Bulls Hold Into Labor Day

Last week, we discussed the S&P 500 breakout to all-time highs:

“Get out your party hats ladies and gentlemen, the market closed at all-time highs on Friday finally eclipsing the January peak. After 145 days of slogging, the ‘bull market is back, baby!'”

Over the last several months, we have been discussing the ongoing “pathway’s” leading us back to these current levels. Each breakout above previous resistance was used to add equity exposure into portfolios while maintaining some cash to hedge against a potential downside break.

However, as I laid out last week:

“While I point out the prevailing risks, and the disconnect between bullish sentiment and hard data, the reality is the bull market remains intact.

Over the last several months we have been tracking the progress of the S&P 500 with pathways back to ‘all-time’ highs. The very quick retest of support, as noted last week, set the stage for the push to market highs.”

As I noted last time:

“With portfolios still long-biased, the question is what happens next, and how to play it.

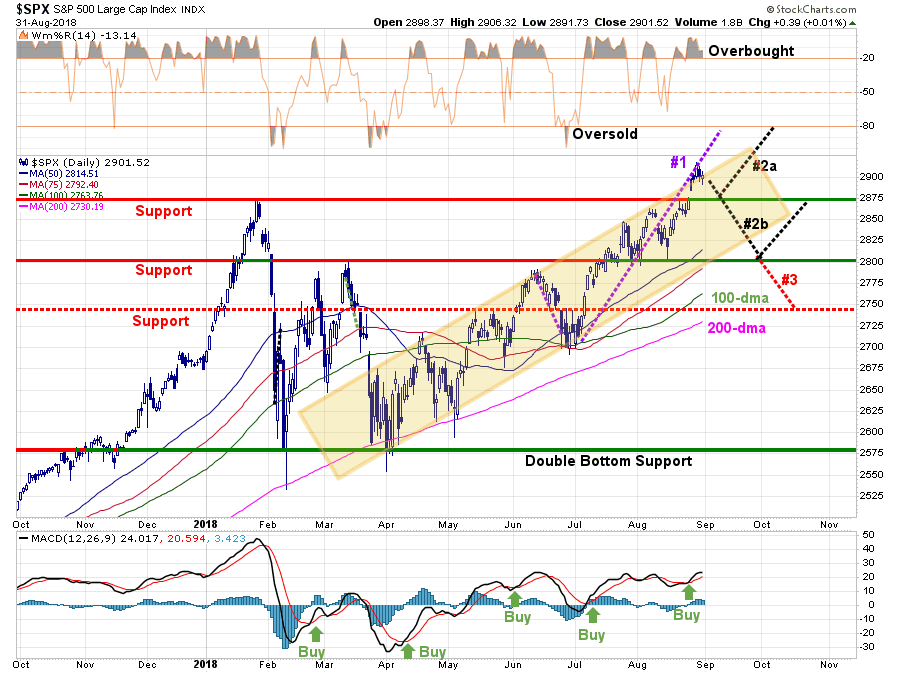

I have updated our pathway analysis to account for the breakout to new highs and the fact we are heading into September which has one of the poorest historical performance records.

- Pathway #1: An uninterrupted advance of the bull market with an expansion of volume and market breadth. This is a lower probability event currently given the extreme short-term overbought condition, light volume of the breakout and a negligible “buy signal” in place. (20%)

- Pathway #2a: Is a bit more of an “exuberant” advance early next week which pulls back to the recent breakout level. The pullback consolidates a bit, works off some of the overbought condition, and then begins the next advance. Such a pullback would turn the previous resistance into support and provide a short-term “buyable” entry. (30%)

- Pathway #2b: Is a higher probability event given the overbought conditions currently. A pullback to 2800-2820 which works off the overbought condition and builds support at previous bottoms. This would also coincide with a “September” type performance and would set the stage for a traditional year-end rally. This would provide the best opportunity to bring portfolios to target weights. (40%)

- Pathway #3: This path is the least likely currently, but should be considered nonetheless. With all of the risks laid out above, something that triggers a credit-related worry in the market could send stocks lower. There is strong support built at 2740 which should initially hold. If it doesn’t we have other issues to discuss. (10%)

Again, with portfolios primarily invested, there is little for us to do. We did let some weak performers go last week and will look for a pullback to add to winners and make some new bets.”

