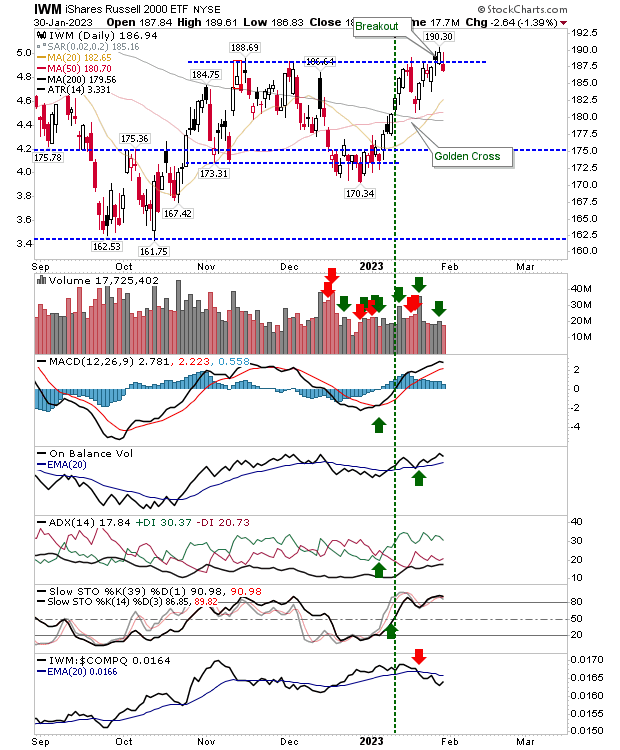

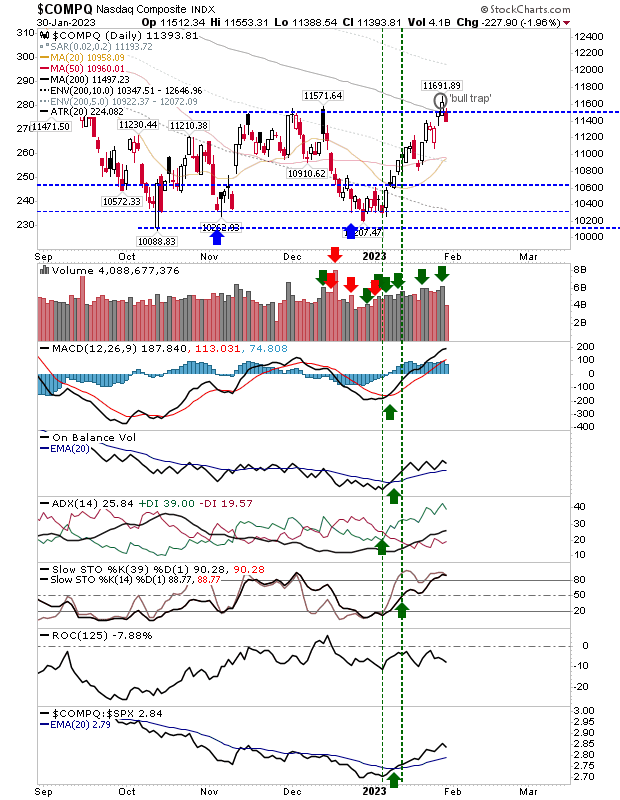

The recent breakouts in the Nasdaq and Russell 2000 (via IWM) now find themselves on the wrong side of the support. There hasn't been a total collapse, selling volume was down in relation to Friday's buying, so the potential for recovery is quite high. However, for this to happen, sellers can't be allowed to build up any momentum. As things stand, the Nasdaq and Russell 2000 now find themselves back inside the prior consolidation.

The Russell 2000 is underperforming the Nasdaq, so it's the most vulnerable to further selling. Even if the 'bull trap' is confirmed, I would still look for the potential of the 20-day MA to play as support.

The loss of the breakout in the Nasdaq didn't do too much damage to the supporting technical picture, but I wouldn't want to see too much of a move away from its 200-day MA. The index doesn't have the benefit of the 'golden cross' between 50-day and 200-day MAs, so it might take a second wave of down-and-up before there is a confirmed breakout.

