Investing.com’s stocks of the week

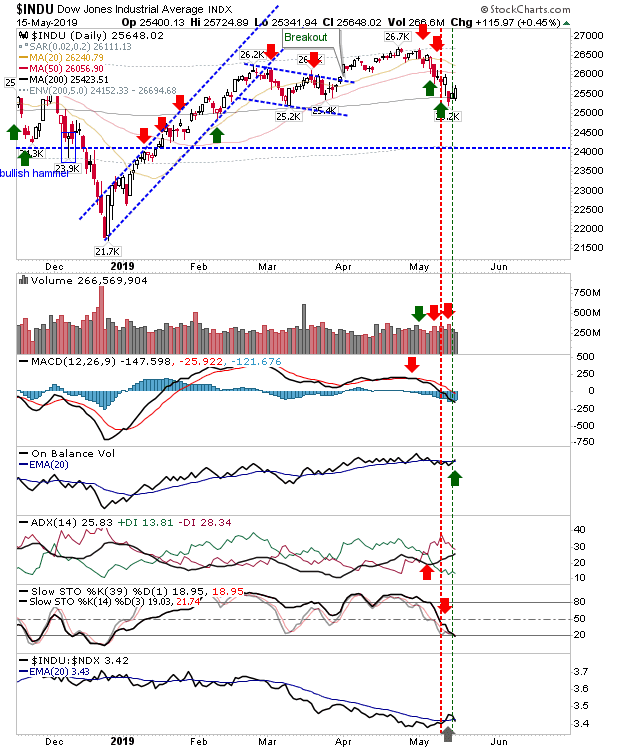

Since the Tariff sell-off, markets have managed to pull themselves back to the moving averages broken by that sell off. Buyers of the bounce off the 200-day MA in the Dow Jones Average are sitting pretty with another 100 points on offer before the 50-day MA is tested. Volume is light and technicals are mixed, but there has been a recovery 'buy' trigger in On-Balance-Volume.

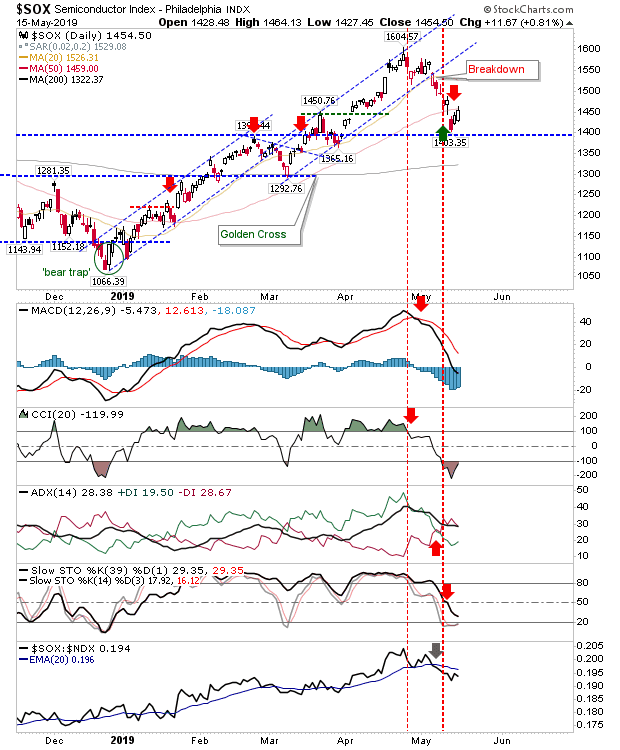

The other bounce candidate was the Semiconductor Index, although the opening gap took away much of the advantage and the index now finds itself challenging the 50-day MA.

