“The Maginot Line, named after the French Minister of War André Maginot, was a line of concrete fortifications, obstacles, and weapon installations built by France in the 1930s to deter invasion by Germany and force them to move around the fortifications. The Maginot Line was impervious to most forms of attack, including aerial bombings and tank fire, and had underground railways as a backup.” – Wikipedia

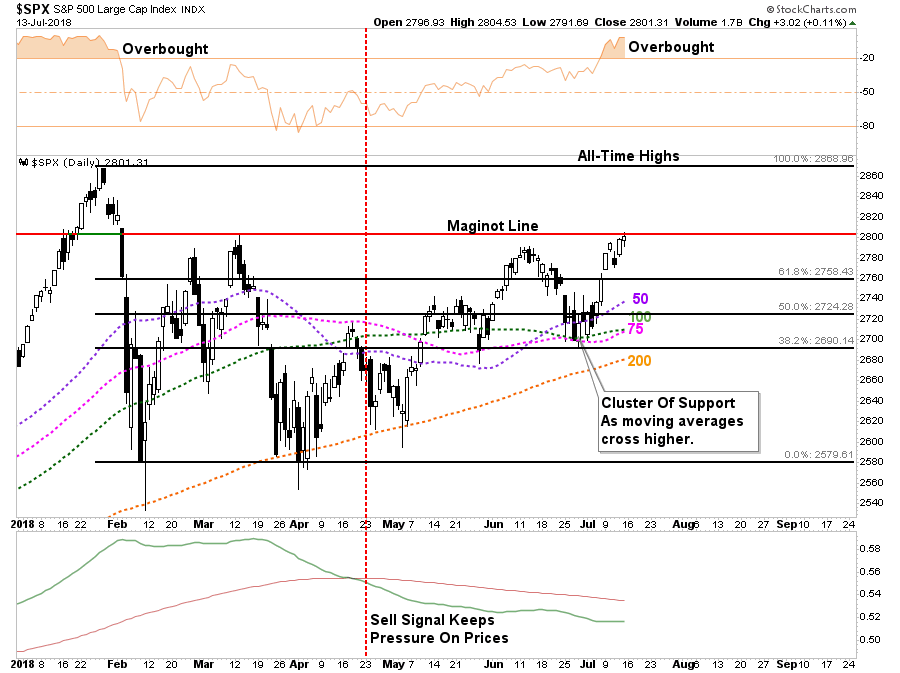

For the market, the bulls are currently testing the respective “Maginot Line” going back to February of this year.

While the longer-term sell signal remains intact currently, the market has now risen enough to test the last line of resistance standing between the “bulls” and a charge to this year’s highs. With the NASDAQ hitting all-time highs on Thursday, it is now quite likely traders will try to also push the S&P 500 to new highs as well.

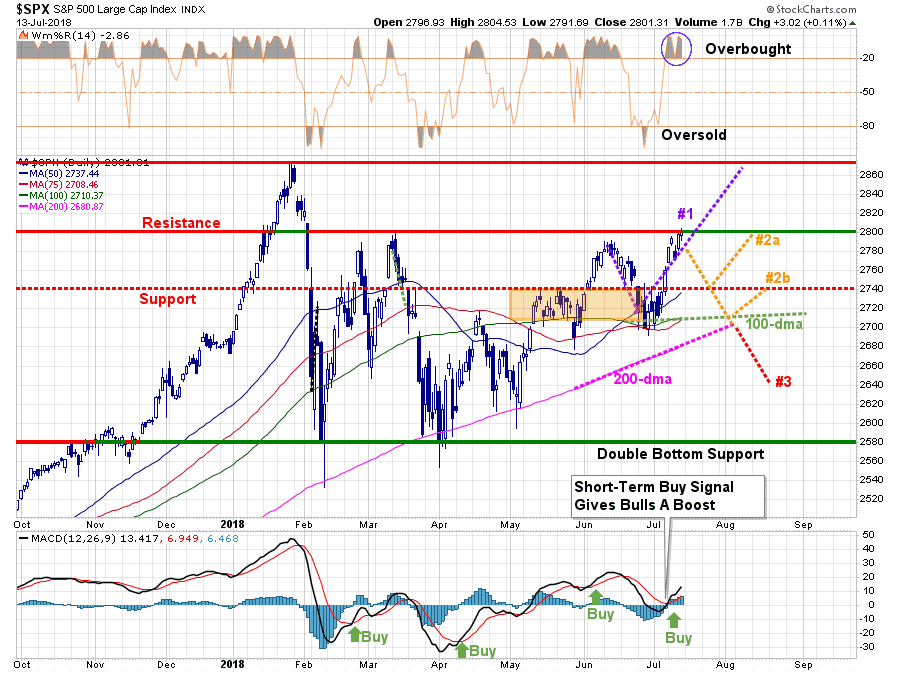

However, as of now, the market stands at a critical juncture. As we laid out a couple of week’s ago, it continues to be a “battle of wills” between the bulls and bears. A break above current resistance will bring Pathway #1 into focus as a push to previous highs becomes a very high probability event. If, however, the market fails to move higher, then Pathway #2 will suggest a retest of recent support at the 50-dma which has now also turned positive. The cluster of support which has gathered around the 100-dma reduces, but doesn’t eliminate, the probabilities of a larger drawdown in the short-term.

