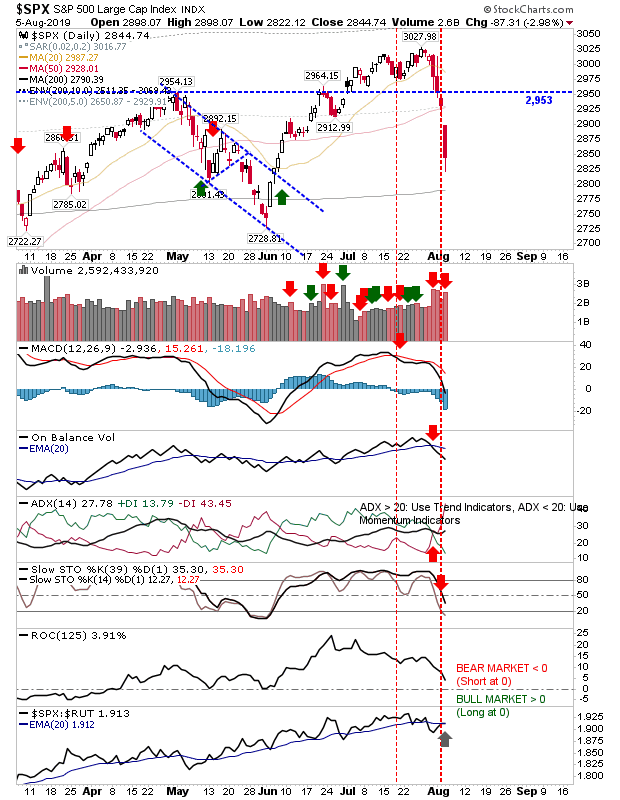

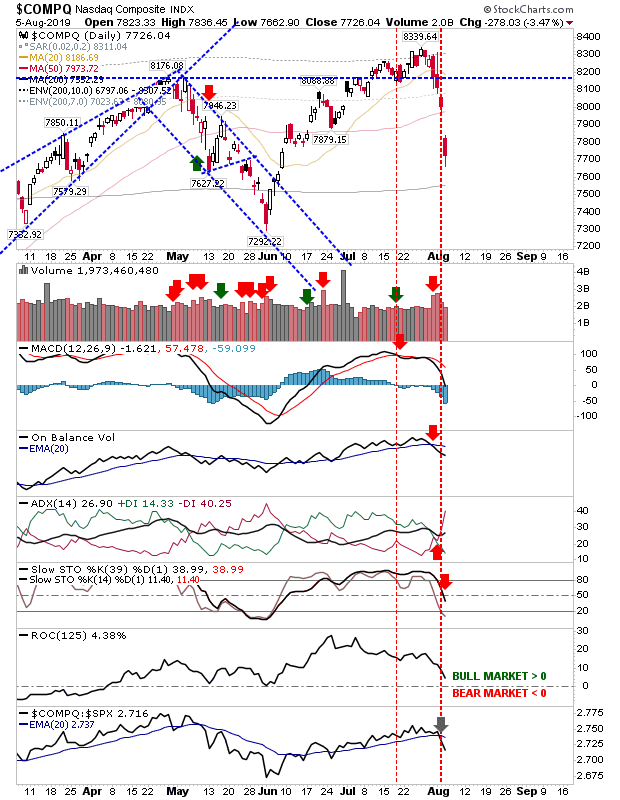

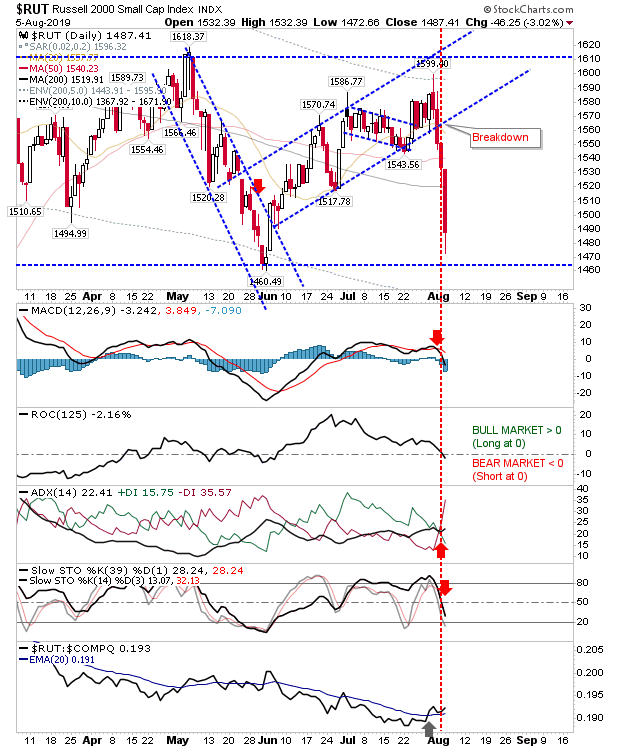

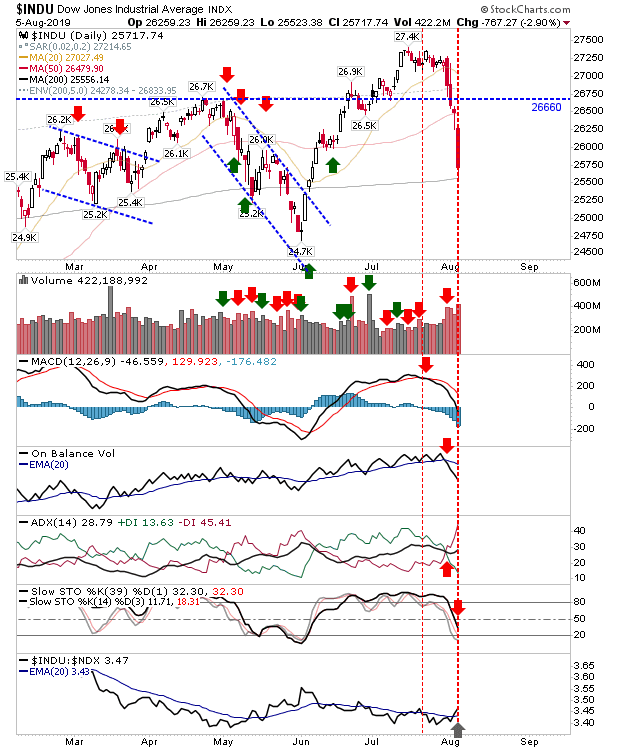

Big losses swept the market as the Chinese trade war was blamed for yesterday's decline, but Trump chaos has been influencing the market for a long time and the failure of the June breakouts is a more likely cause of the continued selloff.

For the S&P, the next move is heading down to retest the June swing low of 2,728. Technicals are net bearish and losses were less than those that hit the Russell 2000, which has actually managed a relative gain. Before it gets there, the 200-day MA is first up

