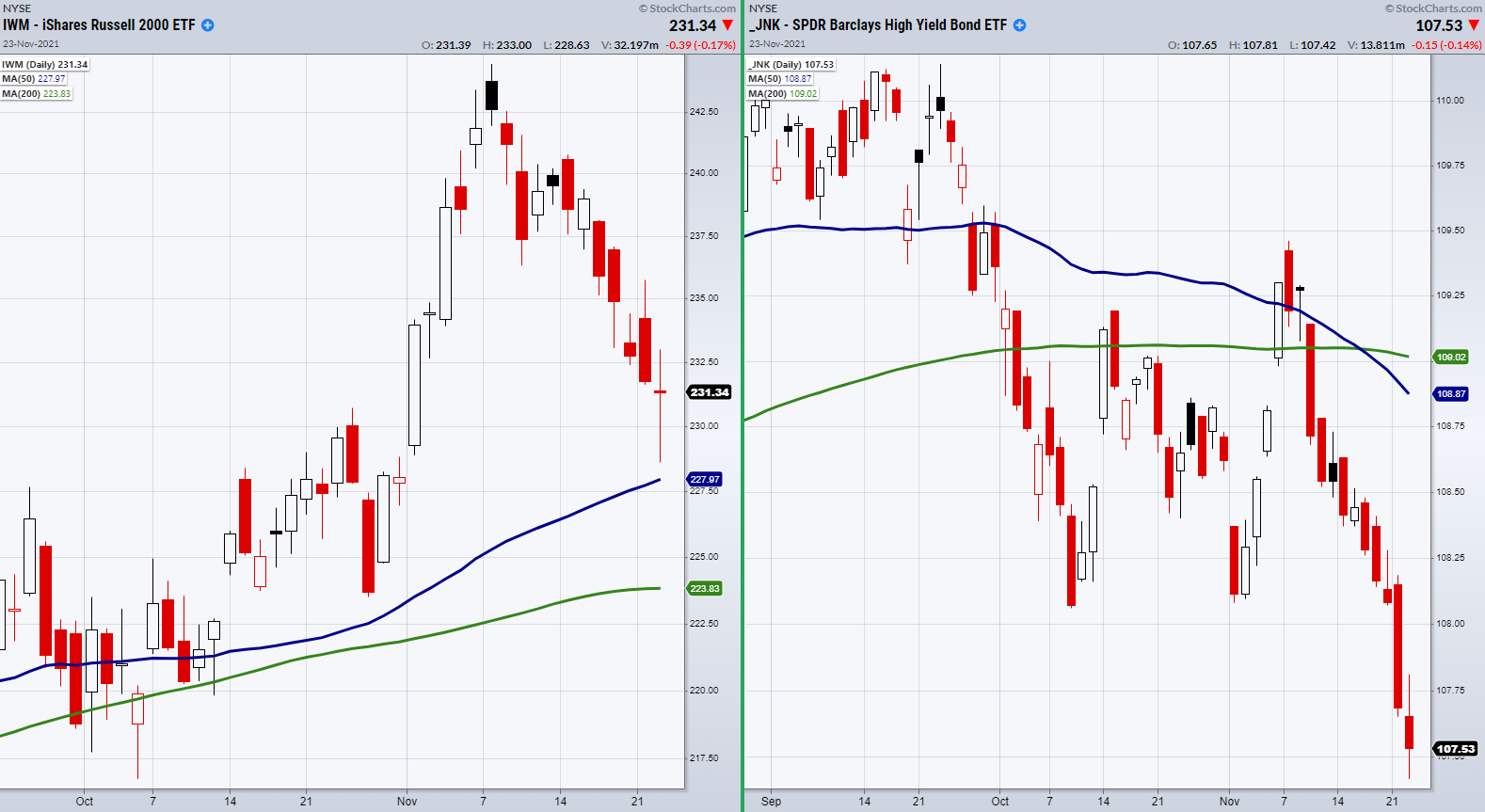

The small-cap Index Russell 2000 (IWM) looks hopeful for a Wednesday bounce while the High Yield Corporate Debt ETF (JNK) sends another warning sign.

Though we are watching all major indices, IWM is the most interesting since it found intraday support near its 50-Day moving average at $228.06. It should be noted that none of the other major indices are as close to a major moving average as IWM.

On the other hand, High Yield Corporate Debt (JNK) has recently broken main support at $108.06. This shows that investors’ appetite for risk has waned as JNK tends to move higher in a bullish environment. Therefore, if IWM is going to turn around, we should also watch for JNK to do the same.

Nonetheless, if IWM pushes higher while JNK continues to break down, a bounce could be short-lived. However, with a potential bounce setting up, let’s look at the strongest members of Mish’s Economic Modern Family for trade ideas.

Currently, Transportation via iShares Transportation Average ETF (NYSE:IYT) and the Regional Banking sector via SPDR® S&P Regional Banking ETF (NYSE:KRE) are the top performers of this week.

As seen in the above charts, KRE along with IYT was able to close over the prior day's low showing extra strength compared to IWM which closed almost flat on the day at -0.26%

With that said, for Wednesday, watch for KRE to clear resistance at $75.59 and for IYT to stay over its 10-DMA at $275.83. These will be pivotal levels for each to clear or stay over.

One last sector to watch is Retail (XRT). If transportation can head higher, watch for XRT to follow as both at times can trend together.

ETF Summary

- S&P 500 (SPY) 464.45 new support to hold.

- Russell 2000 (IWM) 228.06 support the 50-DMA.

- Dow (DIA) Watching 355.34 to hold.

- NASDAQ (QQQ) Was able to close over the 10-DMA at 396.70, however, has better support from Tuesday's low at 392.92.

- KRE (Regional Banks) 75.59 resistance.

- SMH (Semiconductors) Watching to hold over the 10-DMA at 303.52.

- IYT (Transportation) 270.89 support.

- IBB (Biotechnology) Needs to hold over 152.41.

- XRT (Retail) Watching to hold over the 10-DMA at 102.32.

- Junk Bonds (JNK) Watching to find support.

- SLV (Silver) 21.79 the 50-DMA.

- USO (US Oil Fund) Looking for a rally back to highs.

- TLT (iShares 20+ Year Treasuries) 144.46 support area.

- DBA (Agriculture) 19.92 the 10-DMA minor support