The US stocks edged up on Friday on strong labour market statistics. The November Non-farm Payrolls exceeded forecasts amounting to 211’000. Unemployment is the lowest in 7.5 years at 5%. Investors believe such strong data will help the Fed hike the rates on its next meeting on December 16. The fed funds futures are currently pricing in a 78% chance of a Fed rate hike. The JPMorgan Chase (N:JPM) stocks edged up 2.3% after the European antitrust regulator partly dismissed the charges against the bank. The US dollar slightly corrected up on Friday still ending the week 1.7% lower (see US dollar index live data). No important macroeconomic statistics is expected today from the US.

European stocks are increasing for the 2nd straight trading day on Monday being underestimated compared to the US ones. The Р/Е for Stoxx Europe 600 Index is 1.6 while the US S&P 500 is traded with P/E of 17.7. Today in the morning the weak German industrial production for October was released that investors took little notice of. No more significant macroeconomic data is expected today from Europe.

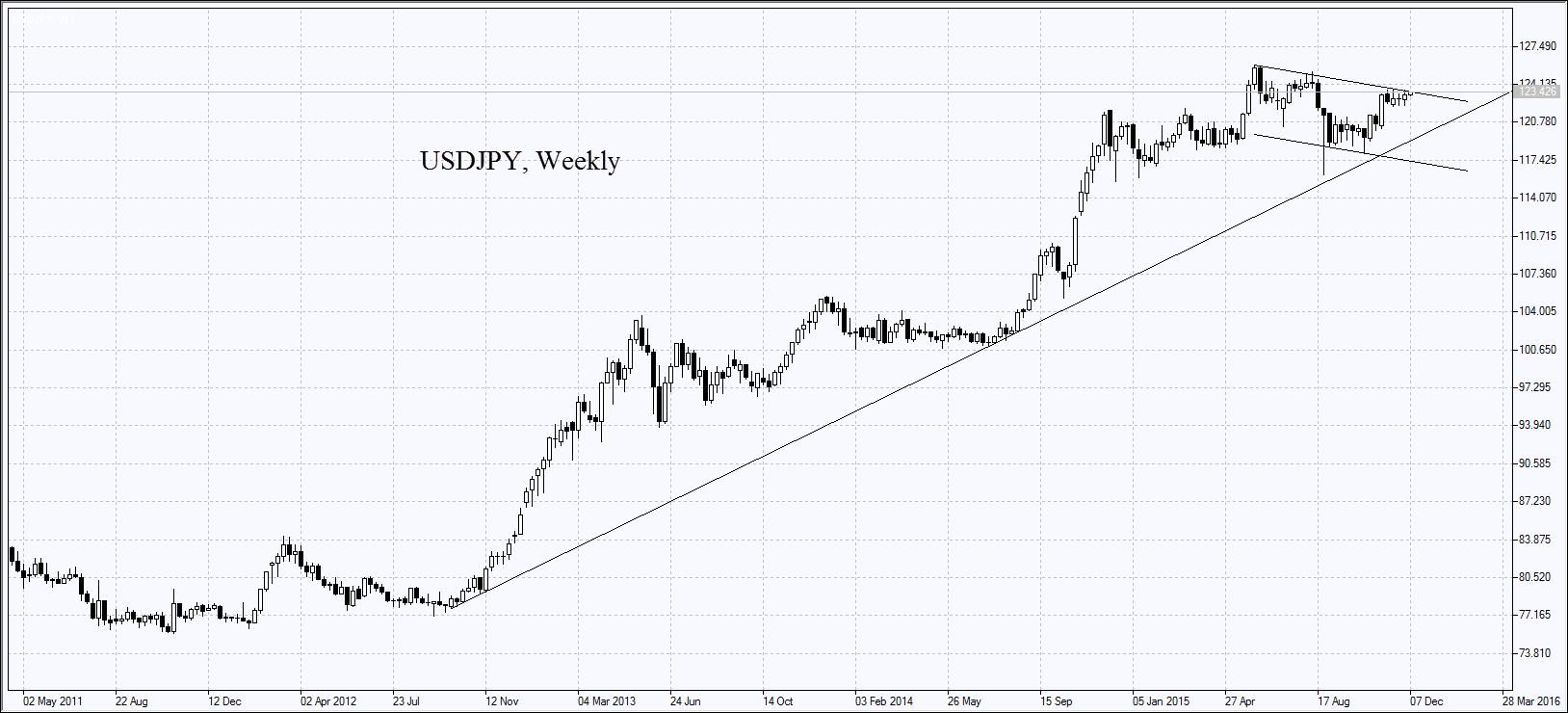

On Friday, the Japanese stock market closed before the release of the positive US data. Nikkei took a cue from the strong indicators closing higher (see Nikkei index live). Amid the weaker yen, the exporters stocks were in demand: Honda Motor (N:HMC) (+1.9%), Nissan Motor (OTC:NSANY) (+1.8%) and Panasonic (OTC:PCRFF) (+1.6%). The retailer Ryohin Keikaku (OTC:RYKKY) advanced 2.8% after Nikkei business daily newspaper published the forecast of its operating profit revised up by 40%. Other retailers stocks - Aeon (OTC:AONNY) and Fast Retailing (OTC:FRCOY) - advanced a bit less than 2%. Mizuho Financial Group (N:MFG) revised up the forecast of the West Japan Railway (OTC:WJRYY) stocks that rose 1.7% on this news. East Japan Railway (OTC:EJPRY) saw its stocks gain in price 1.8%. Tomorrow at 00:50 CET the external trade data for October, the final 3Q GDP and other important indicators will come out in Japan. We believe the tentative outlook is positive.

Tomorrow in the morning China’s external trade data for October will come out which may affect the commodity futures. We see the tentative outlook as neutral.

Oil prices edged lower after OPEC decided on Friday to leave the oil extraction quotes unchanged at the current 30mln barrels a day and the real production at 31.5mln. The next OPEC meeting will take place only in June 2016. The market participants state the oil supply glut of 0.5-2mln barrels a day, which pushes its prices lower. The volume of longs in oil has fallen to the 5-year low, according to the U.S. Commodity Futures Trading Commission.