As I stated previously, these “pathways” are not predictions. The analysis is used to make some “assumptions” about where the markets will likely head given the various risks we are currently weighing in our portfolio allocation models.

Those risks include:

- Trade risk

- Yield curve

- Tweets from the White House (who would have ever thought such would be a risk)

- Interest Rates

- Monetary Policy

- Earnings

- Geopolitical

- Corporate Guidance

You get the idea.

For now, the risk of a bigger correction has been somewhat mitigated particularly as we move deeper into earnings season. Earnings should be somewhat supportive to the bulls as once again, miraculously, there will be a high “beat rate” of earnings estimates. Of course, this is always the case as estimates are lowered prior to entering earnings season so the bar is set low enough to achieve “beat rates.”

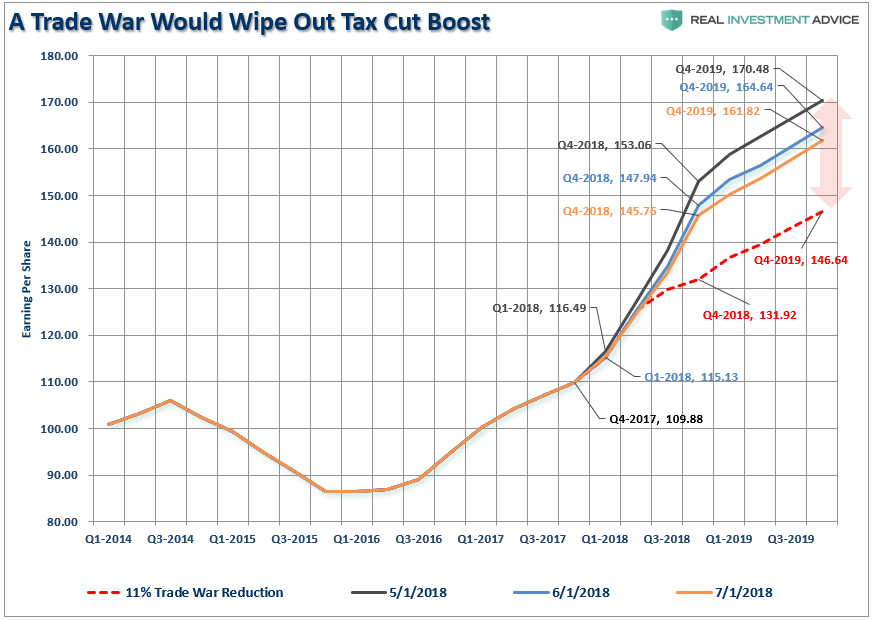

In just the last two months, estimates have been lowered sharply. The reality is that if analysts were required to stick to their initial estimates; 1) roughly all companies would fail to exceed their goals, and; 2) Wall Street would be much more prudent, and honest, about their estimates.

But, while that is a philosophical argument, the reality is that we must also “play the game,” and lowered earnings estimates will make “earnings season” more supportive for the bulls.

The “risk” will be the “forward guidance” as companies start talking about the risk to higher commodity prices, a strong dollar, and tariffs. The chart makes an adjustment to account for the risk of a trade war which could effectively eliminate the benefit of the “tax cut” boost entirely.