Currently, it is pathway #2a that continues to play out. This past week so a bit of an exuberant jump in the markets as traders scrambled to “get long” following the breakout to new highs (albeit it was on very light volume and participation.)

Nonetheless, the current breakout is bullish and any pullback in September that doesn’t violate any important support levels (technically) will provide an opportunity to increase equity exposure for a potential “year-end” advance.

With earnings season winding down, trade wars heating up (again), and the Fed committed to hiking rates further, there certainly seems to be plenty of reasons for something to “go wrong.”

However, so far, the bulls haven’t seemed to care about such “risks” at all.

Kevin Giddis, via Raymond James, summed this issue up well. (H/T to Gerry, my Canadian researcher)

“A lot of what we have seen in the month of August seems to suggest that while the U.S. economy is on very solid ground, corporate earnings continue to grow, confidence at a near term high, and the equity market wakes up looking to make a new record with almost every session, there is a sense of nervousness that something is going to go wrong soon.

Is this what a peak looks like?

The Fed keeps harping on the continuation of its tightening cycle even though wages aren’t really growing and the core rate of inflation vacillates back and forth between 2%, the Fed’s target.

Is it worrying investors that they are going too far too fast?

How about trade? If we (the U.S.) keep applying pressure to our trade partners by adding tariff after tariff, could that backfire on the U.S. and slow the economy without seeing prices rise?

As we climb this wall of worry, the bond market seems to be running in place, waiting for something else to happen. Maybe it’s the inversion of the curve, maybe it’s the continuation of a trade war, or maybe it’s a breakdown in the numbers; none of us really knows.

Then there’s the Fed. We are beginning to see more and more debate about whether the Fed might be going too far with its tightening policy. If the long end of the Treasury market doesn’t budge, and the Fed keeps tightening, the yield curve is likely going to invert. Historically, inversions haven’t ended well for the U.S. economy. The point that I am trying to make is that there are a number of balls in the air, and there is a good chance that not all of them will bounce.

Even in what appears to be the best of times, cracks may be starting to show that we are closer to the end vs. the beginning of what has been a miracle recovery.”

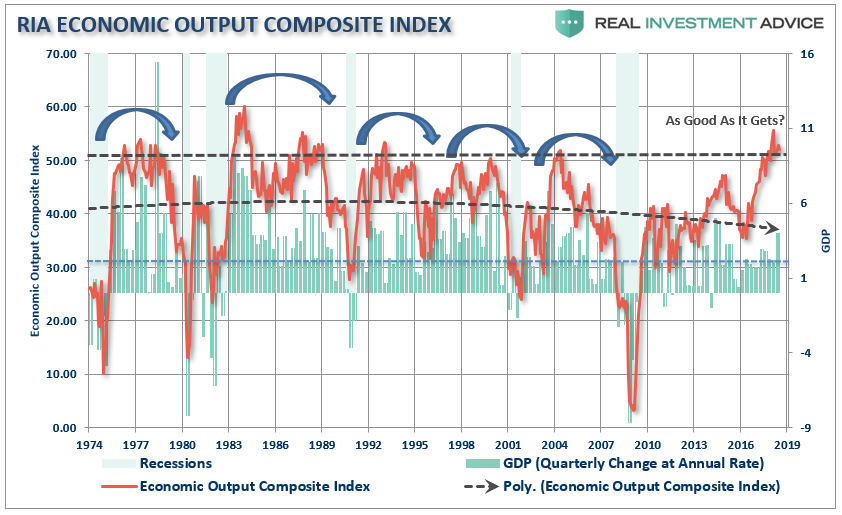

I agree with Kevin on his views. Last week, I noted that currently “everything is as good as it can get,“ which could be seen in our composite economic output index (EOCI).