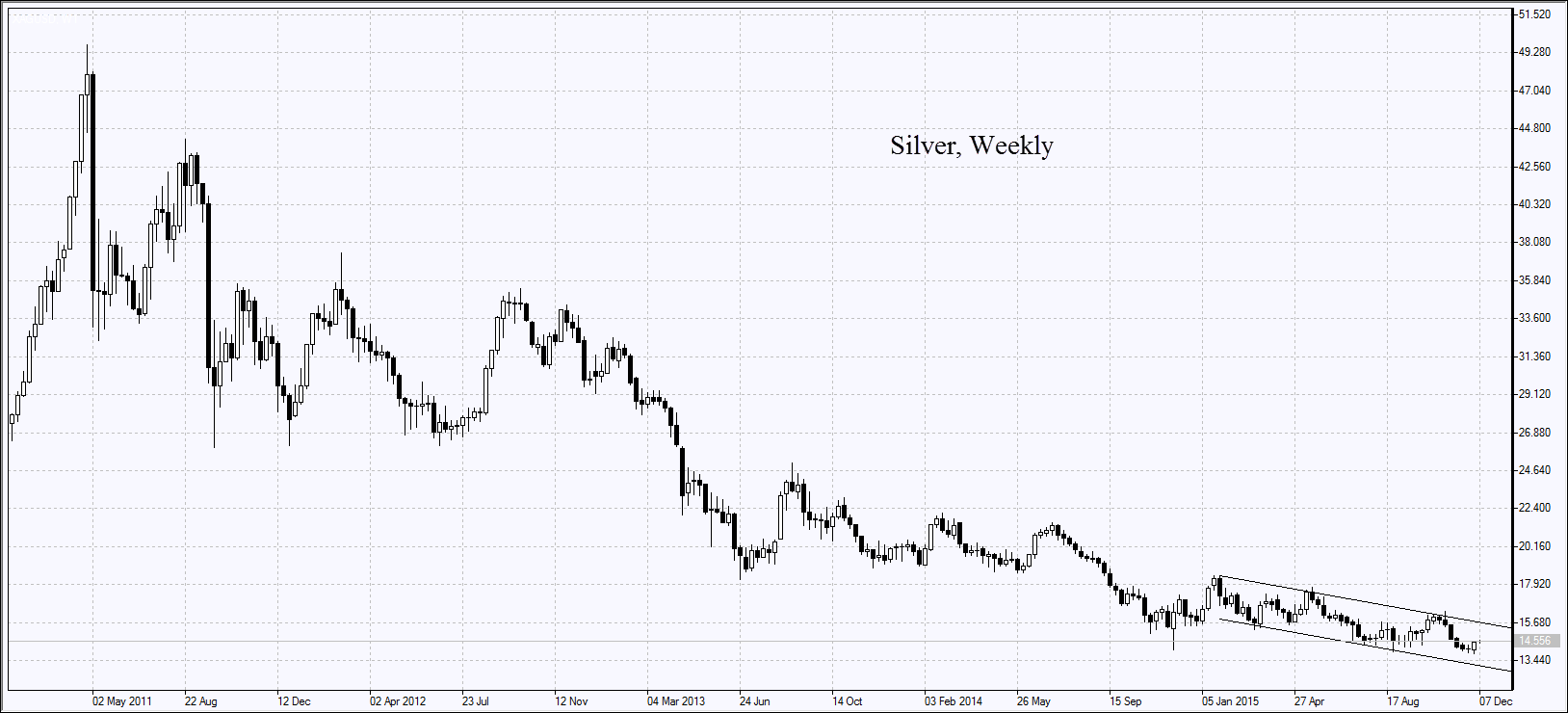

Copper and gold advanced amid the record net shorts. Some of them may have been closed by fiat. The U.S. Commodity Futures Trading Commission states the highest number of shorts in copper is seen on COMEX since April 2013 while in gold it is the highest since 2006. Meanwhile, hedge funds