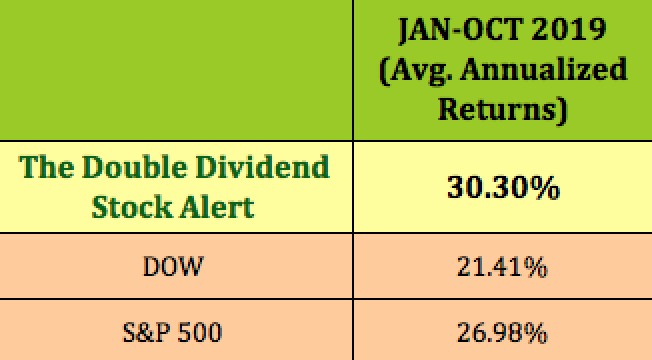

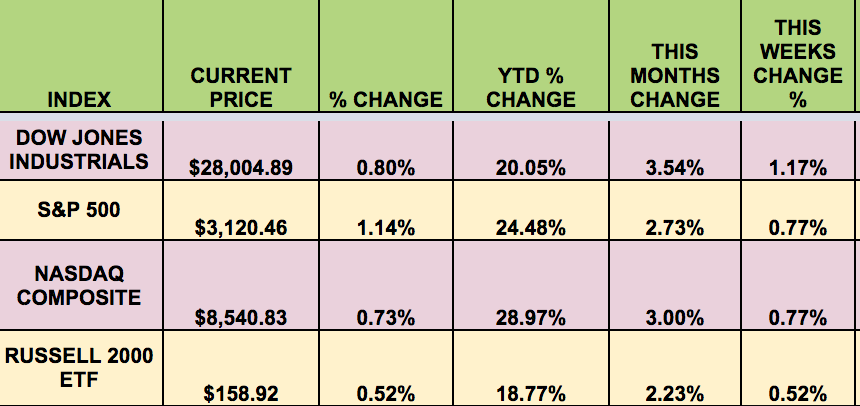

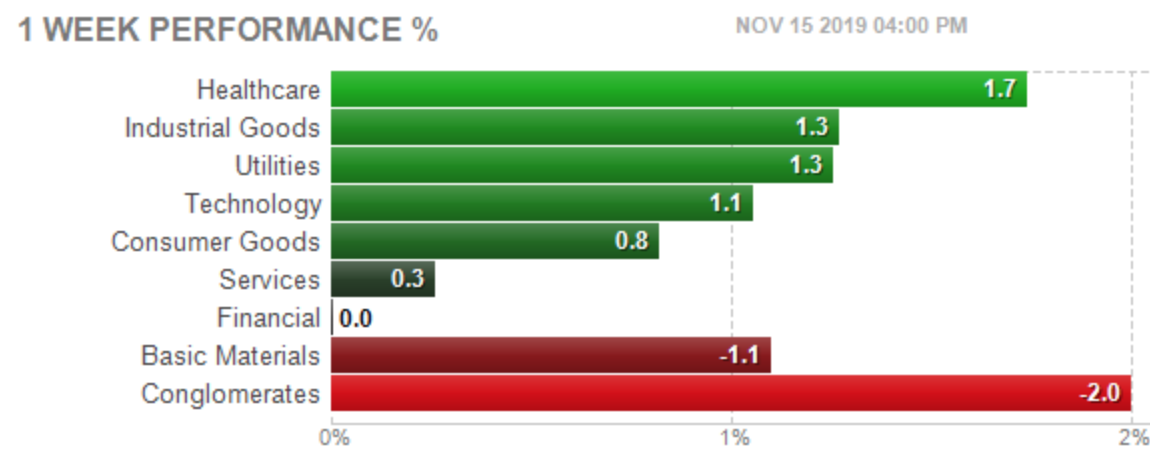

Market Indexes: The S&P 500, the Nasdaq, and the Dow indexes hit record highs this week, for a sixth straight week of gains fueled by fresh optimism over a potential calming of U.S.-China trade tensions and by big gains in shares of healthcare companies.

