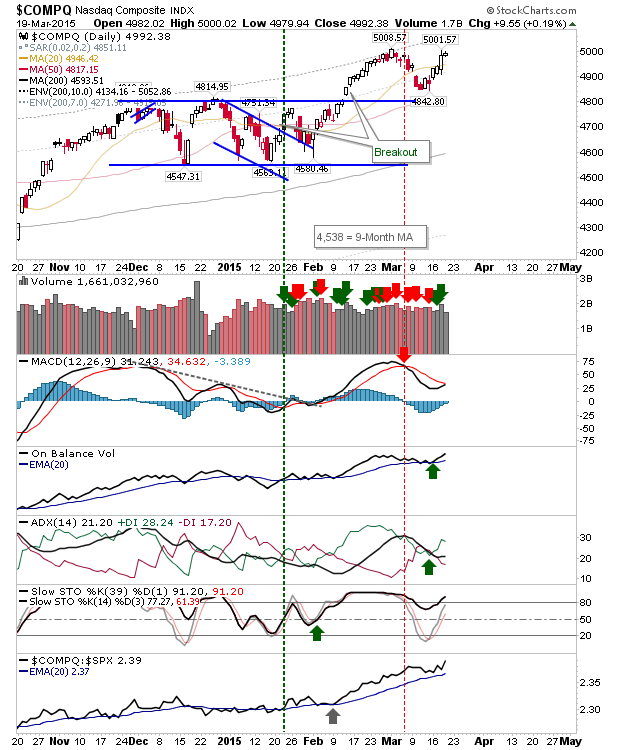

The NASDAQ posted a minor gain yesterday on low volume and performed better than the S&P 500. It didn't really change anything, but it didn't hurt, Now the MACD is on the verge of a 'strong buy' signal.

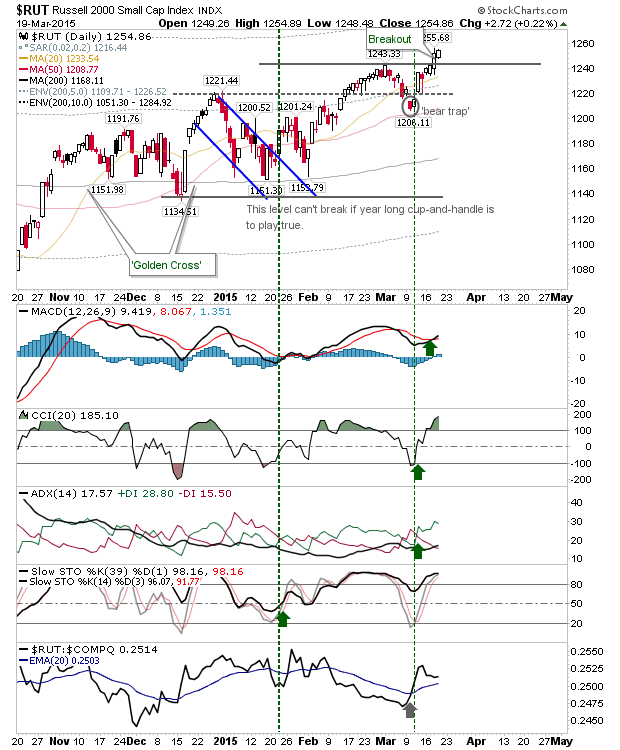

The Russell 2000 added some value and pulled away from 1,240 support, so losses from here will still offer bulls something to work with. Also working in bulls favor are bullish technicals.

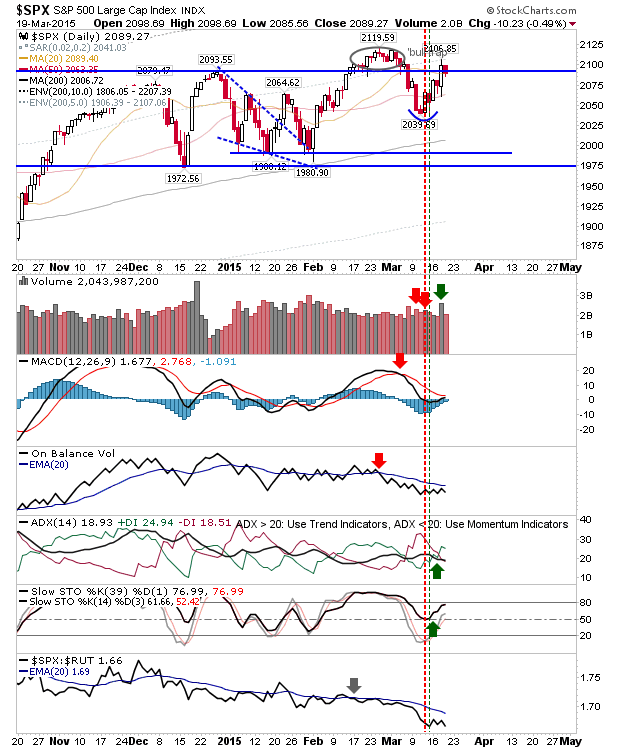

Losses were seen in the S&P 500, The index dropped to just below 2093, as it attempted to challenge its 2119 high.

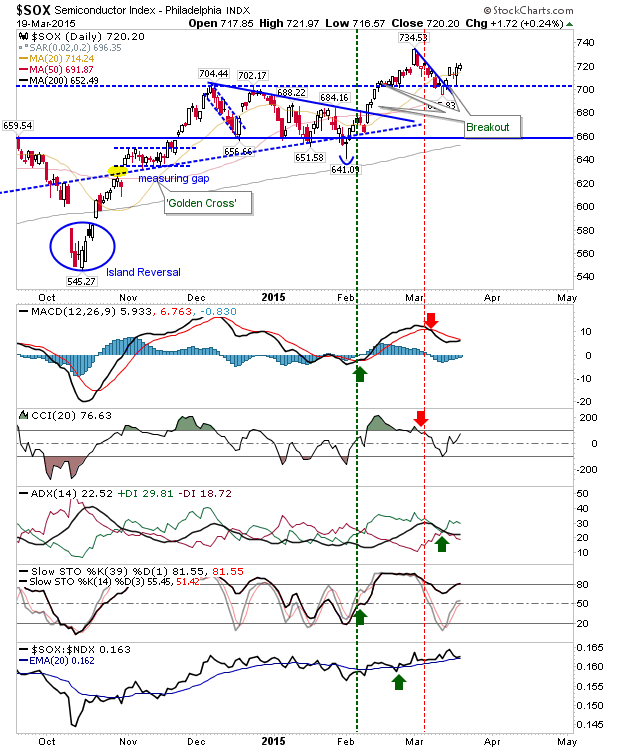

The SOX was not to be excluded, it added 0.24% as it worked itself off support.

For today, take a look at the Semiconductor Index and Russell 2000 to add to yesterday's gains.