have formed the net position in silver. The metal may outperform the gold.

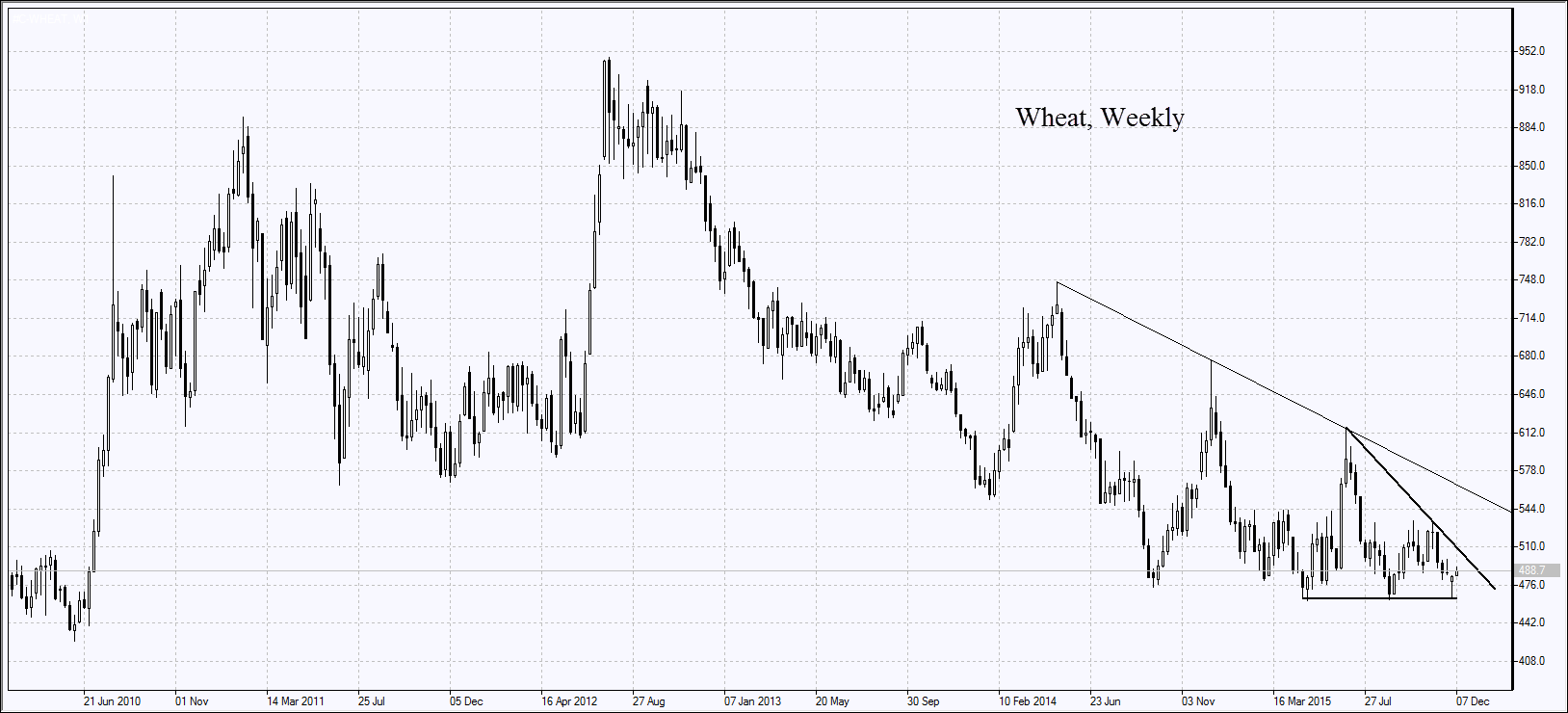

Grain futures are in steady growth amid the higher demand from China. On Wednesday the USDA monthly report will be released which may affect the grains. Market participants believe the crops forecast cut is possible.