What was looking very good into the last couple of hours yesterday just ended up being good. The weakness from Tuesday was pushed aside and there is a buying opportunity for aggressive traders with a loss on Tuesday's lows.

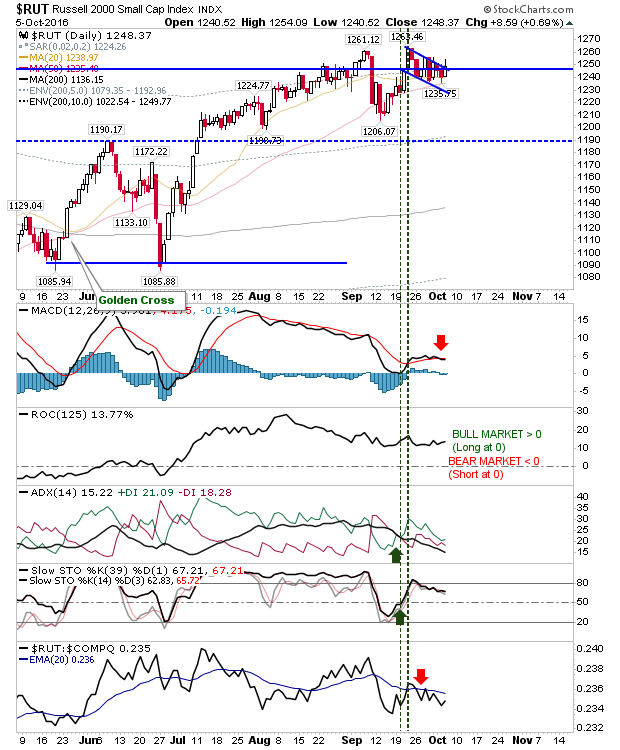

The bullish lead was the Russell 2000. It was in the process of breaking from the 'bull flag', but ended the day back inside it. Technicals still hold to a MACD 'sell', with a weakening +DI/-DI and stochastic. However, as far as price action, it is the best of the indices.

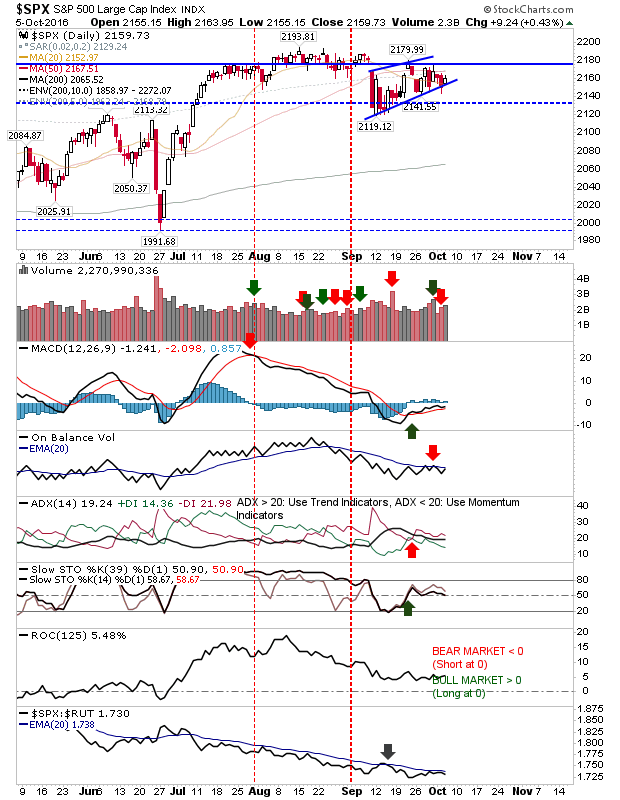

The S&P had a quiet day and didn't venture outside of rising wedge support/resistance.

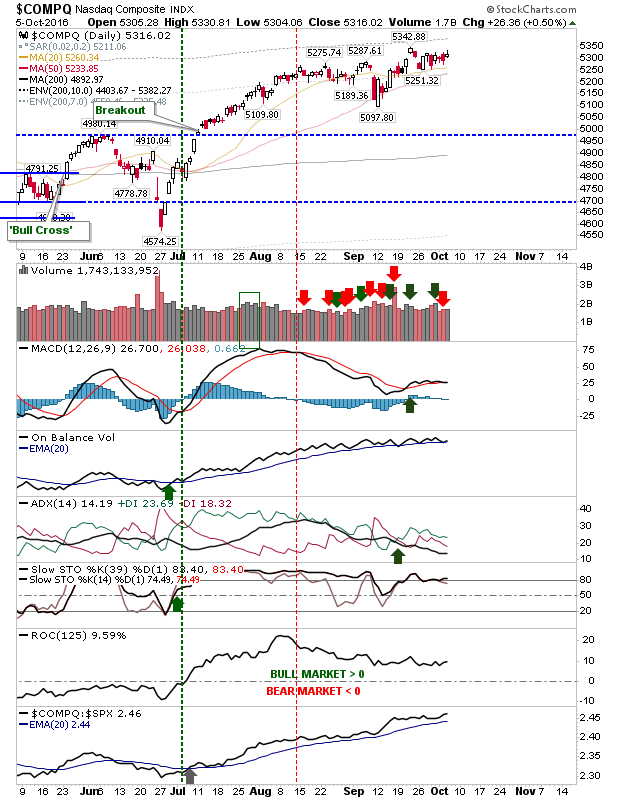

The NASDAQ also experienced a tight trading day yesterday, with little to report.

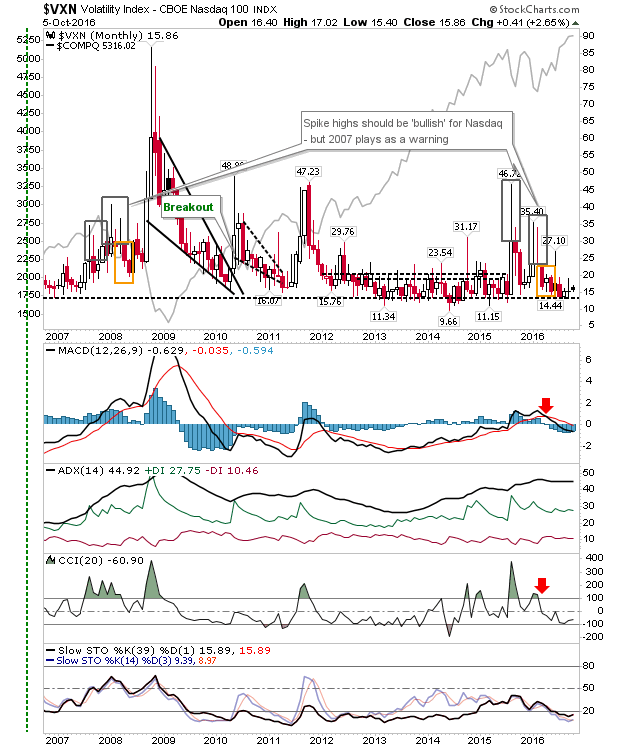

One thing to watch is the NASDAQ 100 Volatility Index. It may be ready to break higher, although for 2012 through to 2015 it did very little as the NASDAQ rallied hard.

Much as I would like to see bears take this market down, yesterday's action does point to continued demand; demand which has outgunned Brexit fears and a potential Trump victory.