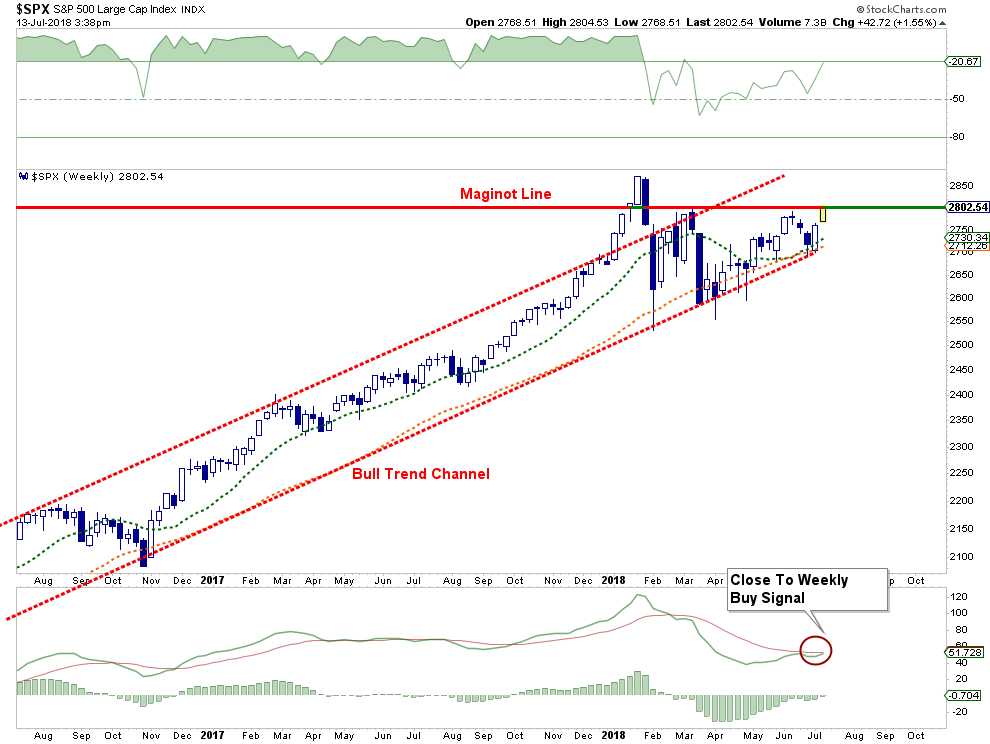

On a weekly basis, the bull’s “Maginot line” becomes clearer.

A couple of weeks ago, I “jumped the gun” and assumed that a weekly “buy” signal was about to be triggered. I quickly relearned my lesson to wit:

“I made a mistake. It happens.

While we strictly adhere to our discipline, sometimes we have to relearn lessons the hard way.

‘Last week, I wrote:

However, if you are so inclined, the pullback to support last week does provide an opportunity to increase exposure modestly. (I said modestly, not ‘jump in with both feet.’)’

That was a mistake as I was ‘anticipating’ a reversal of the ‘sell signal.’ ‘Anticipation’ is an emotion and has no place in portfolio management.

Lesson learned, once again.”

Of course, it is hard to believe that just a few weeks ago we were sitting basically where we are today. With the markets rallying, bullish optimism rising, and the market close to registering a “buy signal,” this time looks a whole lot like “last time.” However, the question is now whether the bulls can succeed where they failed previously.

This coming week, either the bulls will breach the “Maginot Line” and claim “victory,” or they will be repelled back to defensive positions.

Currently, based on the very short-term risk/reward analysis, we find the bulls have the edge. With our portfolios are already mostly exposed to equity risk, there isn’t much for us to do expect to wait for a confirmed break higher to begin moving portfolios back to full target allocation weightings.

Bearish Milestone

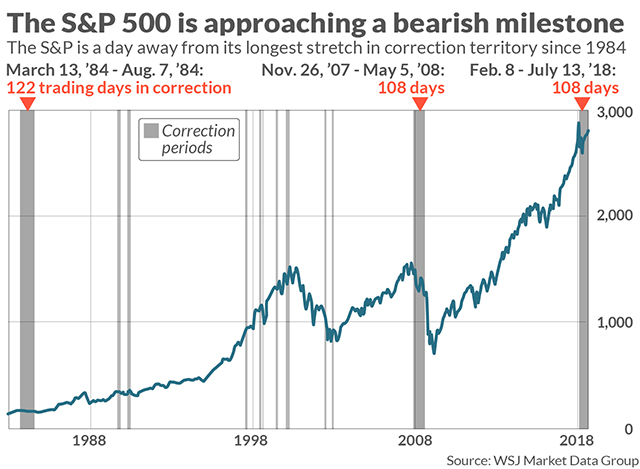

Ryan Vlastelica had an interesting post at MarketWatch last week discussing the long “correction” periods. To wit:

“Amid months of rangebound trading, neither index has been able to fully recover and notch new records, which is what would be needed for them to exit correction territory.

Including Friday, both the Dow and the S&P have been in correction territory for 108 trading days. This matches the longest such stretch since the financial crisis in 2008.

Should the two primary market gauges stay in correction through the close of trading on Monday, that will mean they are in their longest such stretch since 1984. In that stretch, it took the S&P 122 days to emerge from correction territory, and the Dow 123 days, according to the WSJ Market Data Group.”

“Despite the bearish record that could be set on Monday, the market is also nearing a more positive milestone. On a total-return basis, the S&P 500 is just days away from its longest stretch above its 200-day moving average in its history.”

There are two very important takeaways from this article.

The first is that long-corrective periods tend to ultimately resolve themselves relative to the level of valuations.

- The long corrective period that ended in 1984 was just coming out of the 1974 crash and two back to back recessions. Valuations were extremely depressed at the time and inflation and interest rates were high and falling.

- The next series of corrections that started in 1998 were early warning signs to a market frenzy but the bigger corrective period preceded the “dot.com” crash. Valuations were elevated and rates and fears of inflationary pressures were rising.