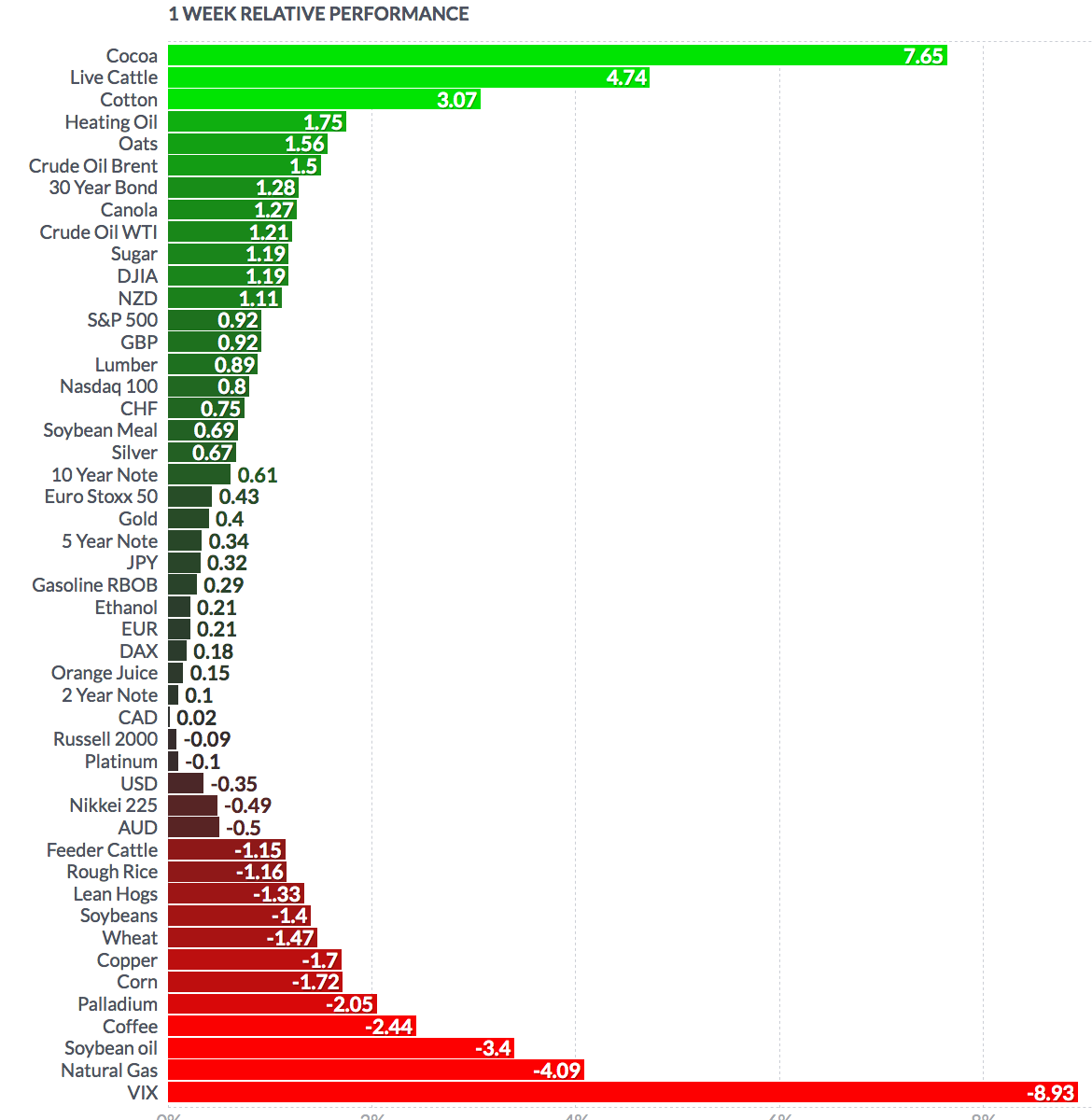

Volatility: The VIX fell 5.15% this week, ending the week at $12.05.

High Dividend Stocks: These high yield stocks go ex-dividend next week: NHTC, ENBL, MNRL,GNK, LB.

Market Breadth: 18 out of 30 DOW stocks rose this week, vs. 26 last week. 60% of the S&P 500 rose, vs. 66% last week.

