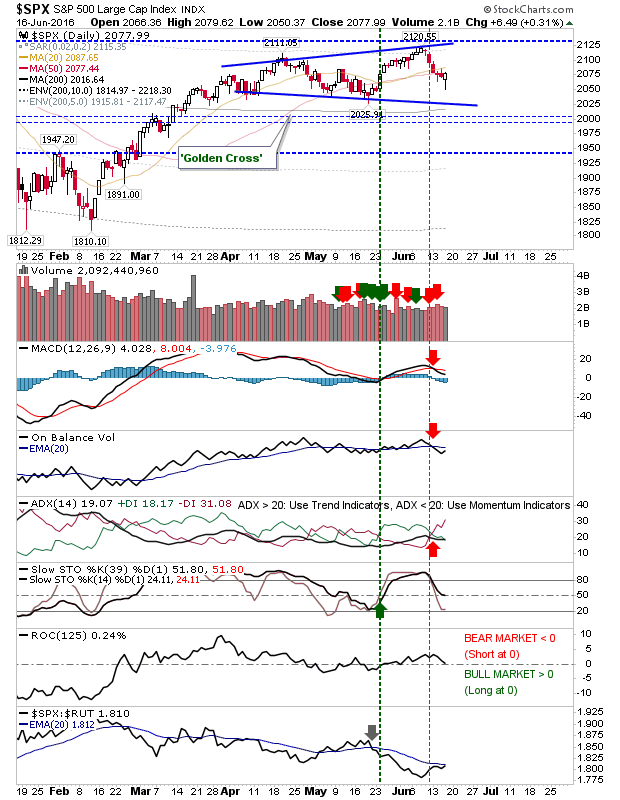

This was the perfect day for bulls. Early selling had squeezed any weak holders out of their positions and sucked shorts in, only for the late recovery to have forced newly minted shorts to cover and encouraged new buyers to come in at lows. What's needed next are solid white candlesticks on Friday to confirm a swing low.

The S&P remained below converged 20-day and 50-day MAs, but a good day tomorrow should easily regain these moving averages as support. Technicals haven't all turned negative, but slow stochastics are hanging on.

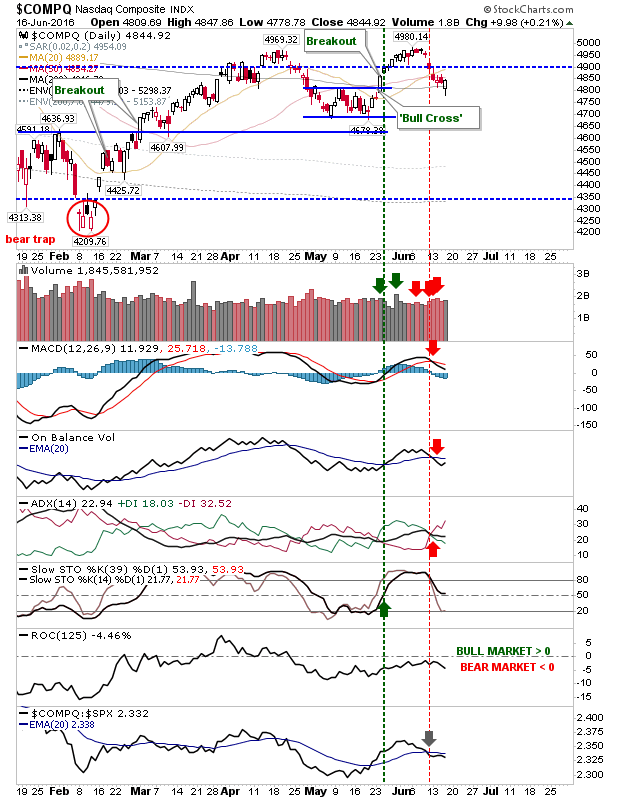

The Nasdaq neatly defended the 200-day MA on higher volume accumulation. It too is hanging on to mid-line stochastics [39,1], but relative underperformance remains against the S&P.

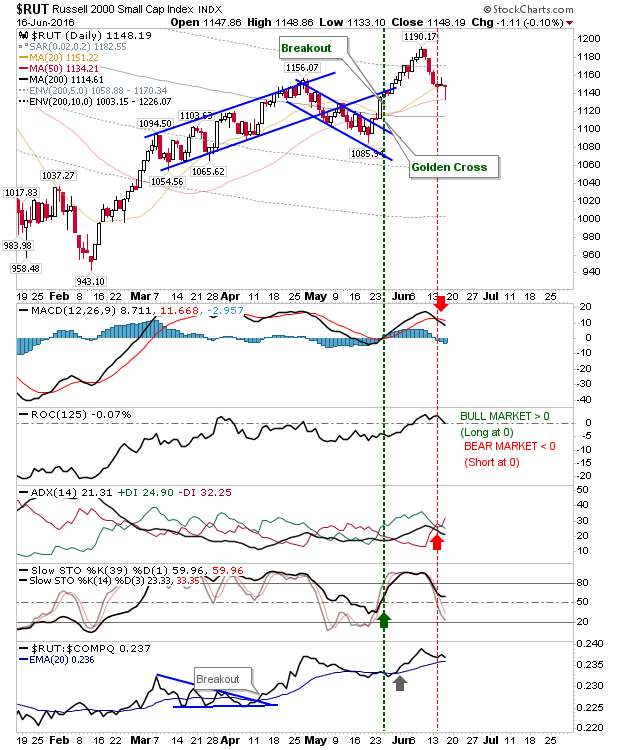

The Russell 2000 was another index able to dig in at moving average support. The 50-day MA was neatly tagged at lows. What's interesting here is that Rate-of-Change has only dipped below the zero mid-line after an extended period below this line. This could possibly be the sign of better things to come.

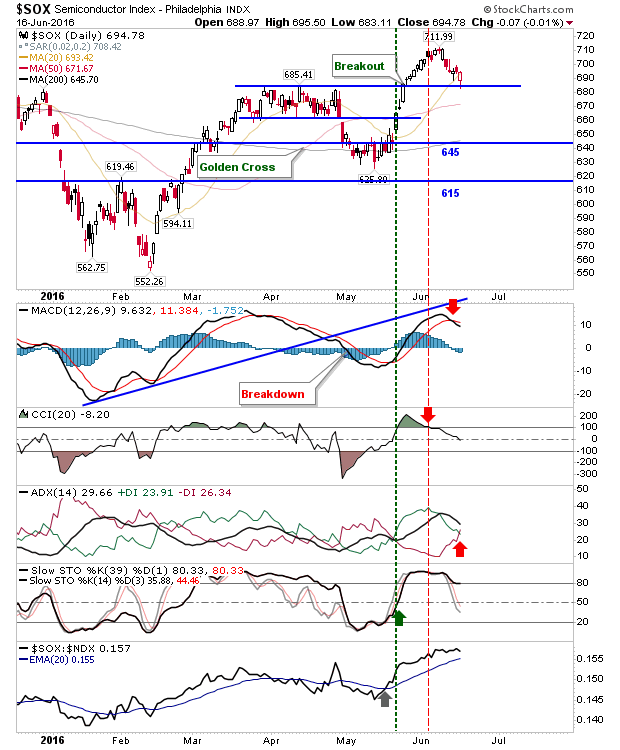

The other index to watch is the Semiconductor Index. It neatly tagged breakout support, although technicals are weakening. The key marker is the strong relative out performance which hasn't weakened much through the pullback.

Can bulls make up the lost ground? Friday offers an opportunity for some upside follow through. On the flip side, there isn't much wiggle room if sellers do come back.