Straight from the off it was a day which belonged to bulls. There was no let up from what was a steady rise higher from open to close. Volume was a little disappointing, but it was a good day for the Russell 2000 and Nasdaq 100.

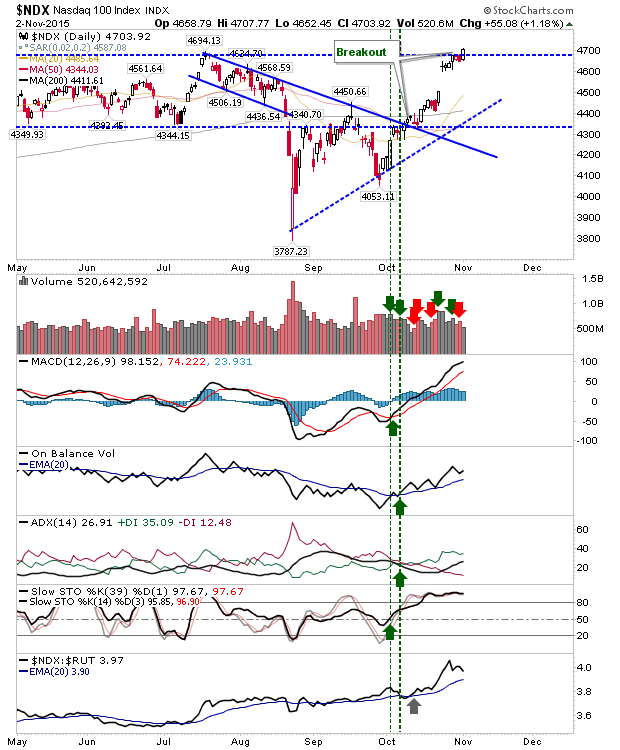

The Nasdaq 100 did enough to close with a new high on continued technical strength. It was enough to knock out my short play, so next is to watch for the 'bull trap'. The flip side is a strong set up for a rally into Christmas. Remember, the strength of the sell-off in August/September was the first since 2011 - a basis for a strong swing low.

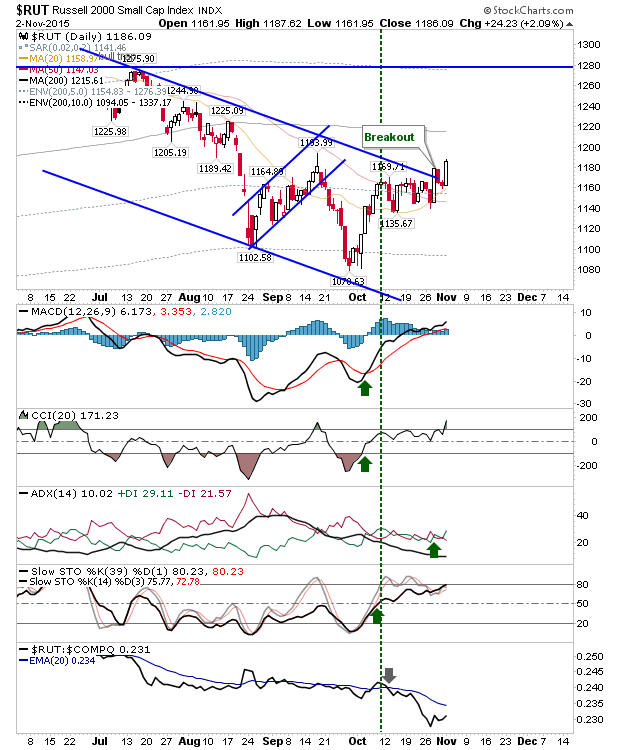

The other index to do well was the Russell 2000. Value buyers will be taking advantage of increased strength, with today's gain the best of any of the indices. Keep an eye on relative performance of the Russell 2000 to other indices: it's steadily improving with plenty of room for upside (and a new rising trend).

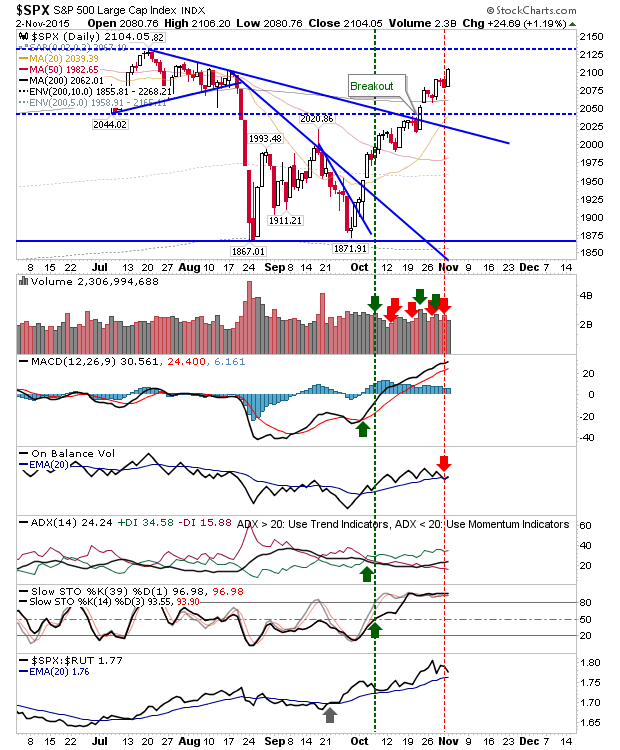

The S&P posted gains and is on course to test July highs. Nothing fancy, but effective. Any shorts will be gasping for air.

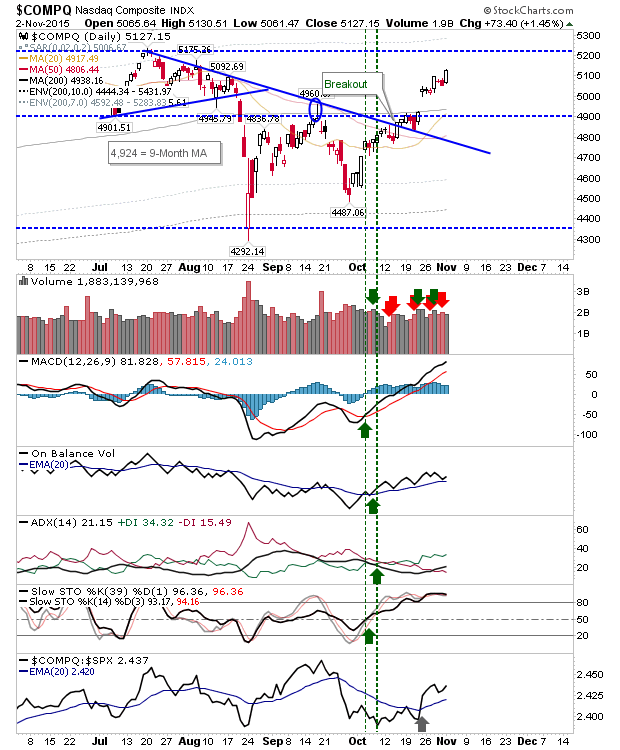

The Nasdaq is another index caught in no-man's land, making it easier to overlook the gain. Lots of room before it gets to equivalent resistance (as broken) in the Nasdaq 100.

For tomorrow, it will be a question of the Nasdaq 100 holding its breakout and bringing other indices along with it. The sleeper rally for the rest of 2015 could come from the Russell 2000. It's well positioned to gain without attracting much attention.