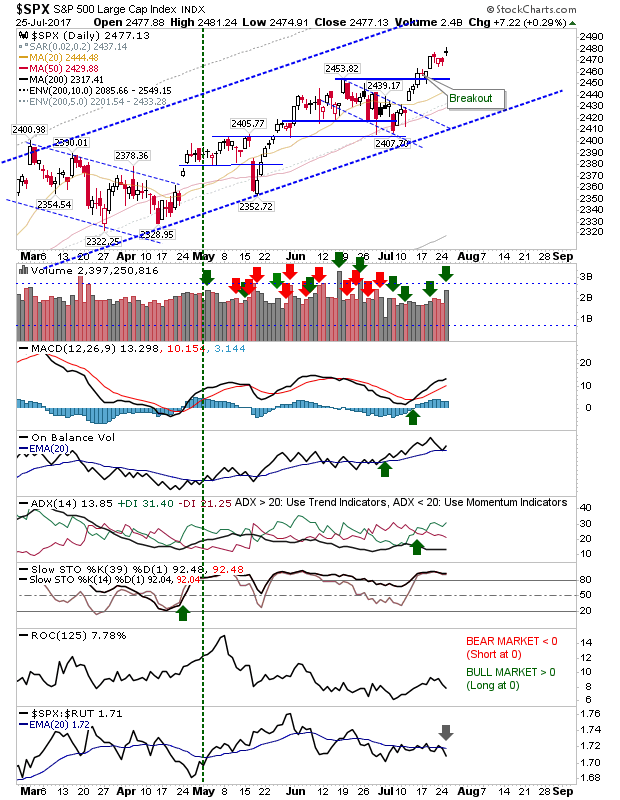

While most of the work was done premarket yesterday, there was enough demand in morning gaps to register higher volume accumulation.

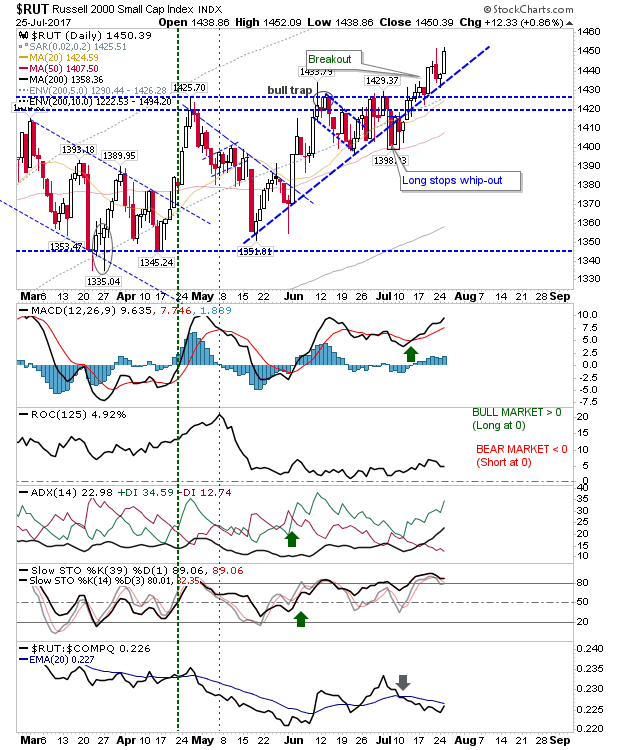

Best of the action came in Small Caps. The Russell 2000 had looked like it was going to drift back to 1,420 and maybe the 50-day MA but instead, buyers took the breakout further from this support level (further squeezing shorts). There is no defined upside target, but February's rally pushed the index 10% above the 200-day MA; a similar move would see a test of 1,500.

Higher volume in the S&P pushed the index to new highs but the doji marks indecision.

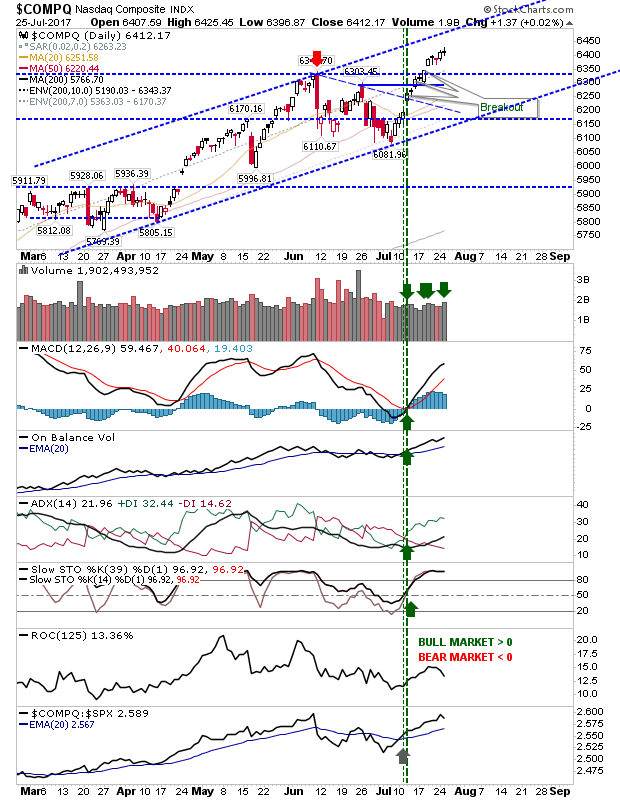

The NASDAQ also finished with a doji but without the opening gap.

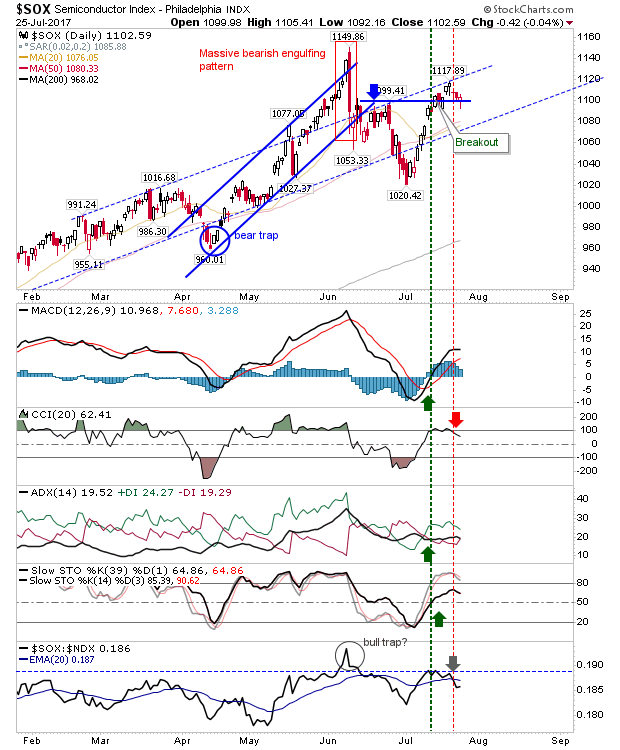

The struggling Semiconductor Index wasn't able to enjoy the gains of other indices but it did manage to retain breakout support. Yesterday's action also managed to post a small hammer - the lower spike denoting an increased area for demand buying.

Today might be an opportunity to take a punt as a buyer in the Semiconductor Index. Don't hold if it drops below 1.090 as further losses are more likely to occur (and a quick switch to the short side may end up more profitable). Gains in the Russell 2000 are good to see but don't be surprised if another round of profit taking occurs today - it didn't really finish at an ideal buying point.