Market Brief

Market professionals are going to wake up to the near unthinkable. My all indications the “leave” vote has cross the vote threshold need for a win. The UK has voted to leave the EU.

Markets had been supremely confident in the “remain” result dominance, especially based on odd makers probabilities, had to quickly reverse positions. It was the early result from Sunderland, which triggered the “Brexit“ trade. In a dramatic collapse GBP/USD fell from 1.4877 to 1.3229 - the lowest level since September 1985 !!! - more than -10% decline, before bouncing back at around 1.36.

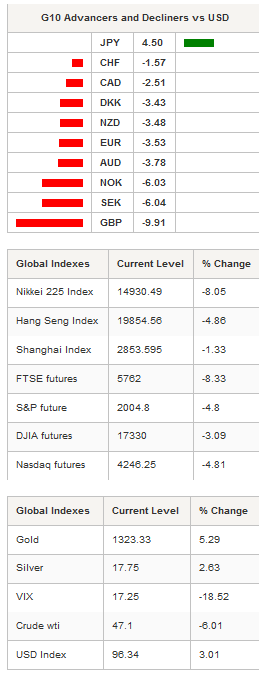

The rest of the “Brexit” trade went as expected with NOK, EUR and SEK, three of the UK largest trading partners, falling the most, while safe-haven trades such as JPY and USD, gained. EUR/GBP rallied to 0.7601 to 0.8196 suggesting at this point the markets views the event as GBP negative, however we suspect that as the smoke clears, market will realized how euro negative a “Brexit” vote really is, and will start reloading short position in the single currency.

Gold reversed strongly off the $1251 support trading up to $1309 on solid volumes, and additional upside expected. Interestingly, despite the early illiquidity and dislocation due to volatility, FX markets have held up surprisingly well… so far. With equity markets potentially unprepared for this unexpected result we anticipate more significant price action today.

Equities dropped massively in Asia amid the results with the Nikkei down more than 8% and the broader Topix index off 7.68%. Mainland Chinese equities were surprisingly resilient with the Shanghai and Shenzhen Composite off only 1.33% and 1.02%, respectively. Elsewhere, the S&P/ASX fell 3.21%, while the NZX was off 2.25%. In Europe, futures on the Footsie were down roughly 8% as investors priced in the negative effects of a Brexit on UK companies.

Asia regional EM FX has declined across the board as risk aversion spread across continents, with MYR, KRW and SGD the biggest losers. Give the limited exposure of Asian to the UK we suspect that further downside should be limited.

EUR/CHF fell to 1.0623, roughly a -3.5% decline before stabilising at around 1.07. Clearly the SNB will be watching developments with wariness. Should the single currency begin pricing the break-up of the EU-28 and possible EMU, we expected a significant rotation into CHF, forcing the SNB to further act) to limit the damaging effect of an overvalued CHF.

Given the lack of deeper decline in EUR/CHF we believe the SNB has been active during the night to prevent further appreciation of the CHF. For now it does not look like the market wants to challenge the SNB. Let’s see how it goes over the next few hours.

What happen next remains highly unclear. First of all, in the short term the official declaration needs to be made. For certain the UK will enter a period of extreme uncertainly, which will weigh on UK asset prices. News from Northern Ireland suggests that with the majority voting for remain a mandate for a referendum on Irish unity will be announced as soon as today. It’s only a matter of time before Scotland follows suit. UK voting to leave the EU might lead to the breakup of the UK.

Currency Tech

EUR/USD

R 2: 1.1479

R 1: 1.1428

CURRENT: 1.1014

S 1: 1.0822

S 2: 1.0458

GBP/USD

R 2: 1.5240

R 1: 1.5018

CURRENT: 1.3611

S 1: 1.3229

S 2: 1.3045

USD/JPY

R 2: 111.91

R 1: 106.84

CURRENT: 102.43

S 1: 99.02

S 2: 96.57

USD/CHF

R 2: 0.9956

R 1: 0.9804

CURRENT: 0.9765

S 1: 0.9522

S 2: 0.9444