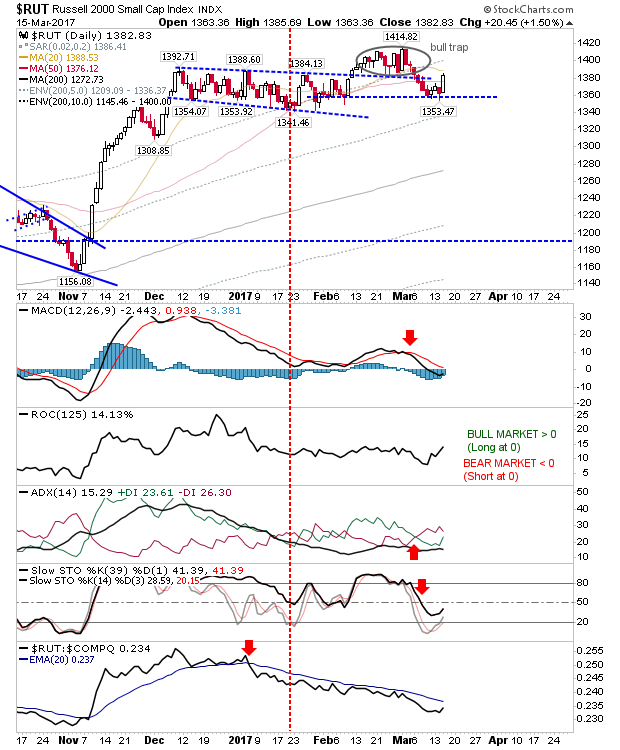

Bulls are looking to build swing lows with some respectable buying across markets. Best of the market action went to the Russell 2000, gaining 1.5% with a close near yesterday's highs. The gain was enough to return the index above the 50-day MA, but there wasn't much technical improvement.

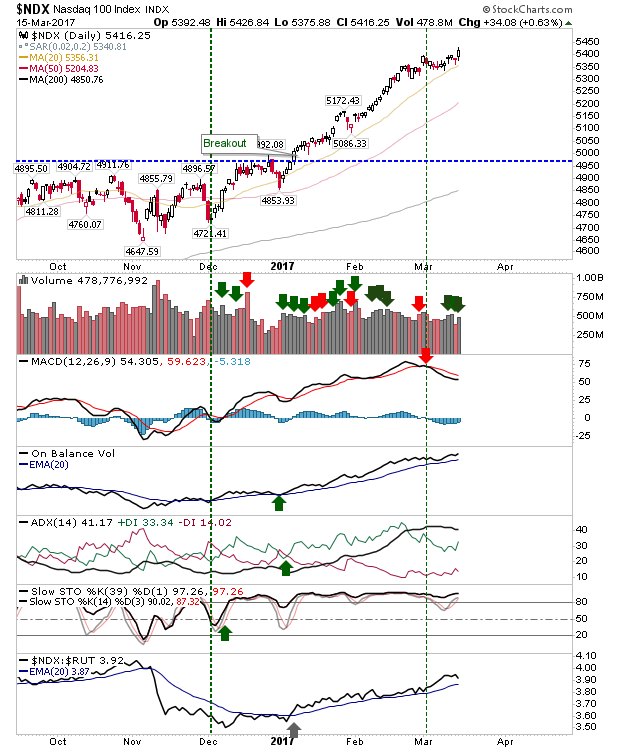

The NASDAQ 100 played to its strong trend as the year's market outperformer posted a new closing high on higher volume accumulation. The only negative was the holding MACD trigger 'sell', but more action like we saw yesterday will quickly rectify that. Stops can be trailed along the 20-day MA.

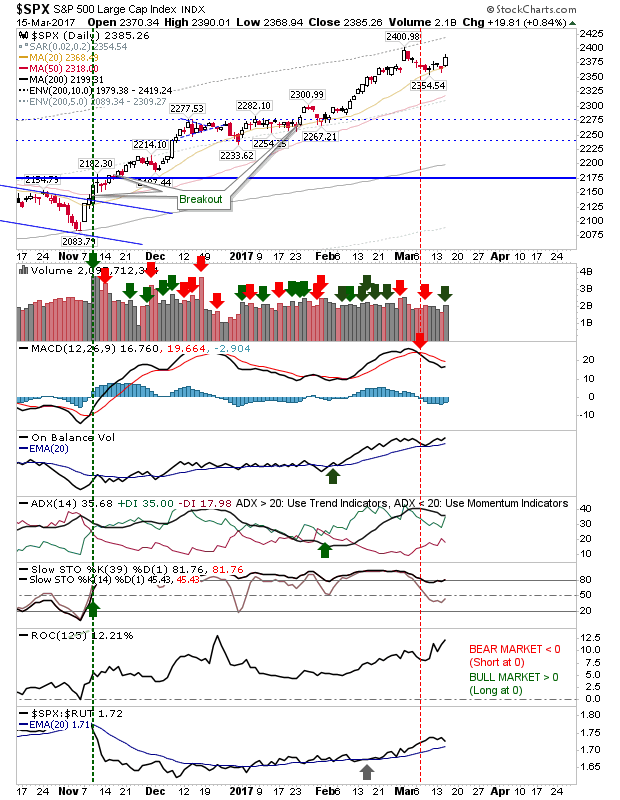

The S&P also enjoyed an accumulation day with a respectable buying day. It may yet challenge the recent highs, but it will take another couple of days of buying before this will happen.

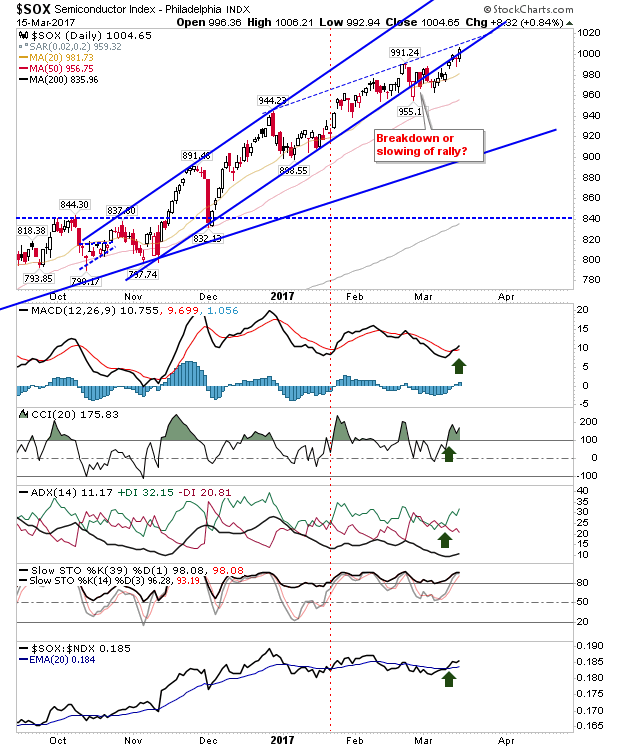

The Semiconductor Index also enjoyed a solid day yesterday. While it managed new highs on a fresh MACD trigger 'buy', it hasn't yet cleared resistance which would negate a potential shorting opportunity. However, if it can break past the hashed blue line it would open up for a move to the solid blue line of the rising channel (a decent long trade).

For today, look for more of the same with buyers holding the upper hand. Long stops go on a loss of swing lows.