- The next corrective periods were near the 2003-2004 lows of the market as the markets begin to consolidate the bear market bottom. Valuations had fallen markedly, rates and inflation were falling, and excesses had been wrung out of the markets.

- Following the credit-driven rise in the market from 2004-2007, the market once again began a long consolidation period which marked the top of the bull market cycle. Once again, rates and fears of inflationary pressures were rising, the Fed was tightening monetary policy, and valuations were elevated.

Where are we today?

Are valuations low with rates and inflationary pressures falling? Or, is it the opposite?

The second point from Ryan was noting the S&P 500 is about to achieve its longest, total-return, run in its history.

- What happened the last time such an incredible feat was achieved?

It is worth remembering that “records are records for a reason.”

Records are never achieved at the beginning of a cycle.

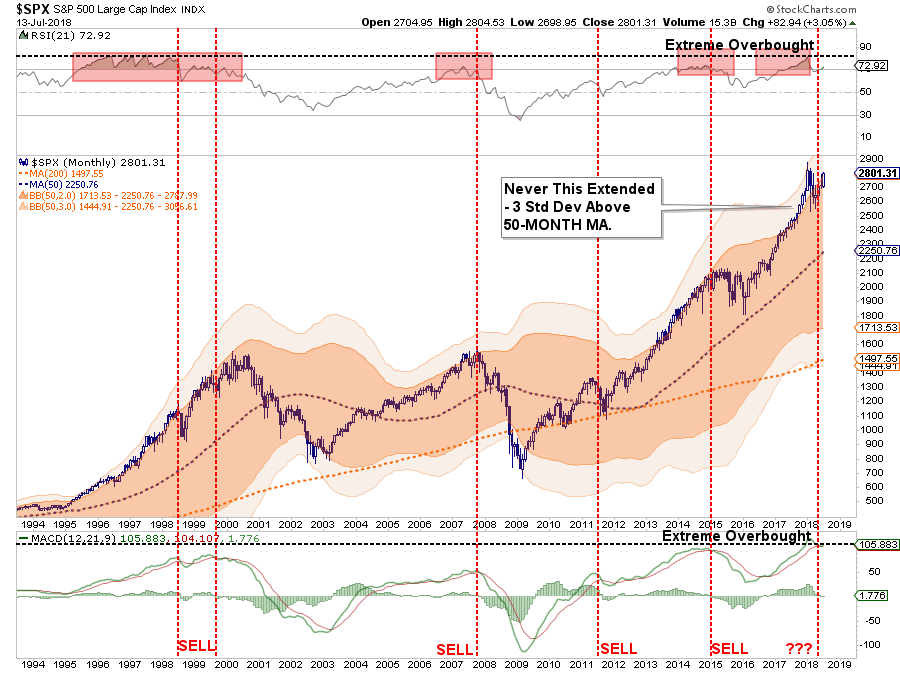

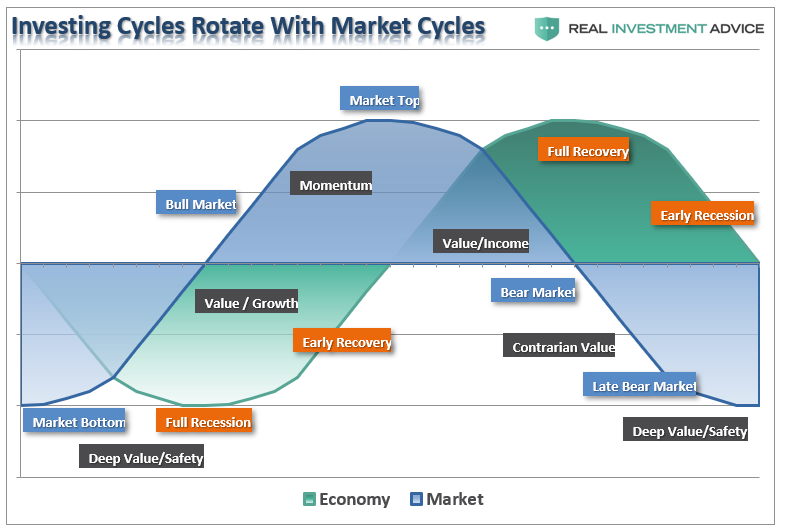

Momentum Is The Last Stage Of The Investment Cycle

While our short and intermediate-term views are more bullishly biased, we are most definitely long-term bears. Ryan’s data points above further support that view.

The laws of physics apply to the markets just like everything else in life. Trying to deny those laws is akin to saying “gravity doesn’t exist.”

Currently, there is little doubt that we are in both the late stages of an economic cycle and a momentum-driven market. Breadth has narrowed substantially, valuations are elevated, rates and inflationary pressures are rising, and price deviations and overbought conditions are at extremes.