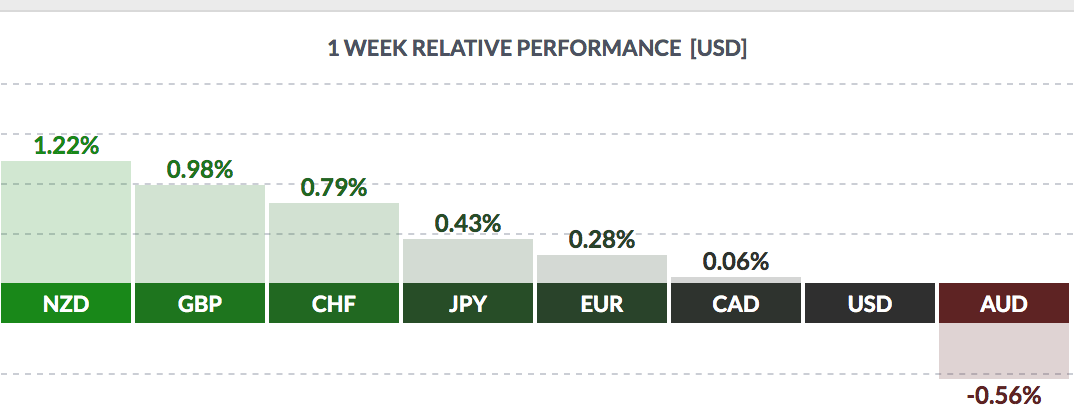

FOREX: The USD fell vs. most major currencies this week, except the Aussie.

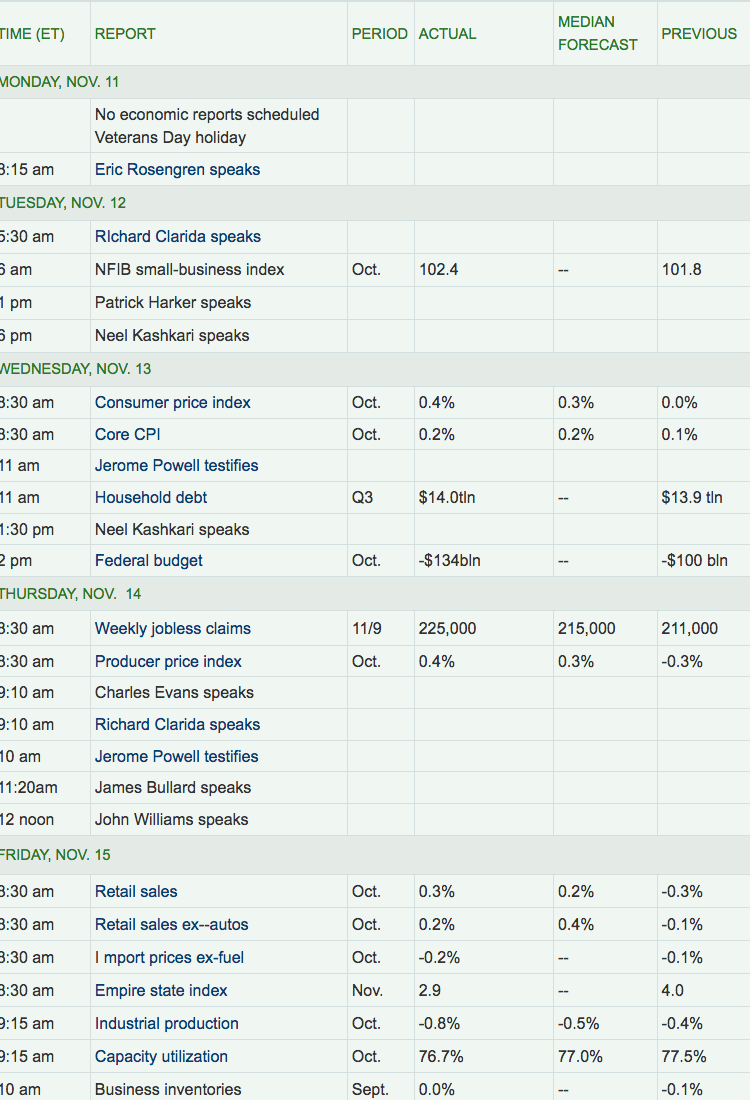

This Week’s Economic Reports:

“Fed Chairman Jerome Powell says the central bank is unlikely to move on interest rates given the “sustained” economic expansion. The central bank has cut its benchmark rate three times this year to a range of 1.5%-1.75%. “Looking ahead, my colleagues and I see a sustained expansion of economic activity, a strong labor market, and inflation near our symmetric 2 percent objective as most likely,” he tells a joint congressional committee.” (CNBC)

“China’s factory output growth slowed significantly more than expected in October, as weakness in global and domestic demand and the drawn-out Sino-U.S. trade war weighed on broad segments of the world’s second-largest economy. China wants tariffs imposed by the U.S. to be removed but has not made the agricultural purchases the United States wants because swine flu has decimated its pork industry and eliminated the need for U.S. soybeans.

