CNBC was throwing all these headlines out on Friday, after the February month-end benchmark results were calculated and it appears that in 2019, the Dow 30, S&P 500 (NYSE:SPY) and the Nasdaq are all on track for their best start to the year since either 1987 or 1991, probably depending on the index.

1991 was the start of Gulf War I, and the fourth quarter of 1990 wasn’t that different than the fourth quarter of 2018, when crude oil spiked after Saddam Hussein invaded Kuwait, the SP 500 corrected sharply, and the mainstream media made it out that the world was poised on the precipice of World War III, given the size and capability of the Iraqi Army. (Didn’t quite turn out that way.)

Yesterday’s blog post detailed that I thought SP 500 earnings would gradually strengthen as the calendar rolled through 2019, and compared 2019 to Q1 ’16.

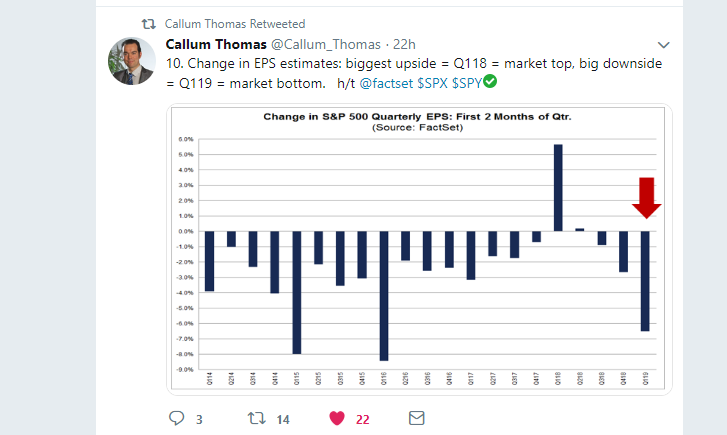

Here was a post this weekend from Callum Thomas (@Callum_Thomas) using Factset data that highlights our reference to Q1 ’16 earnings action:

Readers can see that Q1 2016 saw the worst degradation in the Q1 2016 SP 500 EPS estimate over the first two month of the quarter, and yet the SP 500 returned roughly 1.5% in Q1 of that year and returned 12.5% for calendar, 2016.

My own expectation is that 2019 will turn out the same way.

Once through Q1 2019, it could be a decent year for SP 500 earnings. Brexit is likely fully discounted, and China trade talks will likely see the U.S. gain ground on the issues.

In Summary

SP 500 earnings are a poor market-timing tool, but the SP 500 needs to make an all-time high to put this correction to bed. Look at historical SP 500 returns relative to earnings growth and you can see that in 2013, the SP 500 returned 32% but SP 500 earnings grew 6% that year (we were still seeing heady charge-offs and litigation charges in the Financial sector) and then 2018, where the SP 500 grew earnings 23% – 24% and the return on the benchmark for the year was -4.35%.

It’s one opinion and take it with a substantial pessimism, but I think SP 500 earnings will be fine in 2019 and should gradually improve through calendar, 2019.

The real question is, have we seen the majority of the SP 500 gains for the calendar year already ? Through the first two months of 2019, already its a slightly-better-than-average year for the SP 500 return.