From an investment standpoint, we must maintain an investment focus which is adjusted to current market dynamics. As stated, given we are in a “momentum” market, we must adopt strategies that incorporate relative strength and momentum based measures. The chart below shows the overlay between market and economic cycles and investing strategies.

Momentum cycles are the “last phase” of an investment/market cycle. Eventually, momentum will give way to a “mean reversion” process at which point our focus will switch to a valuation-based strategy.

But this is the risk that most investors are overlooking currently as individuals chase“hot stocks.” The belief is that if they have doubled once, they will double again.

In the short-term, this is not entirely wrong. There have been many studies published that have shown that relative strength momentum strategies, in which as assets’ performance relative to its peers predicts its future relative performance, work well on both an absolute or time series basis. Historically, past returns (over the previous 12 months) have been a good predictor of future results. This is the basic application of Newton’s Law Of Inertia, that states “an object in motion tends to remain in motion unless acted upon by an unbalanced force.”

In other words, when markets begin strongly trending in one direction, that direction will continue until an “unbalanced” force stops it. Momentum strategies, which are trend following strategies by nature, have been proven to work well across extreme market environments, multiple asset classes and over historical time frames.

While there is substantial evidence that market valuations and fundamentals are not supportive of asset prices at current levels, the “momentum chase” can keep markets “irrational longer than logic would dictate.”

But, not indefinitely.

The problem for solely “fundamentally based” investors is they tend to be slow to react to new information (they anchor), which initially leads to under-reaction but eventually shifts to over-reaction during late cycle stages.

The other inherent problem of primarily data-based investors is the “herding” effect.

As prices move higher, valuation arguments lose relevance. However, the need to produce investment performance in a rising market, leads to “justifications” to explain over-valued holdings. In other words, buying begets more buying.

Lastly, as the markets turn, the “disposition” effect takes hold and winners are sold to protect gains, but losers are held in the hopes of better prices later. The end effect is not a pretty one.

Understanding these issues is why we apply momentum strategies to fundamentally derived investment portfolios. This allows the portfolio to remain allocated during rising markets while managing the inherent risk of behavioral dynamics.

While we discuss the risk of investing as it relates to the destruction of both “capital” and “time,” our portfolio models have remained “bullishly” allocated during the market’s advance. But such will change when the markets change.

Our job as investors is to make money when markets are rising during the first half of an investment cycle, and avoid potentially catastrophic losses during the second half.

For now, the markets are rising, and we need to participate until the trends change. Of course, if your current portfolio management philosophy doesn’t have a method to understand when “trends” have changed, how will you know when it is time to step away from the poker table?

To paraphrase Kenny Rogers:

“As every good investor knows…you gotta’ know when to hold’em, know when to fold’em.”

See you next week.