The NASDAQ was late to the party on the breakout but it too is rushing back to the June swing low. First up is the 200-day MA. As the Nasdaq loss was above 3% it registered as a significant relative loss against the S&P.

The Russell 2000 will be the first to confirm whether June swing lows will hold as support, but the 200-day MA didn't offer much to help so don't be looking for much defensive action from this moving average for the S&P or Nasdaq

Speaking of the 200-day MA, the Dow Jones tagged it on Monday on heavier volume distribution. Can it work a bounce on Tuesday

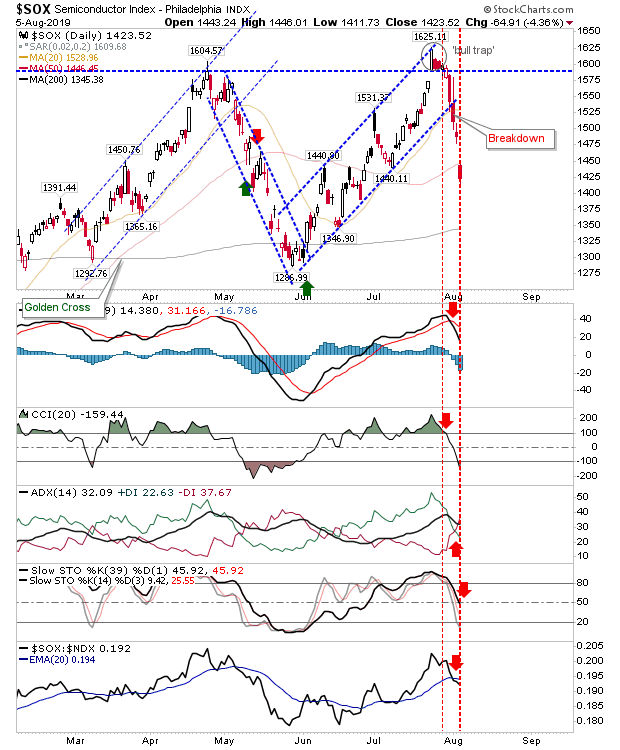

The Semiconductor Index lost over 4% but it's still some way from testing its 200-day MA.

For today, a relief bounce may emerge but indices are now caught well inside prior trading ranges and it's going to be a few weeks before the next move can be determined.