Good day traders!

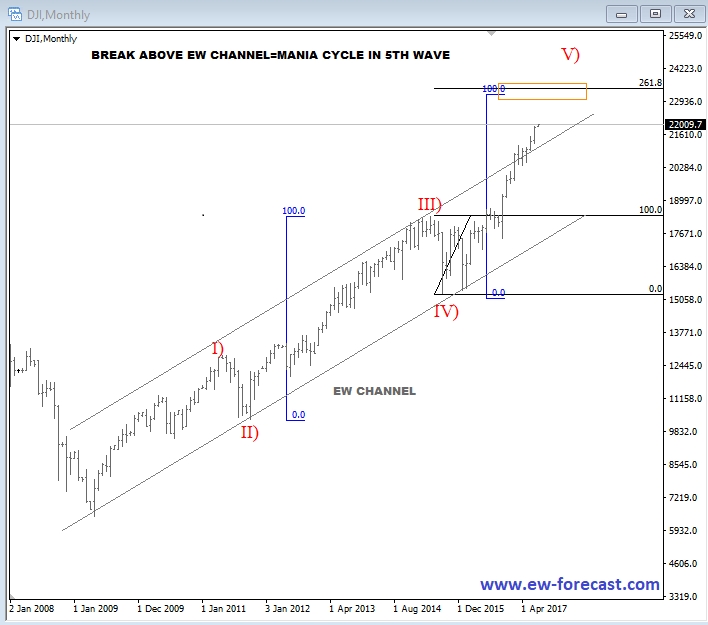

German DAX and S&P 500 are in negative correction for the last few weeks; with US market trading at all-time high while DAX lost nearly 7% since June 20th high. Technically we see US markets entering into bullish mania phase with DJIA breaking above the upper trendline of an EW channel.

We may see fifth wave rally to continue up to 24000-25000. Mania cycle is also confirmed by Charles Schwab reports that clients opened the highest number of brokerage accounts in the first half of 2017 since 2000 as highlighted in article by ZeroHedge. Keep in mind that from 2000 peak DJIA lost nearly 40% in two years and S&P 500 fell nearly 50%. However, I don’t think that top is near yet, as EW model appears incomplete; it suggests more upside in coming months.

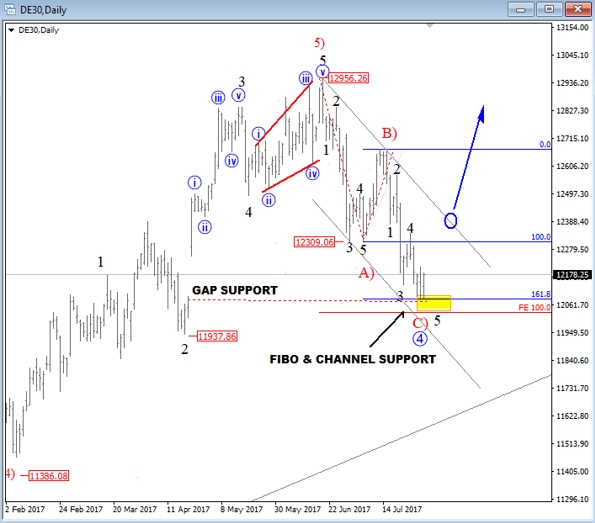

So if we go back to DAX and US markets correlation, I think that DAX can see more upside and join the mania phase as well while DJIA is trading towards projected levels. In fact, DAX came down in three waves to fill gap around 12000, which can prove out to be a good support area. Break above the upper channel resistance line can be an important evidence that European and US markets are going back into positive correlation. Higher DAX should also impact the EUR/USD moves.

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All our work is for educational purposes only.