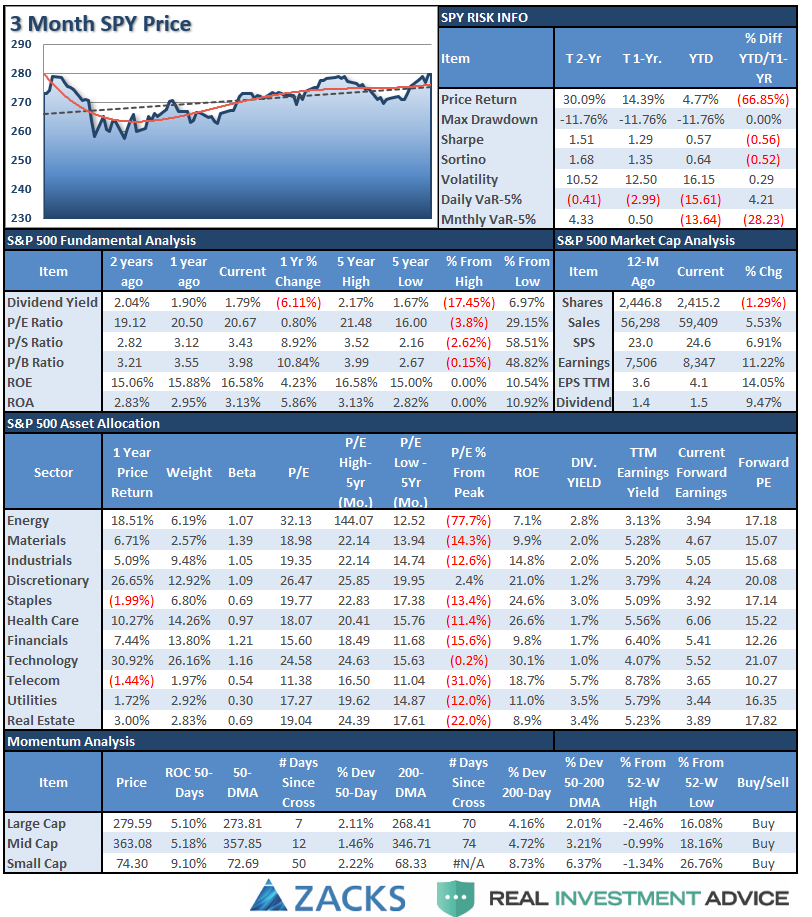

Market and Sector Analysis

Data Analysis Of The Market and Sectors For Traders

S&P 500 Tear Sheet

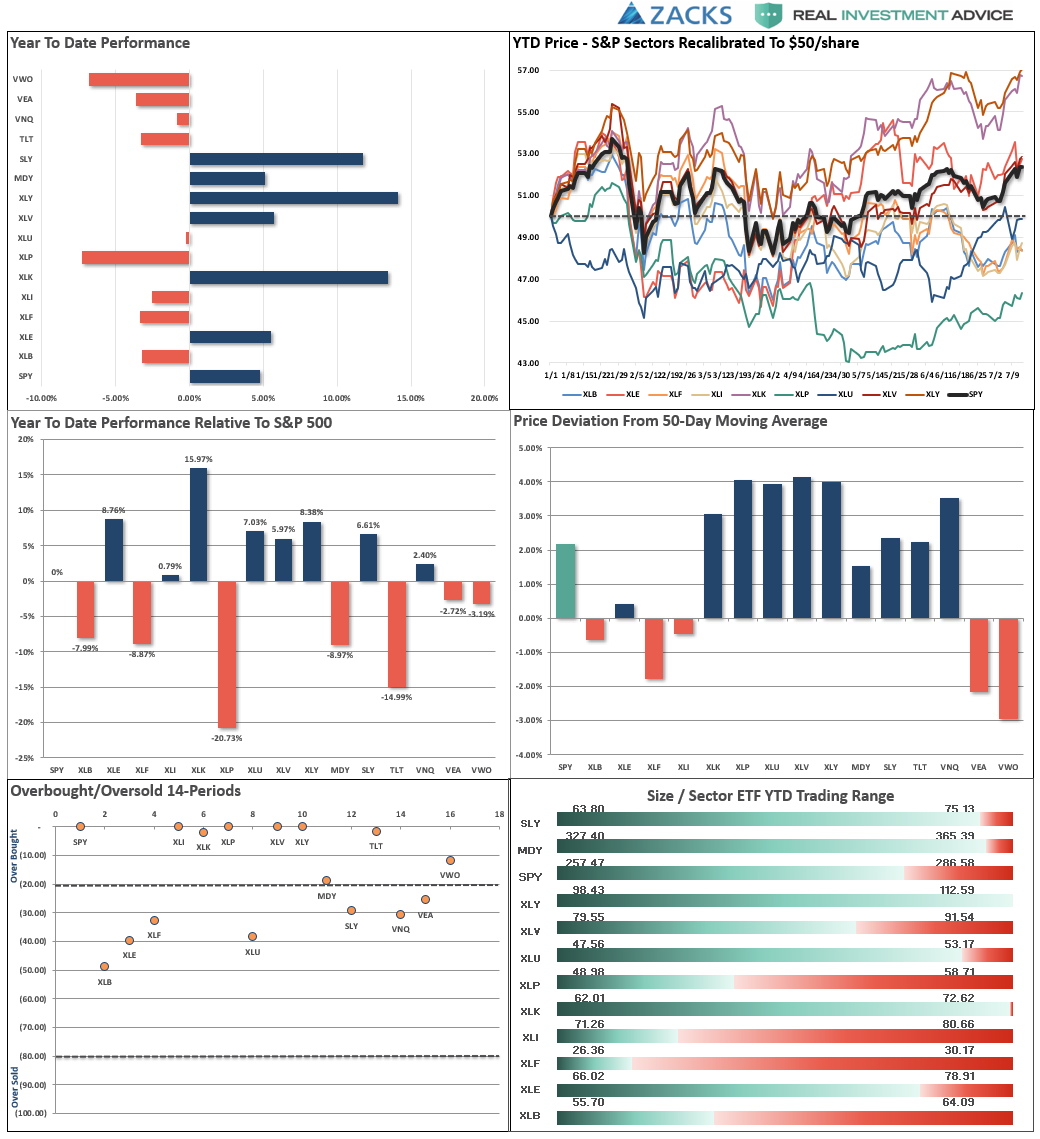

Performance Analysis

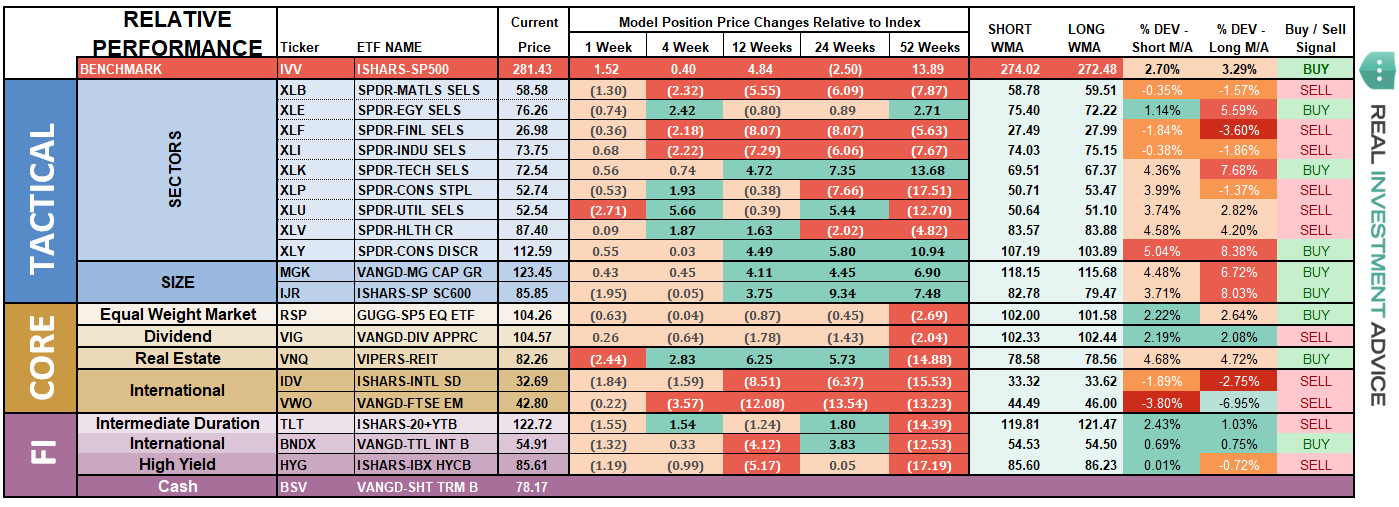

ETF Model Relative Performance Analysis

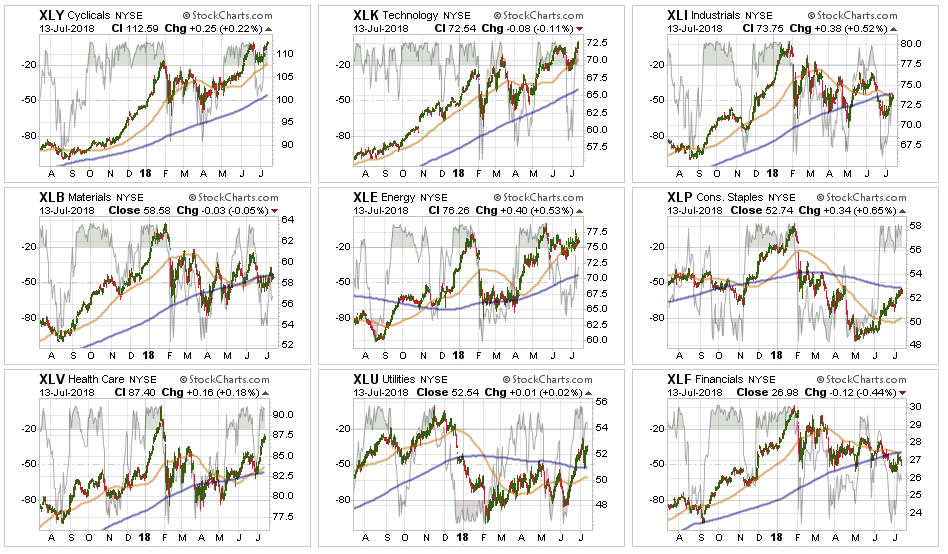