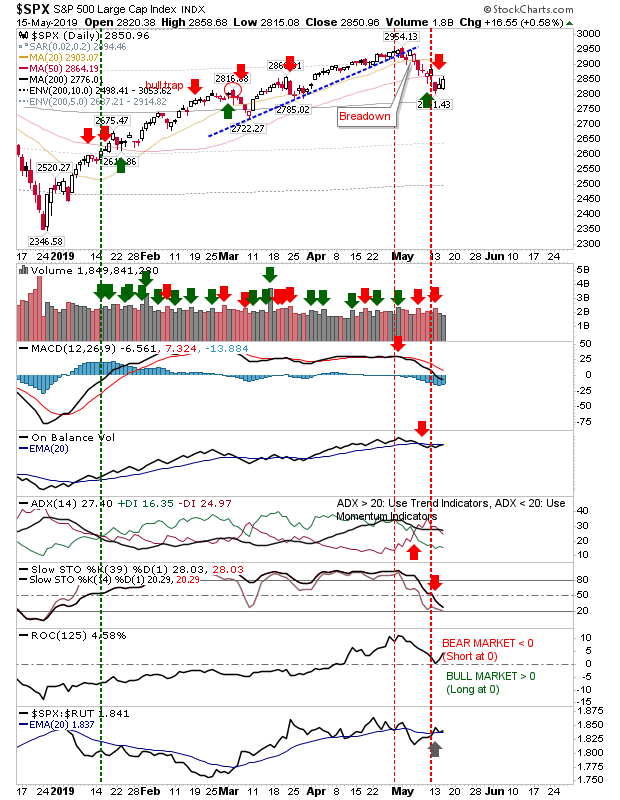

The S&P 500 bounced back to its 50-day MA. This is an aggressive shorting opportunity with a stop just above the moving average, but don't linger in the position if there is a push through - particularly if the volume is strong. Technicals are still net negative.

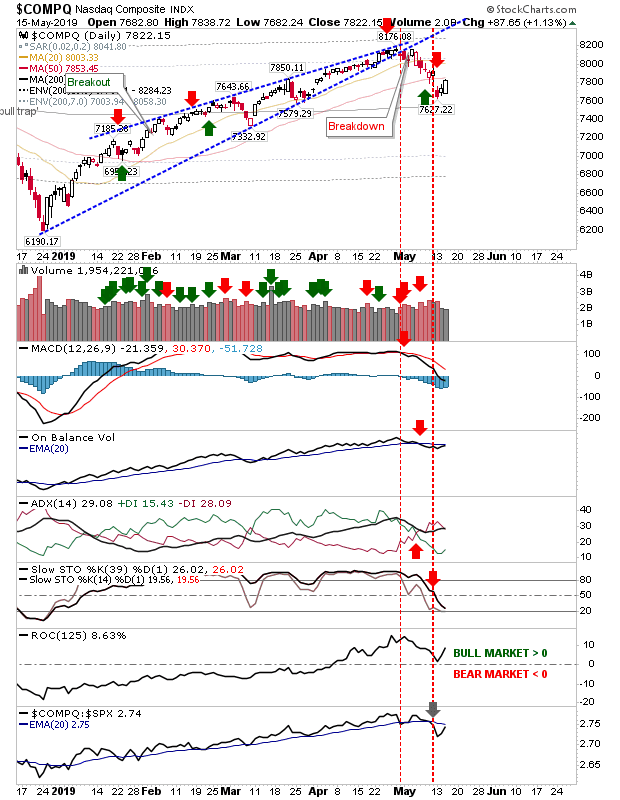

The Nasdaq sits in a similar predicament as the S&P, except it's under-performing against the S&P and therefore more vulnerable to shorts. Technicals are net negative, fueling the weakness.

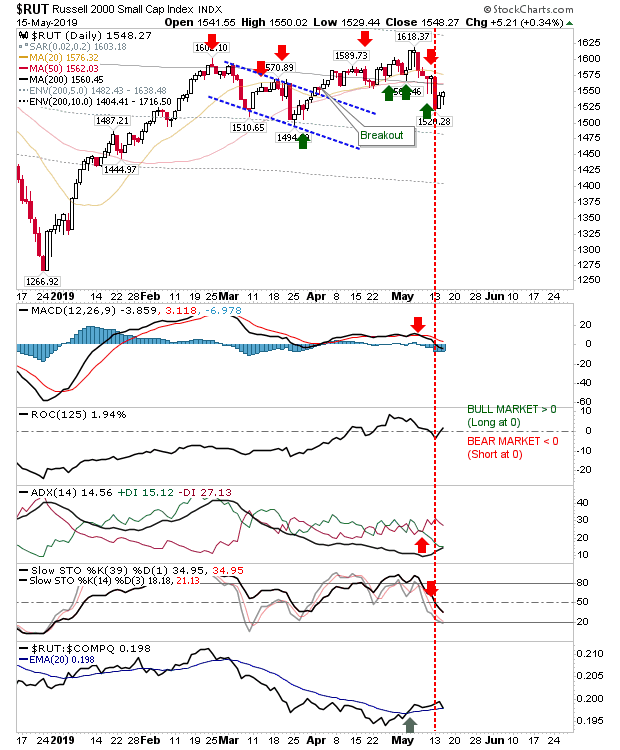

The Russell 2000 finished with a 'hammer' but the index is not oversold, weakening the bullish aspect of this candlestick.

Morning action will determine whether moving averages are going to play as resistance (and a shorting opportunity) or if there is power-through the and the 3-4 day dip below the moving averages turns into a 'bear trap'.