“To understand this we can look at our own RIA Economic Output Composite Index (EOCI) which is an extremely broad indicator of the U.S. economy. It is comprised of:

- Chicago Fed National Activity Index (an index comprised of 85 subcomponents)

- Chicago Purchasing Managers Index

- ISM Composite Index (composite of the manufacturing and non-manufacturing surveys)

- Richmond Fed Manufacturing Survey

- New York (Empire) Manufacturing Survey

- Philadelphia Fed Manufacturing Survey

- Dallas Fed Manufacturing Survey

- Markit Composite Manufacturing Survey

- PMI Composite Survey

- Economic Confidence Survey

- NFIB Small Business Index

- Leading Economic Index (LEI)

All of these surveys (both soft and hard data) are blended into one composite index which, when compared to U.S. economic activity, has provided a good indication of turning points in economic activity.”

I went into substantially more detail about the index in the article, but the main point is that historically when the index has been at this level, bull markets did NOT keep rising indefinitely into the future.

While many are quick to dismiss the trend of the yield curve currently under a “this time is different” scenario, such has been a dangerous premise in the past.

Pick A Side

This is the point where readers often get confused, and I get a comment demanding me to “pick a side.”

Investing is not about taking sides.

Being a “full-time bull” is just as dangerous as being a “full-time bear.”

In the short-term, as I discussed on Tuesday, the market is indeed bullish. The trend is positive, supports are in place and any pullback that reduces the short-term overbought condition should be bought.

“Regardless of the reasons, the breakout Friday, with the follow through on Monday, is indeed bullish. As we stated repeatedly going back to April, each time the market broke through levels of overhead resistance we increased equity exposure in our portfolios. The breakout above the January highs now puts 3000 squarely into focus for traders.”

I am indeed “bullish” at the moment.

However, in the longer-term, the market dynamics and fundamental backdrop are concerning. The full-cycle will complete itself and there will be a “mean-reversion” process along the way. As I noted:

“With markets extended, extremely deviated from long-term means, and at the third most overbought level since the turn of the century, the longer-term outlook remains bearish.”

As an investor, you have two choices.

- Ride it out

- Reduce risk when the trend changes and protect capital.

What you decide to do is up to you.

However, my clients didn’t hire me to sit around and watch 50% of their investment portfolio evaporate. They also didn’t hire me to regurgitate the false narrative they shouldn’t worry because “it will come back someday.”

Getting “back to even” is not an investment strategy as it destroys the ‘time” required to reach your financial goals.

Managing money through 2-massive bear markets taught me better.

So, I will opt for #2.

See you next week.