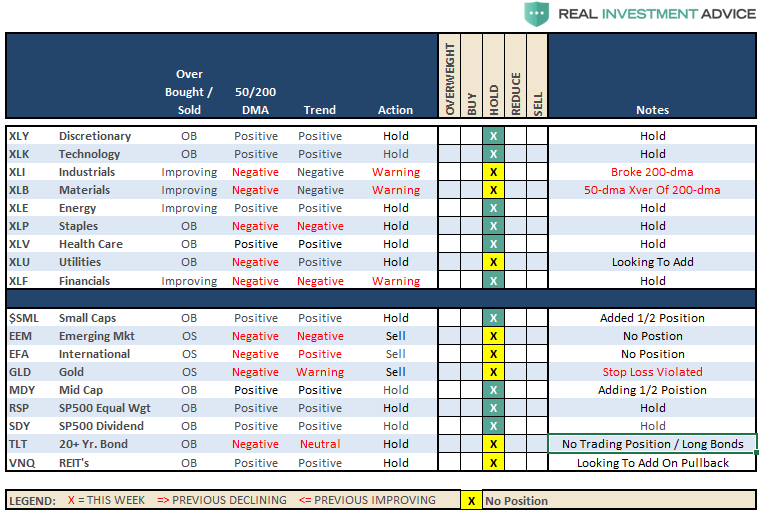

Sector and Market Analysis:

Last week, the market recovered from the pre-holiday sell-off to effectively get back to where they started. Overall, the breadth of rally has remained more substantially narrow as momentum chasing continues to funnel money into fewer names.

