Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

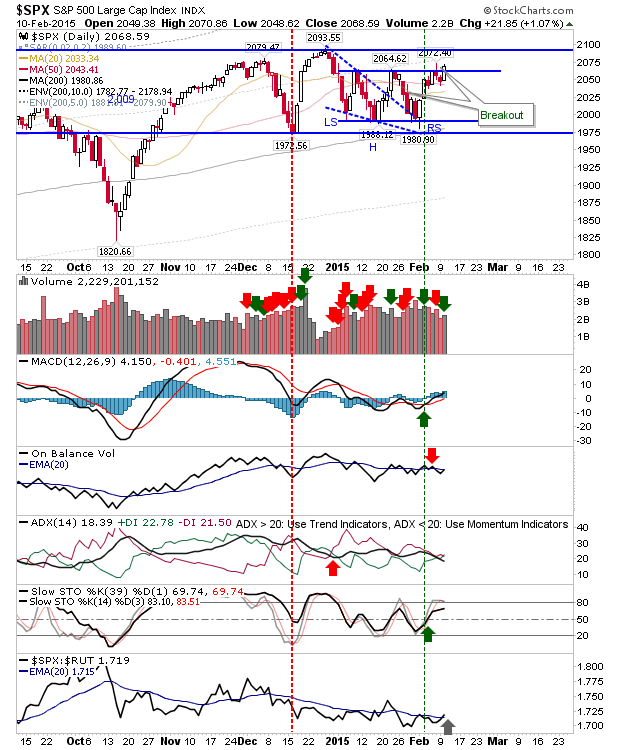

It took a couple of days, but the S&P 500 finally edged above the consolidation in place since the start of 2015. The challenge of the 2,093 high might not be so difficult to break. Volume climbed to register accumulation, although overall buying volume was not particularly high. Technicals are (slightly) bullish.

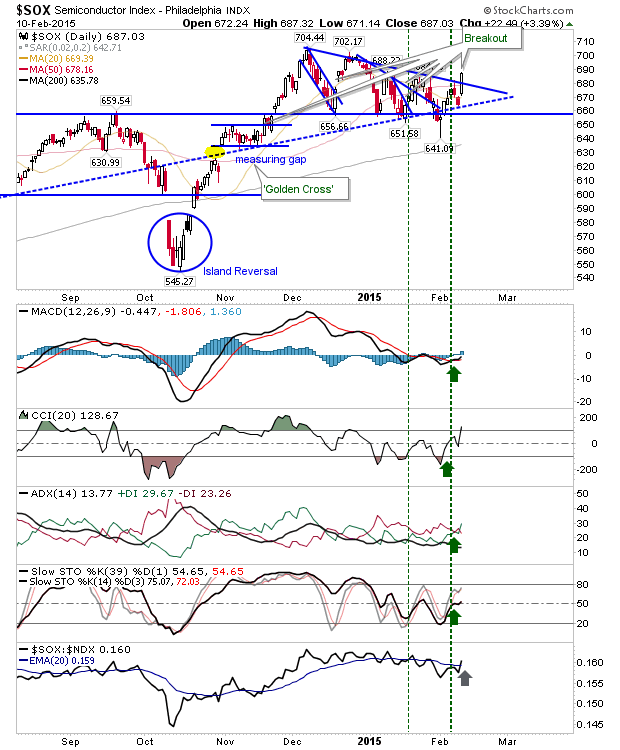

The other index to do was the Semiconductor Index. It cleared the consolidation triangle after a successful test of 659 support. Bulls looking at the long term will probably do well to keep track of this index; it's the one making the moves after a decade of underperformance.

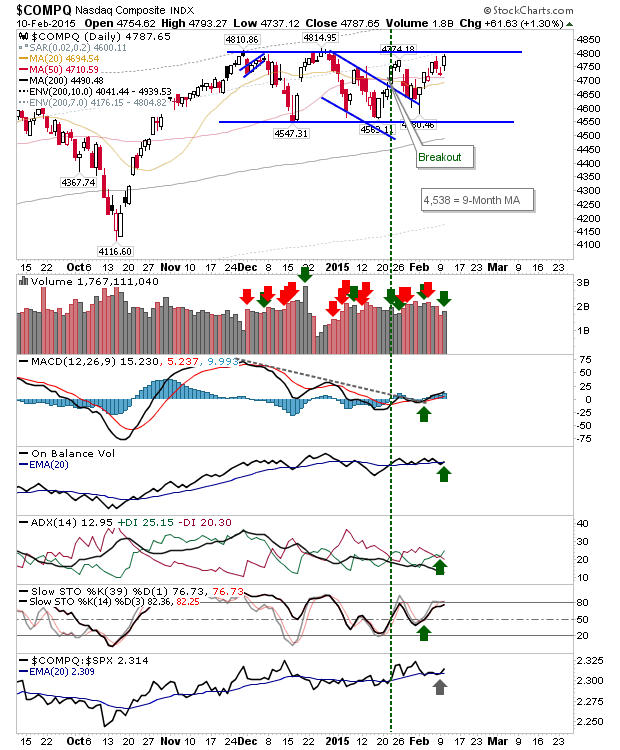

What's good for the Semiconductor Index is also good for the NASDAQ. Technicals showed some improvement with a 'buy' trigger in On-Balance-Volume and an accumulation day just shy of a break of 4810.

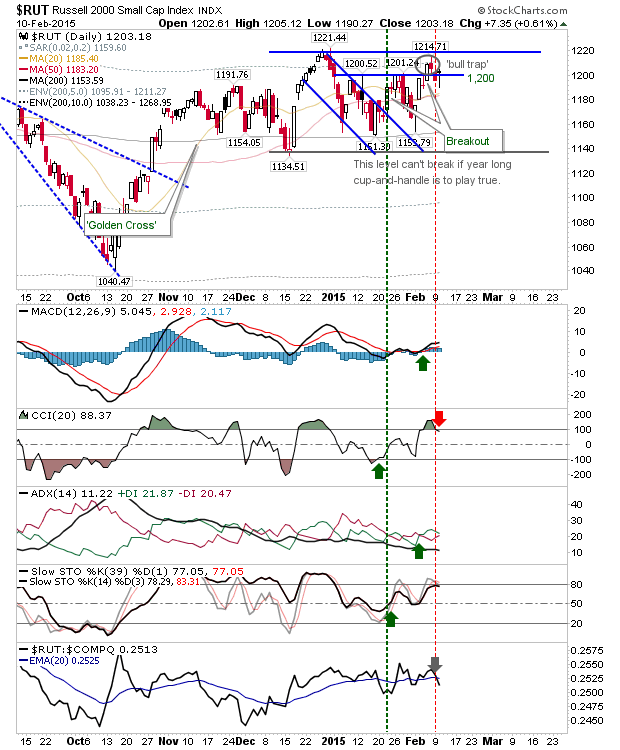

Finally, the Russell 2000 kept its nose above 1,200. It hasn't yet negated the 'bull trap' (a move above 1,214 is required for that), but yesterday's doji is a reminder of bullish demand, and a sign that bears are unlikely to succeed.

Today there is a chance for bulls to turn the screw. So far, yesterday's action places the majority of buyers from the start of the year in the green. It would be hard to be a short here, which leaves just reluctant buyers to join the party.