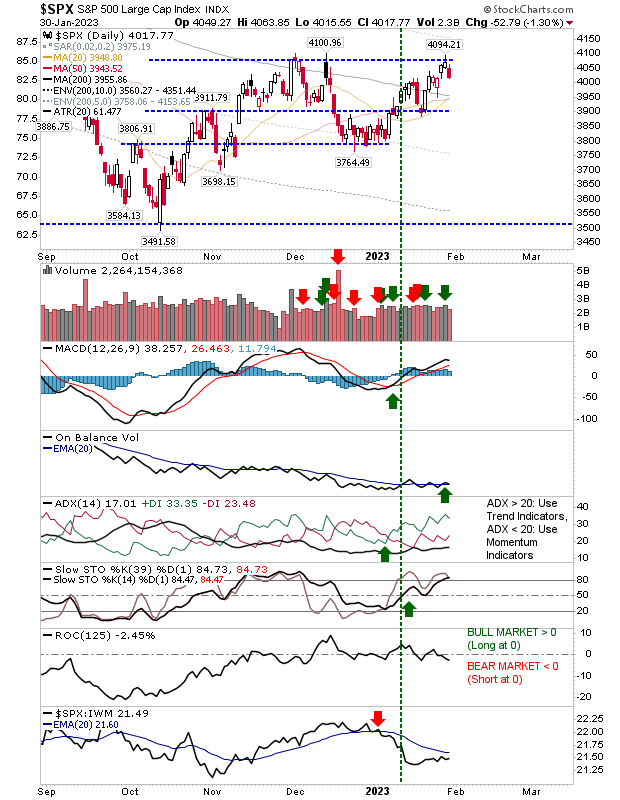

The S&P 500 didn't have a breakout to lose, so there would have been no technical alert for this index to reverse. It's as you were for the index, but one thing I like is the pending 'golden cross' between the 50-day and 200-day MAs which might be the driver for a breakout. In such a scenario, I would be looking for the Russell 2000 to lead out and the S&P to follow.

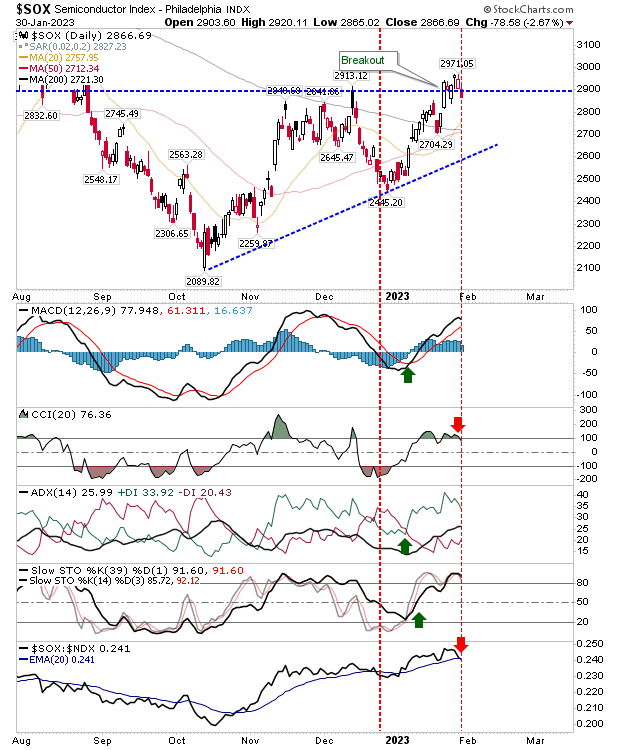

As a final note, the Semiconductor Index has also drifted below its breakout level but there is also a pending bullish cross between 50-day and 200-day MAs.

For the rest of the week, if ex-breakout indices are able to hold on to moving average support - and this could be any of 20-day, 50-day or 200-day MAs - then I wouldn't be too worried about yesterday's breakout losses.