Discretionary and Technology stocks continue to lead the charge and with profit taking already completed in these sectors for now, there is little to do except watch and wait for what happens next. The successful retests of support for both sectors keep us allocated accordingly.

Healthcare, Staples, and Utilities continued their performance recently as money has chased very beaten up sectors in a sector rotation move. After adding Staples to our portfolios previously, we are now looking for pullbacks to support that hold to further add to these holdings. Healthcare also remains at target weights for now but is getting very overbought.

Financial, Energy, Industrial, and Material stocks, after a brief spurt of excitement, have all slipped backward. While the trend for Energy remains in place, for now, we remain underweight holdings due to lack of relative performance. We currently have no weighting in Industrial or Materials as the “trade war” continues to negatively impact the companies in the sectors. The decline of the “yield curve” continues to weigh on major banks and, so far, early earnings reports from the sector have been disappointing. We continue to remain underweight the sector as well.

Small-Cap and Mid-Cap continue to lead performance overall. We noted last week, that after small- and mid-caps broke out of a multi-top trading range, we needed a pull-back to add further exposure. We recently added small-cap exposure to portfolios and are maintaining stops at the 50-dma. Any further weakness in the markets that hold supports and we will likely increase exposure further. Note: small- and mid-caps are purely the manifestation of the “momentum” chase. They are highly sensitive to changes in economic growth and tariffs so maintain stops accordingly.

Emerging and International Markets were removed in January from portfolios on the basis that “trade wars” and “rising rates” were not good for these groups. Furthermore, we noted that global economic growth was slowing which provided substantial risk. That recommendation to focus on domestic holdings in allocations has paid off well in recent months. With emerging markets and international markets continuing to languish, there is no reason to ad exposure at this time. Remain domestically focused to reduce the drag on overall portfolio performance.

Dividends and Equal Weight continue to hold their own and we continue to hold our allocations to these “core holdings.”

Gold – we haven’t owned Gold since early 2013. However, we suggested over a month ago to close out existing positions due to a violation of critical stop levels. We then recommended that again given the cross of the 50-dma back below the 200-dma. Then two weeks ago I stated:

“With the 50-dma now back below the 200-dma there is still no reason to own gold currently. If you are long in the metal currently, gold is extremely oversold and a bounce is likely. Use that bounce to reduce holdings for now.”

That bounce came and went. With gold sitting on very short-term support, if you are still long the metal, set your stop to $117. Look to sell on any rally to $121.

Bonds and REITs – Bonds have continued to improve performance despite a continued bullish backdrop to equities. These two things do not generally coincide for long periods, so either, the “bulls” are wrong on stocks or the “bears” are wrong on bonds. I would bet on the latter.

We remain out of trading positions currently but remain long “core” bond holdings mostly in floating rate and shorter duration exposure. REITs are much more interesting now with a break back above their 200-dma and now the 50-dma crossing back above the 200-dma. The sector is extremely overbought, so on a pullback that does violate support, you can increase REIT exposure.

The table below shows thoughts on specific actions related to the current market environment.

(These are not recommendations or solicitations to take any action. This is for informational purposes only related to market extremes and contrarian positioning within portfolios. Use at your own risk and peril.)

Portfolio/Client Update:

The improvement last week has given us the ability to start slowly adding additional equity exposure to portfolios. A confirmed break above the “Maginot Line,” as discussed above, will be short-term supportive of additions. The cluster of support at the 50- and 100-dma remains in place and we are currently evaluating market conditions for small step ups in equity exposure to add to current holdings. Depending on how the market behaves next week, we are still looking to take the following actions across our portfolio models.

- New clients: Will will look to buy 50% of target equity allocations for new clients.

- Equity Model: We previously added 50% of target allocations. Those positions will be “dollar cost averaged” and 1/2 weight of new holdings will be added opportunistically.

- Equity/ETF blended models will be brought closer to target allocations. We will add to “core holdings” and add 1/2 weight to new holdings and bring existing holdings up to target model weights.

- Option-Wrapped Equity Model will be brought closer to target allocations and collars implemented.

Again, we are moving cautiously, and opportunistically, as we continue to work toward minimizing risk as much as possible. While market action has improved on a short-term basis, we remain very aware of the long-term risks associated with rising rates, excessive valuations and extended cycles.

It is important to understand that when we add to our equity allocations, ALL purchases are initially “trades” that can, and will, be closed out quickly if they fail to work as anticipated. This is why we “step” into positions initially. Once a “trade” begins to work as anticipated, it is then brought to the appropriate portfolio weight and becomes a long-term investment. We will unwind these action either by reducing, selling, or hedging, if the market environment changes for the worse.