Market and Sector Analysis

Data Analysis Of The Market and Sectors For Traders

S&P 500 Tear Sheet

Performance Analysis

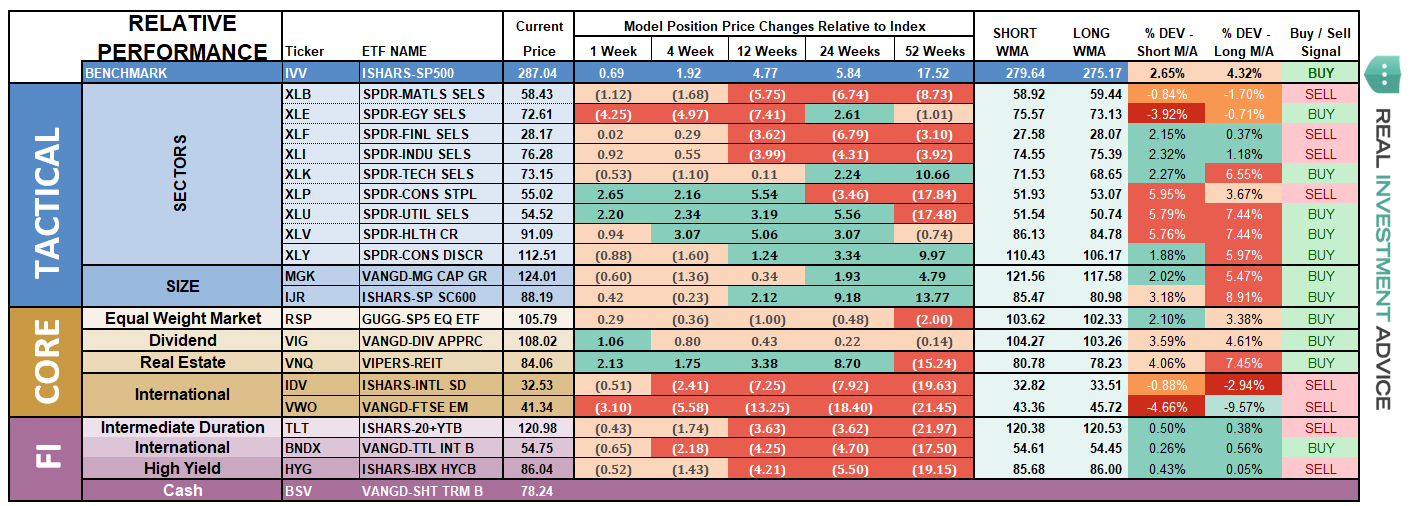

ETF Model Relative Performance Analysis

Sector and Market Analysis:

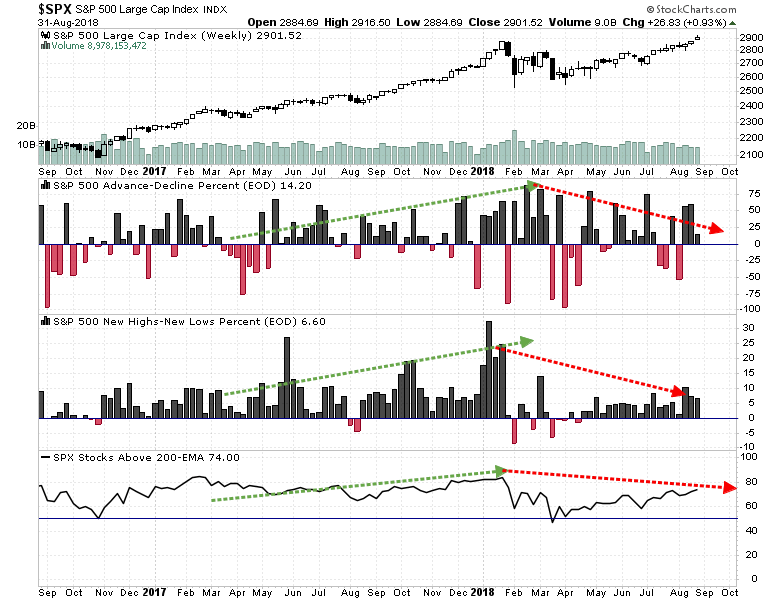

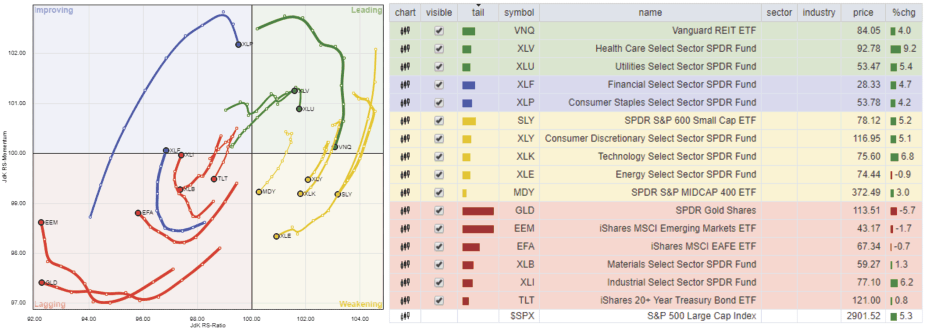

Despite the markets breaking out to all-time highs last week, there are definitely signs of rotation from previously leading sectors of the market to the laggards. This is shown below in the 10-week relative-rotation graph which compares performance relative to the S&P 500 index.

