As 2019 is starting out, both financial and cryptocurrency markets are hopeful for a turnaround in their respective fortunes.

The Dow Jones Index, the S&P 500, and the majority of public company stocks have had to endure a torrid end of the year. Even highly successful tech companies like FAANG (Facebook, AAPL, AMZN, NFLX, and Google) have become the victims of financial markets, losing more than $1 trillion in total from their all-time high value less than half a year ago.

From the perspective of cryptocurrencies, similar price developments have been observed, albeit from the beginning of 2018. Bitcoin and other digital assets have lost on average 90 percent of their market values in just one year, shortly after claiming all-time high price levels.

Correlation For Investors

In the grand scheme of financial markets, price movements are directly or indirectly influenced by investors’ perception. In traditional markets, if all of the biggest investment firms that make up most of the trading on markets follow similar models and assumptions, then one would expect similar output decisions in trading. Hence, there are critical moments when certain stocks either break out or down at the slightest confirmation of a positive or negative signal.

This can also partly explain how correlated some stocks or markets are. Generally, stocks representing companies from the same industry will be positively correlated. This means that price will tend to move in the same direction in the same market conditions. Conversely, there are asset classes or certain industries that have a negative correlation with each other — such as a company that sells ice-cream and one that sells umbrellas.

Institutional investors usually try to mimic and beat the overall market. This translates into managers picking asset classes that will outperform during positive trends and those that will allow them to avoid the bleed during a downward trend. As such, portfolios are comprised of different stocks and investment products with different correlations between them. Finding asset classes with negative correlation or almost no correlation with a portfolio is sometimes a tough task.

Bitcoin’s Stance

As Bitcoin wants to enter the international financial markets and fight for its own supremacy, many have lamented that Bitcoin’s price might be correlated with that of other asset classes. If this is true, institutional investors might not have an incentive to diversify their portfolios into digital assets.

As it turns out, Bitcoin has no correlation with some of the major asset classes.

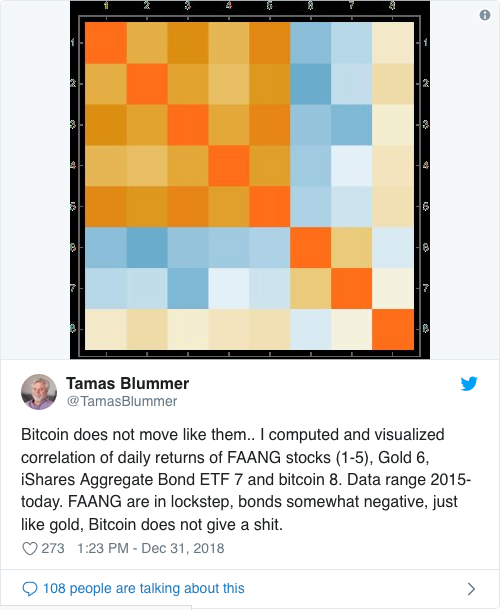

Tamas Blummer has published a correlation matrix between several stocks and major global exchange traded funds (ETF). The analysis included daily returns for the FAANG stocks, an aggregated ETF, gold and Bitcoin.

The matrix reveals a very high correlation between the big tech companies, which most have already deduced during the second half of 2018. At the same time, gold and the ETF have a slight negative correlation with the rest, which makes these a good hedging tool for investors. The cryptocurrency representative in this group (Bitcoin) is showing almost no correlation with neither of the asset classes in this analysis.

Investors Bringing Correlation?

While looking at the yearly performance, one would assume that Bitcoin, just as much as the stock market, has taken a beating and hence would seem correlated. However, data is showing that the asset classes remain mainly uncorrelated. This finding remains true even for weekly returns of the aforementioned asset classes.

As Bitcoin proponents would argue: BTC doesn’t care. However, the uncorrelated price of Bitcoin to other asset classes could also be tied to the fact that most of the current investors are retail. With the impending entrance of major investment firms into the digital asset industry, the neutral correlation could slowly disappear. As institutional investors park more of their funds in digital assets and have a grasp of these markets’ movements, Bitcoin might not remain uncorrelated to other assets.

Ultimately, it’s the investors’ perception that influences the markets.

What do you think? Will institutional investors bring correlation for digital assets with other assets into play? Tell us in the comments below.