Traffic to my site has doubled over the last three days as 'panic reading' takes hold of the market. Such spikes in readership have in the past acted as good points for a near-term bottom, although yesterday's action does not suggest as such.

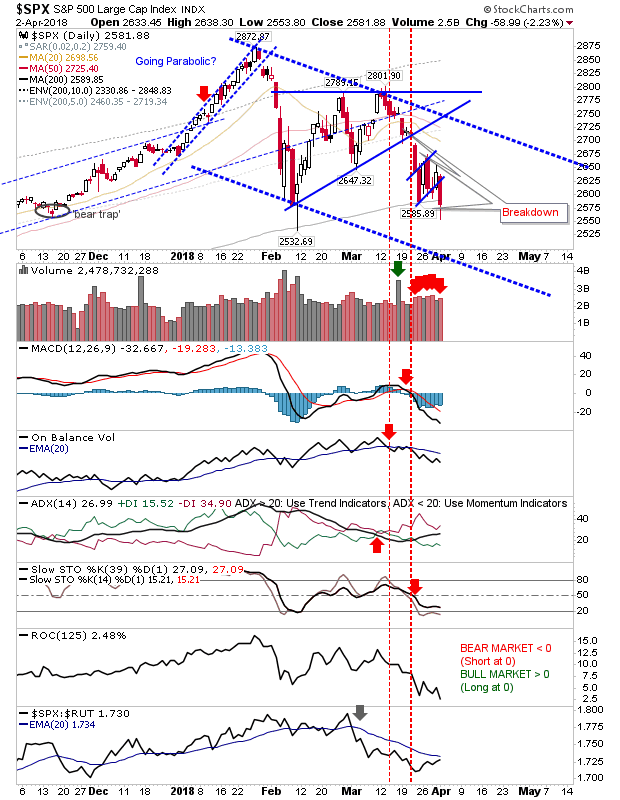

The S&P and Dow Jones both offered breakdowns from their respective 'bear flags'. The S&P broke from the 'bear flag' and closed just below its 200-day MA. Volume climbed in distribution although there is enough to suggest this could be a support level.

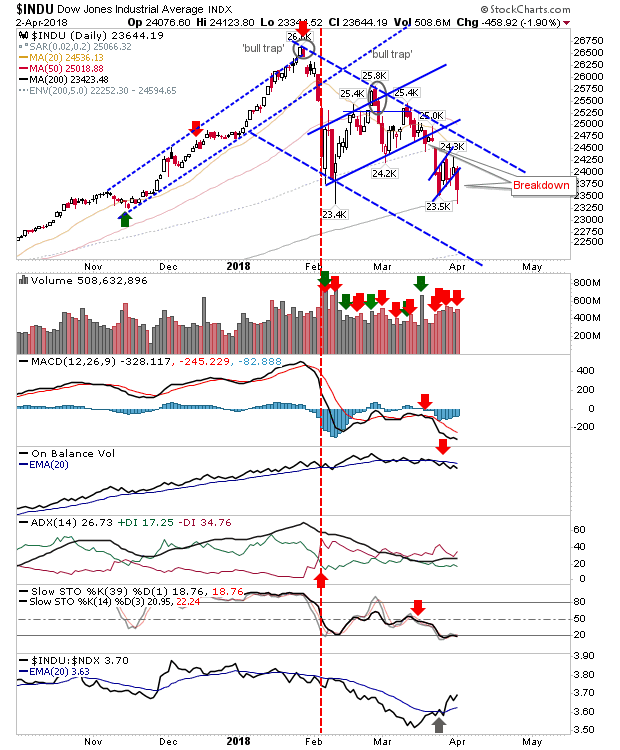

The Dow Jones Industrial average did break its 'bear flag' but didn't lose its 200-day MA. With the sharp uptick in relative performance (against Tech averages) there is a chance yesterday's tag of the 200-day MA will act as a launch point of a rally. Today could offer a 'hammer' or 'doji' spike low which moves below - but finishes above - its 200-day MA. Stochastics are oversold enough for a bounce to emerge.

