Things will be cooling down a little heading into the Christmas break, but Friday offered bears a huge boost with significant distribution and technical reversals. Few indices escaped the selling.

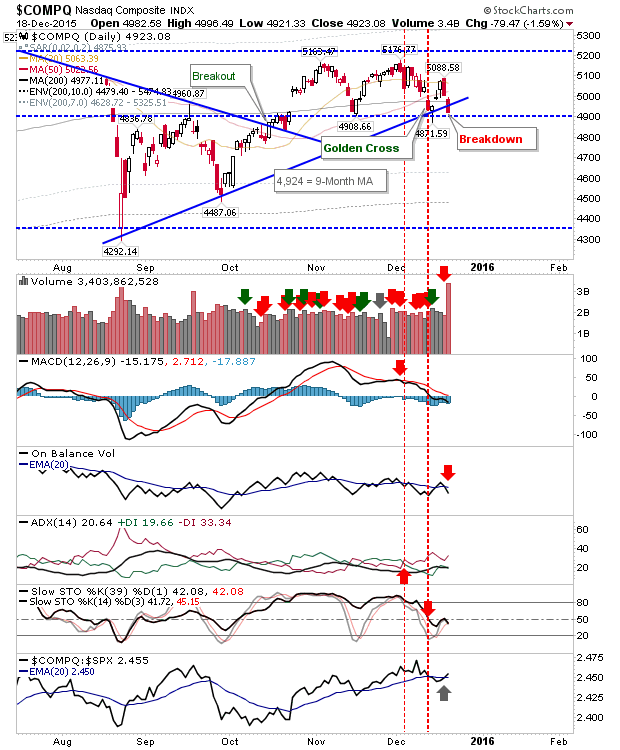

The Nasdaq lost rising support, and undercut its 200-day MA in a ,move to set to challenge the swing lows of November and December. The 4,900 level is a critical level for the trading range as a loss of this would open up for a retest of the August/October swing lows.

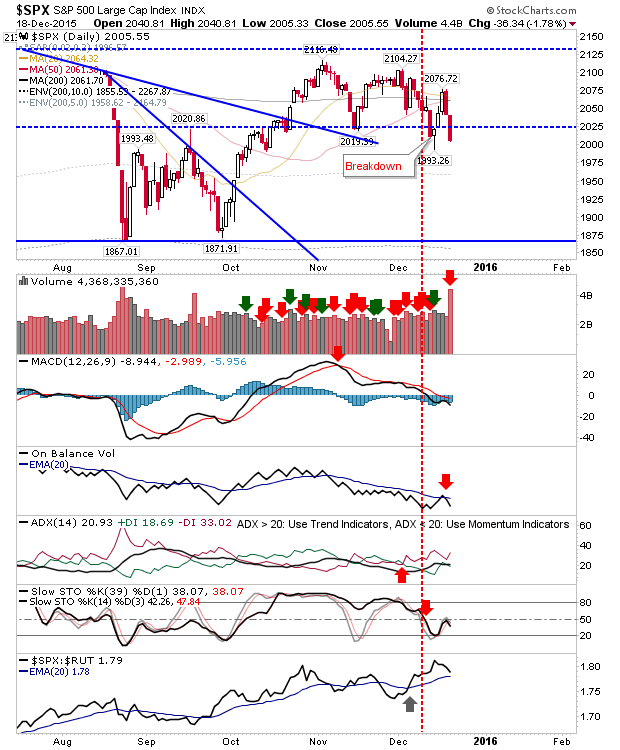

The S&P had long said goodbye to all of its moving averages and the November swing low. Friday saw it drop back to the December swing low, and is very much looking at a retest of August/September/October swing lows (lows which rated as a major swing low, last seen in 2011). There is still a chance bulls could defend the December low, but I wouldn't see this as significant support (not enough time has passed for this to be so).

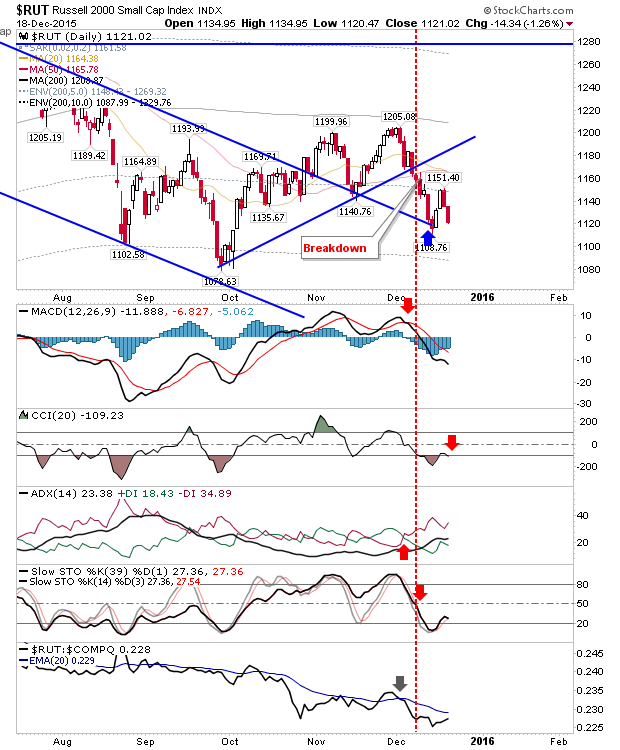

The Russell 2000 had been underperforming relative to key indices. Friday was no exception as losses took it back to the December swing low. Note, this index is already down at August/Swing lows (which at the time was a major swing low), so as a leader for other indices its action is worrying. Technicals are firmly negative.