The German economy grew just 0.1% in the third quarter, avoiding slipping into a mild contraction thanks to consumer spending, but remaining weak nevertheless.” (Reuters)

“U.S. producer prices increased by the most in six months in October, lifted by gains in the costs of goods and services, further bolstering the Federal Reserve’s stance that it will probably not cut interest rates again in the near term. The report from the Labor Department on Thursday showed healthcare costs accelerated last month, with the cost of outpatient care at hospitals posting its largest rise since 2009. The jump in healthcare prices mirrored gains reported in October’s consumer price index report on Wednesday. Still, underlying producer inflation remained muted last month.

The Fed, which has a 2% annual inflation target, tracks the core personal consumption expenditures (PCE) price index for monetary policy. The core PCE price index rose 1.7% on a year-on-year basis in September and has undershot its target this year. October PCE price data will be published later this month.” (Reuters)

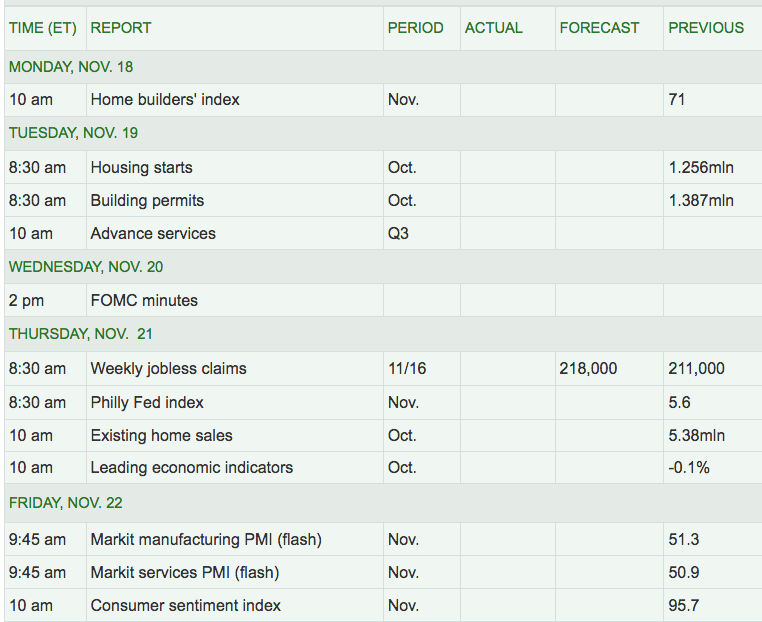

Week Ahead Highlights: Earnings season will continue next week, with several retailers reporting, including Macy’s (NYSE:M), Lowe’s (NYSE:LOW), and Home Depot (NYSE:HD).

Next Week’s US Economic Reports:

Sectors: Healthcare led this week, with Basic Materials lagging.

Futures: WTI crude rose 1.21% this week, finishing at $57.93, while Natural Gas fell 4.09%.

“The U.S. Energy Information Administration’s (EIA) NATURAL GAS REPORT 2018 shows that the United States set new records in natural gas production, consumption, and exports in 2018. In 2018, dry natgas production increased by 12%, reaching a record-high average of 83.8 billion cubic feet per day (Bcf/d). This increase was the largest percentage increase since 1951 and the largest volumetric increase in the history of the series, which dates back to 1930. U.S. natural gas consumption increased by 11% in 2018, driven by increased natgas consumption the electric power sector. Natural gas gross exports totaled 10.0 Bcf/d in 2018, 14% more than the 2017 total of 8.6 Bcf/d. Several new liquefied natural gas (LNG) export facilities came online in 2018, allowing for more exports.”