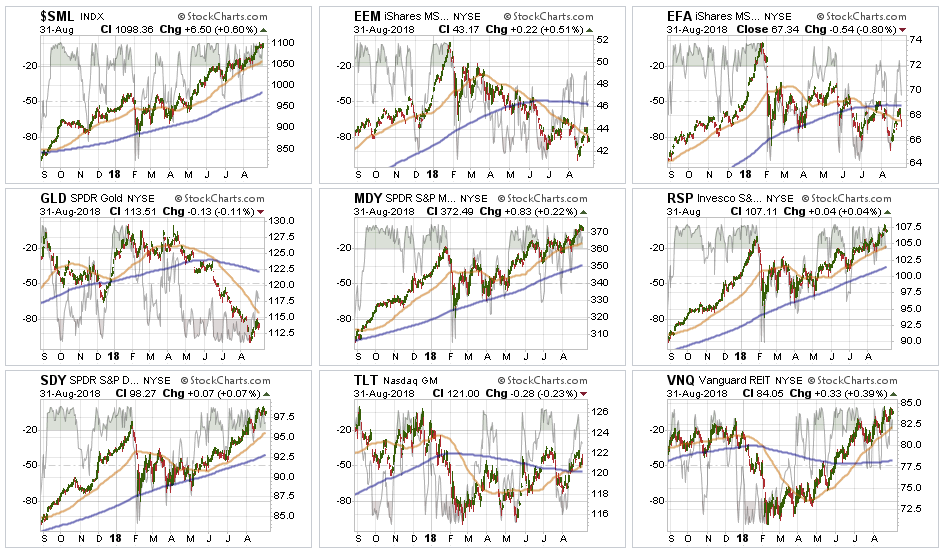

While emerging and international markets are beginning to show a bit better relative performance to the S&P 500 in the short-term, with the issues internationally in both dollar funding status, economic growth and geopolitical risks, there is no reason to add exposure currently. We are watching for a potential entry point for the industrial sector which has begun to improve performance-wise, but we remain wary of the “tariff” risk as the White House and China continue to scale up the rhetoric.

Discretionary, Technology, and Healthcare – continue to pace the way higher in the market over the last few weeks. We continue to hold our weightings in these sectors, outside of just trimming position sizes to account for gains for now. With the sectors VERY overbought and extended currently use pullbacks for adding to exposure or increasing target weights.

Staples and Utilities – have regained strength after a very tough start to the year. As we stated last week, there is a movement to more defensive sectors of the market (late economic stage sectors) that is still occurring. Use pullbacks to support, and oversold conditions, to add exposure accordingly.

Financial, Energy, Industrials, and Materials – while Industrial finally gained a bit of momentum due to earnings season, the risk of an ongoing, and acceleration of, tariffs and “trade wars” keeps us out of both the Industrial and Materials sector for now. However, with that said, Industrials performance is improving and on a pullback to support that doesn’t violate it, we may consider adding a small exposure. Energy’s recent slump successfully tested the 200-dma. As we stated last week, the 50-dma acted as resistance. Stops should remain at the recent lows. Financials continue to languish along support but not showing much in the way of strength to support overweighting the sector currently.

Small-Cap and Mid-Cap continue to perform well and after adding exposure to these areas a few weeks ago, there is little to do currently. With these markets extremely overbought and extended, pullbacks to support is needed to add additional exposure.

Emerging and NYSE:EFA Markets were removed in January from portfolios on the basis that “trade wars” and “rising rates” were not good for these groups. With the addition of the “Turkey Crisis,” ongoing tariffs, and trade wars, there is simply no reason to add “drag” to a portfolio currently. These two markets are likely to get much worse before they get better. Put stops on all positions.

Dividends and Equal Weight continue to hold their own and we continue to hold our allocations to these “core holdings.” We will overweight these positions on a pullback to support that does not violate that level.

Gold – If you are still hanging onto gold, we have been consistently providing stop loss levels and sell points since May of this year. These points have continued to decline. Last week we gave a rally sale point of $114 which was achieved this past week. With gold very overbought on a short-term basis, if you are still long the metal this is your opportunity to rethink your strategy. Stops remain at $111 this week.