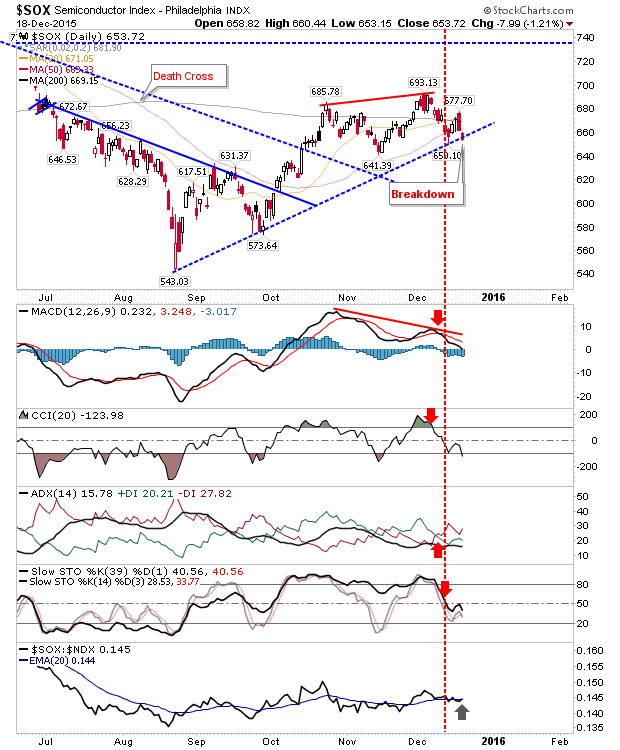

The Semiconductor Index inched a breakdown, but it's close enough to rising support to offer bulls something to work with on Monday. It there is a bullish response pre-market, this is the market to watch.

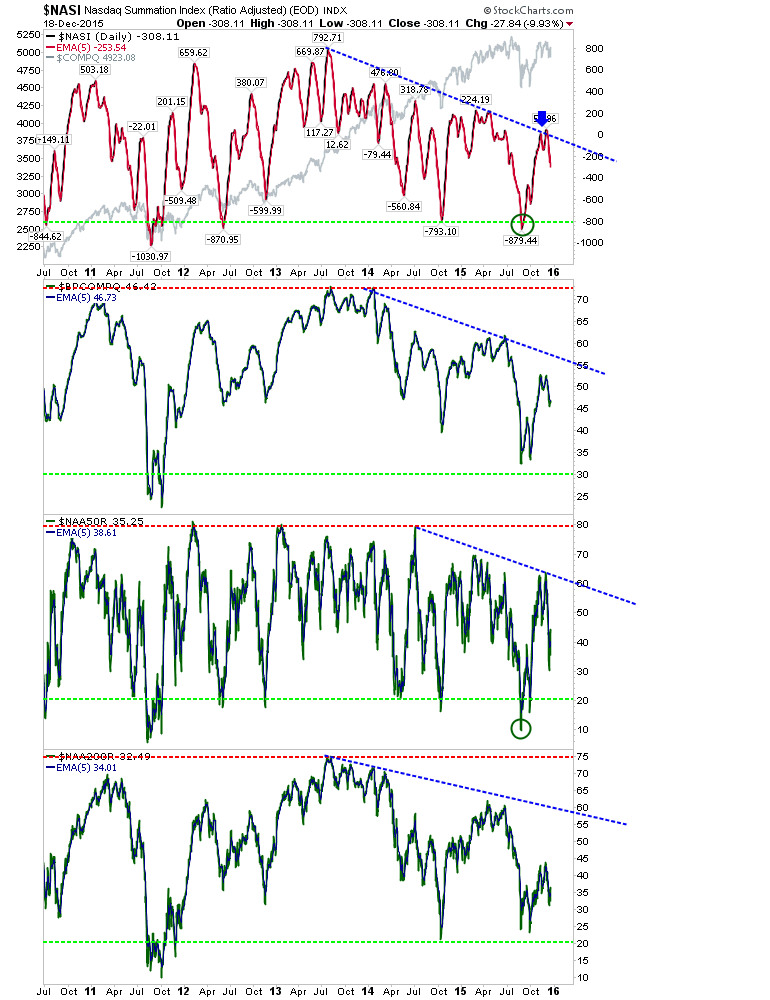

In breadth terms, the Nasdaq is caught in the middle. The Nasdaq Summation Index reversed off resistance, but it hasn't yet reached oversold levels. Other breadth metrics are similarly caught in no-mans land. This is a key worry for bulls, as a move to August/September-October lows may not be enough.

This may be a quiet week for these indices.