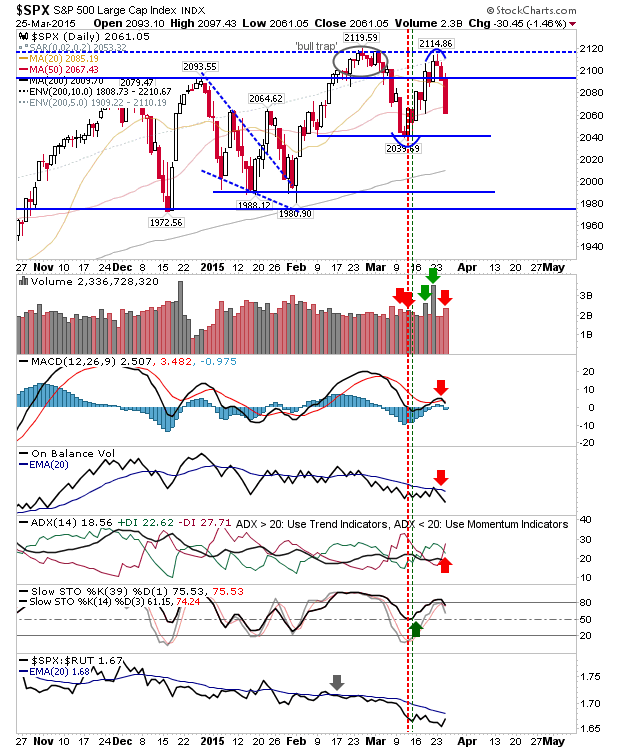

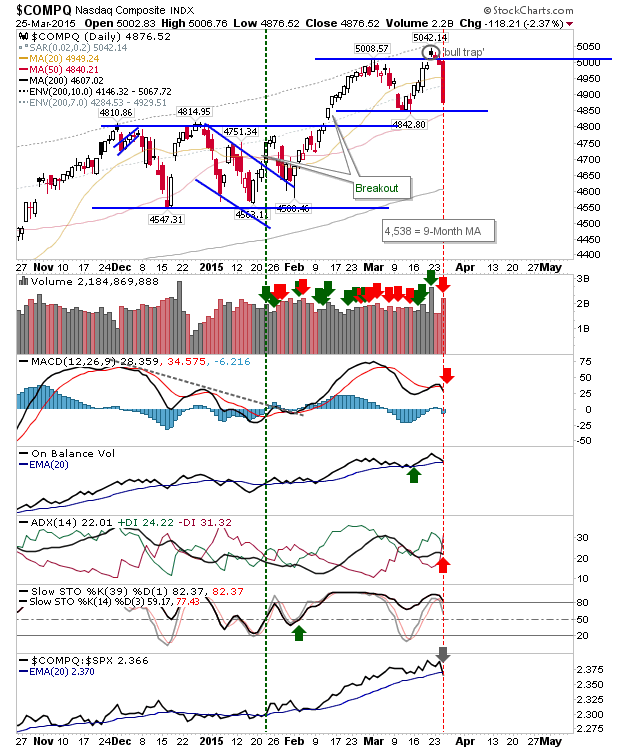

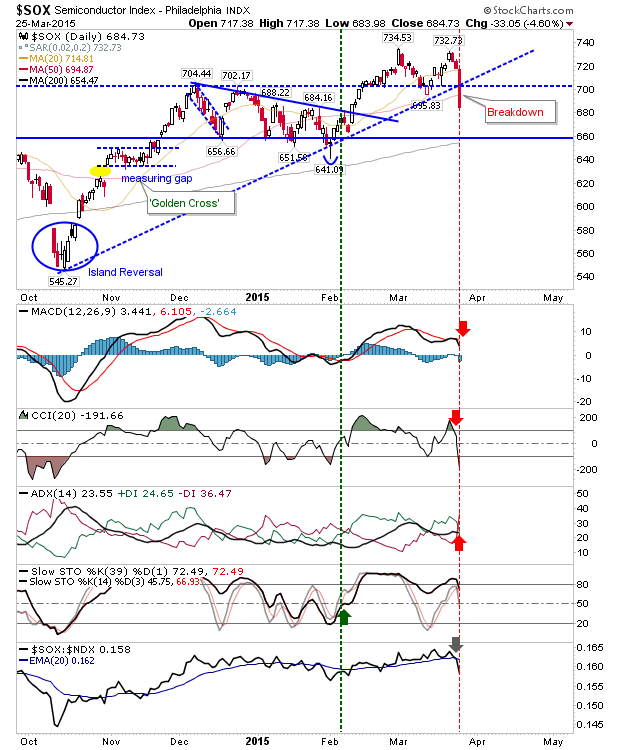

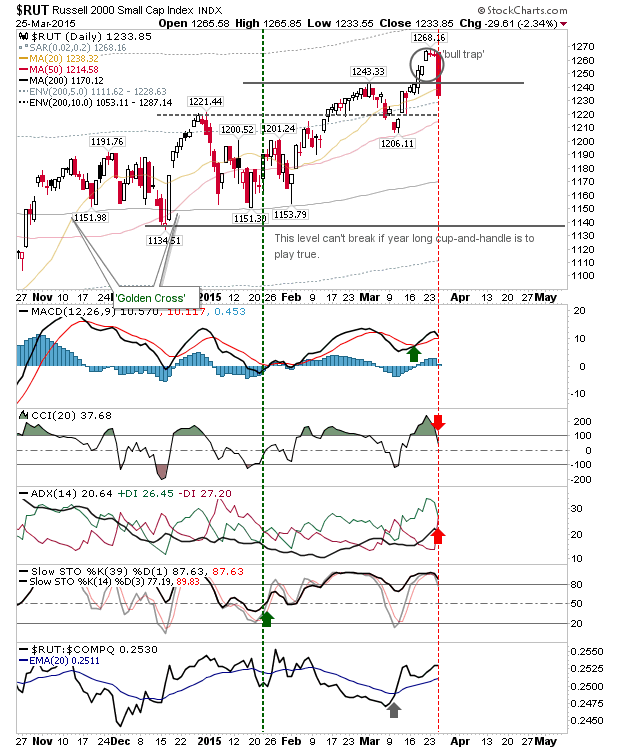

Yesterday was a difficult day for bulls as sellers swarmed out of the gates. Volume climbed to register distribution across all indices as technical weakness expanded.

The S&P finished the day below its 50-day MA, but hasn't yet challenged support of the March swing low at 2,039. If a double top is to emerge, then a close below 2,039 is required; if this plays true, look for a downward target of 1,965. Technicals already point in shorts' favour with a MACD 'sell' trigger and bearish cross of +DI / -DI.

The NASDAQ experienced an even bigger loss. It will reach the swing low at 4,842 at the same time as it tests its 50-day MA today. In addition, the MACD trigger 'sell' coincided with a bearish cross between +DI and -DI. Should buyers fail to emerge at 4,842, then the 200-day MA at 4,607 comes into play.

The Semiconductor Index lost nearly 5%, undercutting trend support and the 50-day MA in the process. A MACD trigger 'sell' joined other such triggers in the indices. It was also the first index to undercut the March swing low.

The Russell 2000 finished yesterday with a 'bull trap' and a 2.34% loss. However, the damage to this index was not as great. The swing low of 1,206 remains far away, and the 50-day MA too. The index did close below the 20-day MA, but it's close enough to the 1,243 high to reclaim it. A push back to 1,243 will open the opportunity for a bearish head-and-shoulder pattern. For this to be true there can't be much follow-through above 1,243 in today's session, and the neckline becomes 1,206.

Markets appear to be setting up for double tops, and a broadening of trading ranges established from the time of the 'Santa Rallies.' Meanwhile, it may take a challenge of 200-day MAs to re-awaken bulls.