Bonds – The rally over the past three weeks establishes a series of rising bottoms for bonds AND we have now registered an important “BUY” signal for bonds as the 50-dma crosses back above the 200-dma. As noted previously, we remain out of trading positions currently but remain long “core” bond holdings mostly in floating rate and shorter duration exposure. However, with a “buy” signal in place, we will look to add trading positions back into portfolios as necessary.

REITs keep bouncing off the 50-dma like clockwork. Despite rising rates, the sector has continued to catch a share of money flows and the entire backdrop is bullish for REITs. However, with the sector very overbought, take profits and rebalance back to weight and look for pullbacks to support to add exposure.

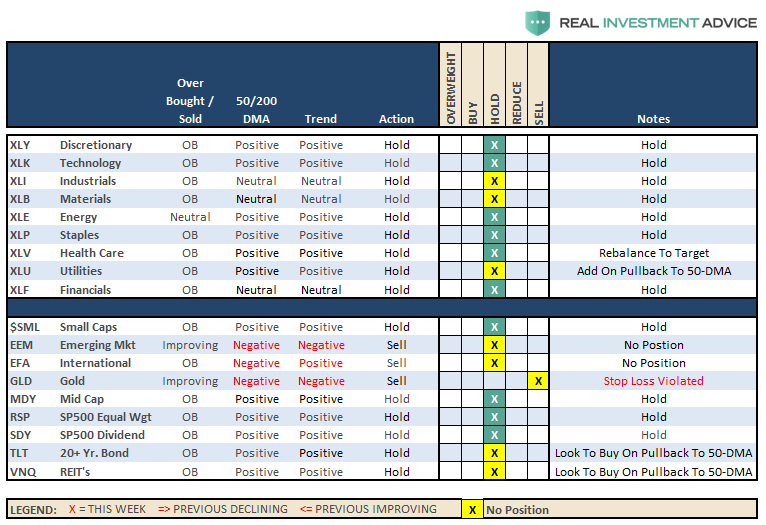

The table below shows thoughts on specific actions related to the current market environment.

(These are not recommendations or solicitations to take any action. This is for informational purposes only related to market extremes and contrarian positioning within portfolios. Use at your own risk and peril.)

Portfolio/Client Update:

Over the last few weeks, I have discussed the increases to equity exposure in portfolios as the market’s momentum has continued to push higher. However, we have done this cautiously by using pullbacks to support, which then subsequently broke out above resistance, to do so.

Last week, the market was able to hold above the “breakout” levels once again, so we will look to take the following actions within the next week or so. We are looking for a bit of pullback which provides a better entry point as we enter into the seasonally weak month of September. The goal is to be positioned in portfolios for the potential year-end upside bias.

- New clients: Add 50% of target equity allocations.

- Equity Model: We recently sold three laggards last week (Chevron (NYSE:CVX), Constellation Brands Class A (NYSE:STZ), and Eastman Chemical (NYSE:EMN)) and will replace with new positions opportunistically.

- Equity/ETF blended – Same as with the equity model.

- ETF Model: We will overweight core “domestic” indices by adding a pure S&P 500 index ETF (NYSE:SPY) to offset lack of international exposure. We remain overweight outperforming sectors to offset underweights in under-performing sectors.

- Option-Wrapped Equity Model sold CVX and will add two new positions opportunistically.

Again, we are moving cautiously. There is mounting evidence of short to intermediate-term risk of which we are very aware. However, the trend of the market remains positive, and we realize that short-term performance is just as important as long-term. It is always a challenge to marry both.

It is important to understand that when we add to our equity allocations, ALL purchases are initially “trades” that can, and will, be closed out quickly if they fail to work as anticipated. This is why we “step” into positions initially. Once a “trade” begins to work as anticipated, it is then brought to the appropriate portfolio weight and becomes a long-term investment. We will unwind these actions either by reducing, selling, or hedging, if the market environment changes for the worse.