Investing.com’s stocks of the week

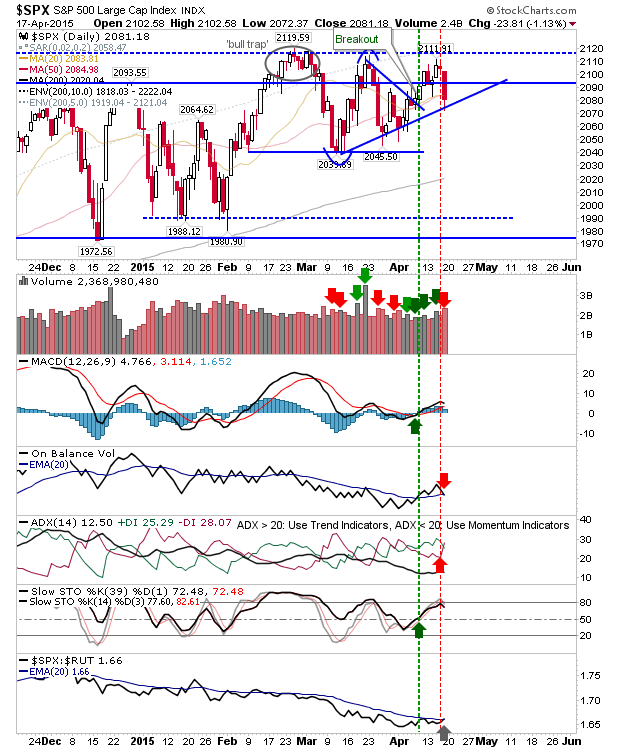

Sellers hit indices hard on Friday, leaving markets vulnerable to breaks of nearby support. The S&P managed to find some traction at trendline support and 50-day MA, but it won't be able to handle any further loss on Monday. To add insult to injury, volume climbed to register as distribution, and there were 'sell' triggers between +DI / -DI and On-Balance-Volume.

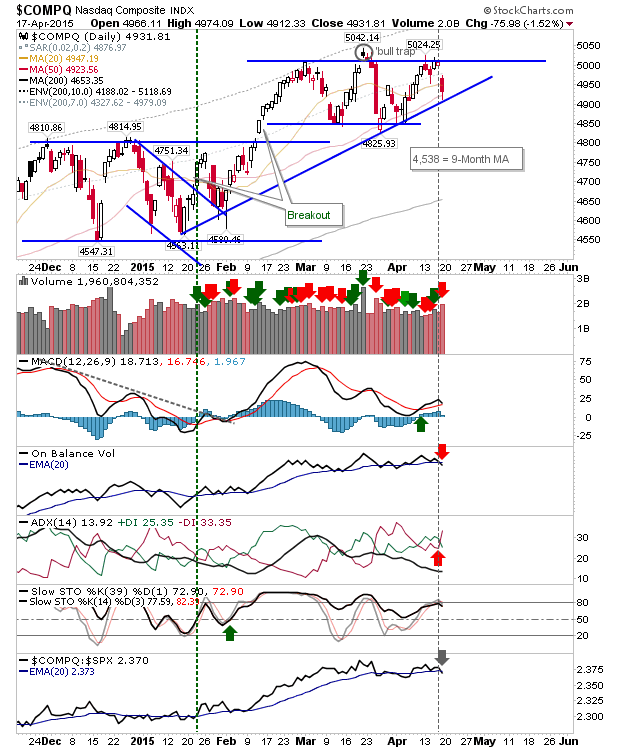

The NASDAQ also dug in at trendline support and 50-day MA. However, the +DI / -DI bearish cross, and On-Balance-Volume 'sell' add to the sell side.

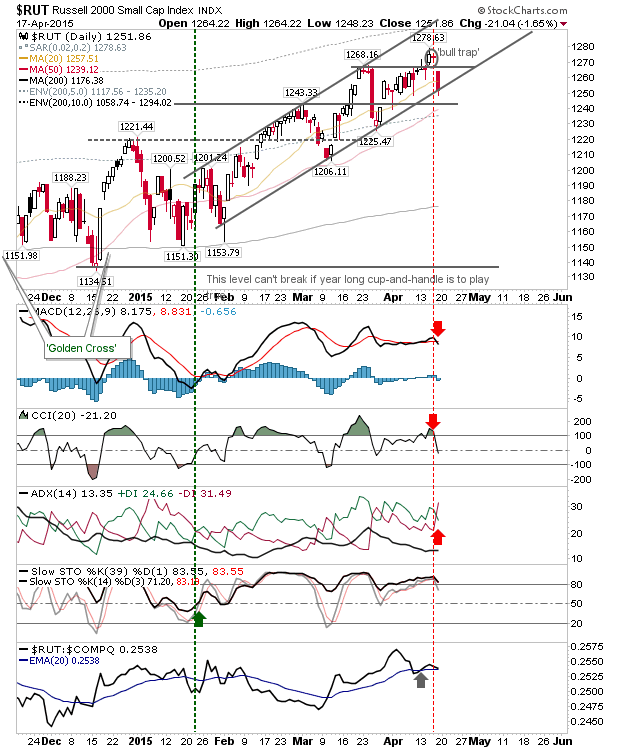

The Russell 2000 finished Friday with a 'bull trap'. It was a disappointing turn after a period of market leadership. The index is still holding on to its relative leadership, but after Friday it might find this hard to hold on to. Note the 'sell' trigger in the MACD, in addition to the 'sell' triggers in the +DI/-DI and CCI.

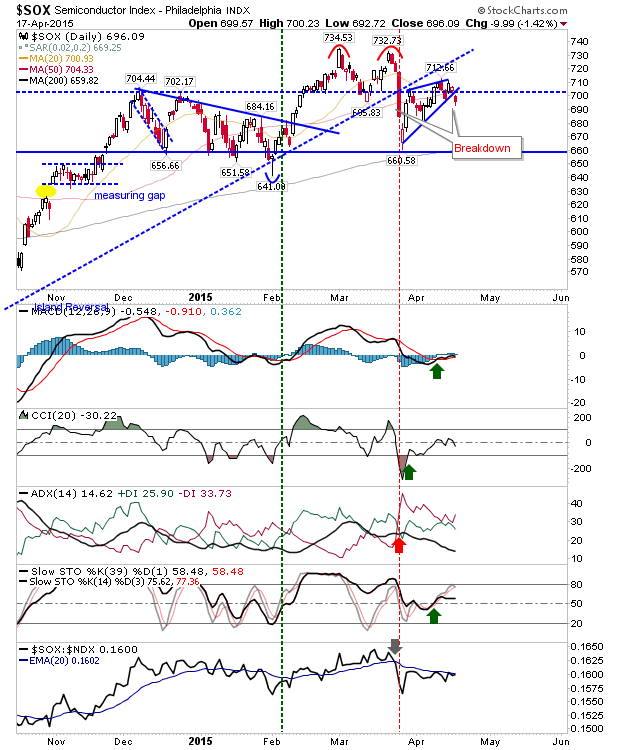

The one index which has switched to the bear side is the Philadelphia Semiconductor Index. It lost bearish wedge support below the 702 neckline and is looking vulnerable to further losses down to 660.

Monday could be tricky for bulls as bears may have finally put the scare on longs. There is support to work with, but much of this support has already endured multiple tests and is unlikely to survive much more. The Semiconductor Index has already cracked, will others follow?