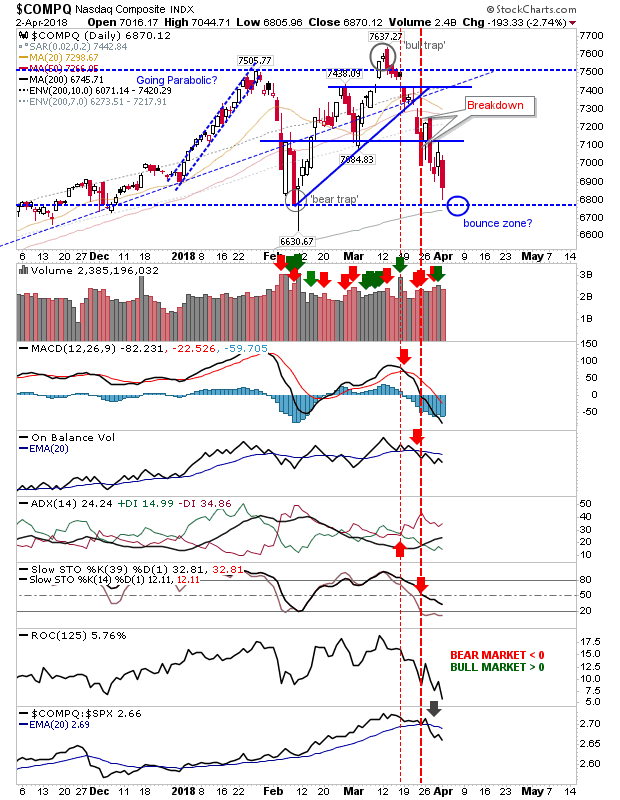

The NASDAQ gave up close to 3% but didn't tag its 200-day MA. I still like the 200-day MA as a bounce zone but it could still be a few days before it's tested; stochastics are still a long way from oversold. Relative performance is falling sharply which will make calling a bounce more difficult.

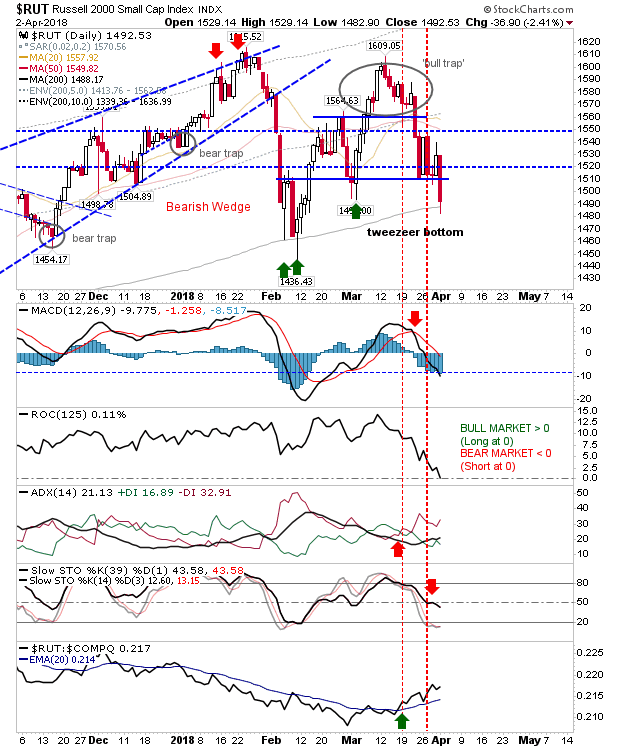

The Russell 2000 did tag its 200-day MA as it undercut the 'tweezer bottom'. The opportunity for a bounce off the bullish stochastic 'mid-line' weakened with yesterday's dip below this mid-line. The silver lining is the relative performance of the index which continues to gain. For the next rally, look for leadership from Small Caps but it might be a tough sell, to begin with.

For today, for indices near 200-day MAs it will be important for them to close at or above this key average - but intraday moves below this moving average can and should be expected.