Investing.com’s stocks of the week

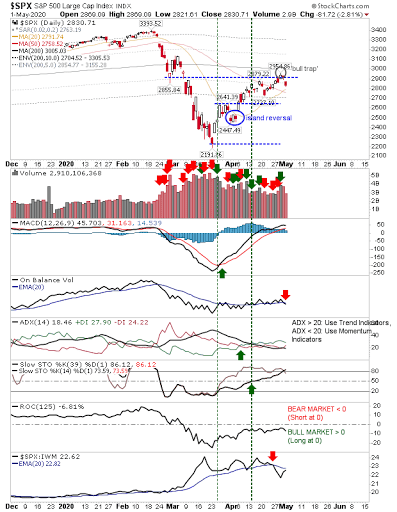

Based on recent price action, Friday's loss was relatively light, but it could prove to be of greater significance in the weeks ahead. It chalked two bearish markers on the S&P in confirming a 'bull trap' and creating a gap down in the process. Friday didn't register as a distribution day although there was a bearish cross in On-Balance-Volume to mark a shift back in favor of sellers.

Ironically, it's making a relative improvement gain against Small Caps. Is this when profit-takers take over in a race to the bottom?

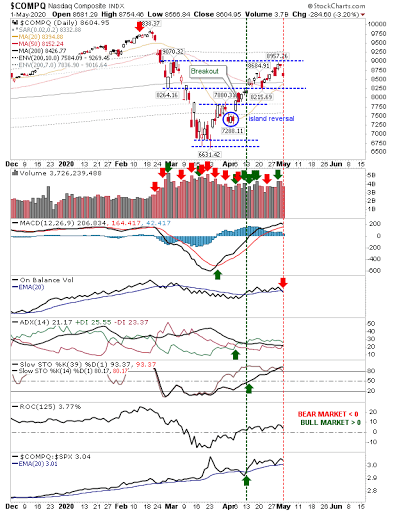

The NASDAQ took a bigger hit than the S&P, but as it's between support and resistance the technical damage is not as bad. But like the S&P there was a 'sell' trigger in On-Balance-Volume.

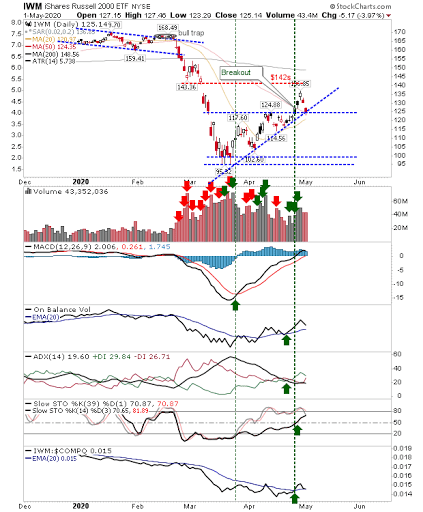

The Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) lost nearly 4%—putting its breakout under pressure. However, there was no distribution to go with it and since the bottom in March it has enjoyed good accumulation, enough so that Friday's selling was not too damaging.

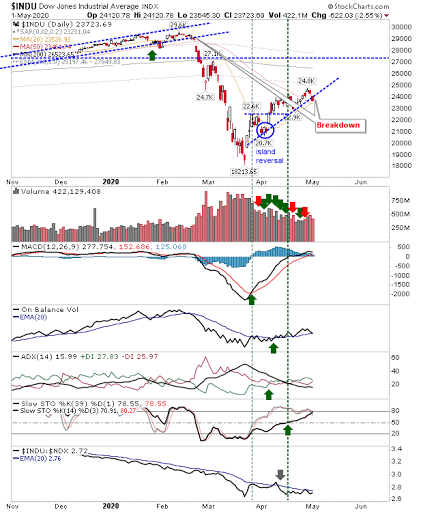

The Dow—like the S&P—also had it's 'bull trap' but it also has registered a breakdown of a rising trend. No matter how you slice and dice it, this still looks bearish.

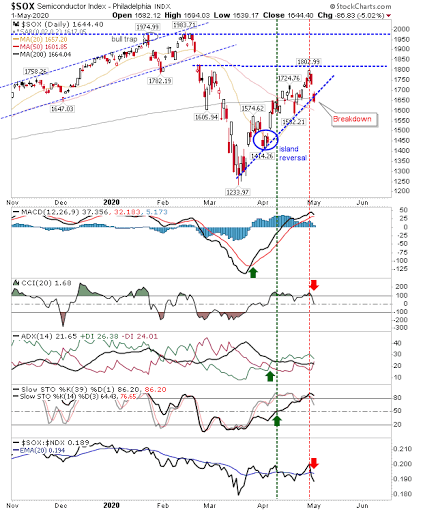

Also adding to the general shift in favor of bears was the breakdown in the trend for the Semiconductor Index. The trend break is more likely a shift to a slower (rising) trend, but sellers may be in control for a few weeks.

Certainly, existing longs—particularly those who were lucky enough to buy at the low—will be wondering if or when to sell. It will be hard for them to hold if they have managed to rack up big gains in a short space of time and may now have to watch those gains shrink.

Investors who have bought it will be happy to hold, and will probably be waiting to add on weakness, but these are unlikely to be the ones who drove the rally, and it's those traders that are the ones to worry about.