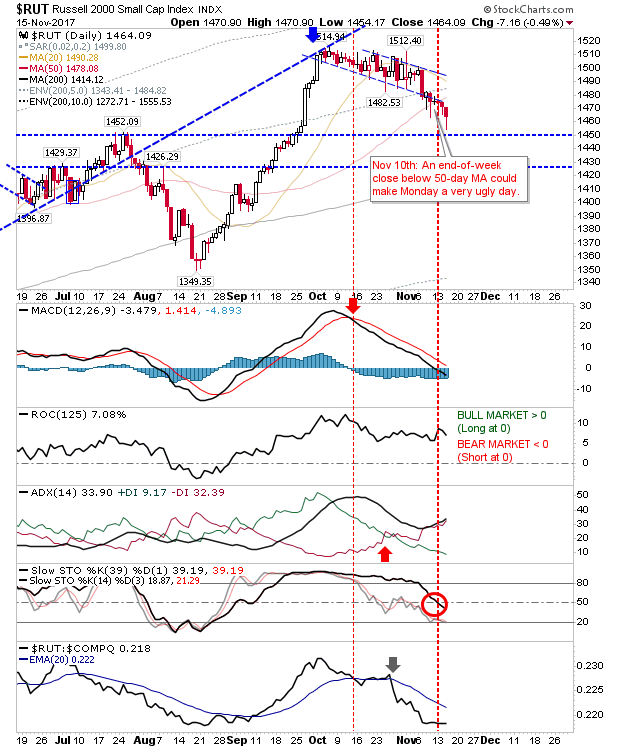

The Russell 2000 was again under pressure yesterday as it shed another 0.5%. The Russell 2000 now trades below its 50-day MA despite recovering some of yesterday's intraday losses. It looks like controlled selling with an artificial prop to prevent a rout. The 200-day MA is the next port of call but a 1% loss or more will bring sellers in fast. Technicals are weak but not oversold.

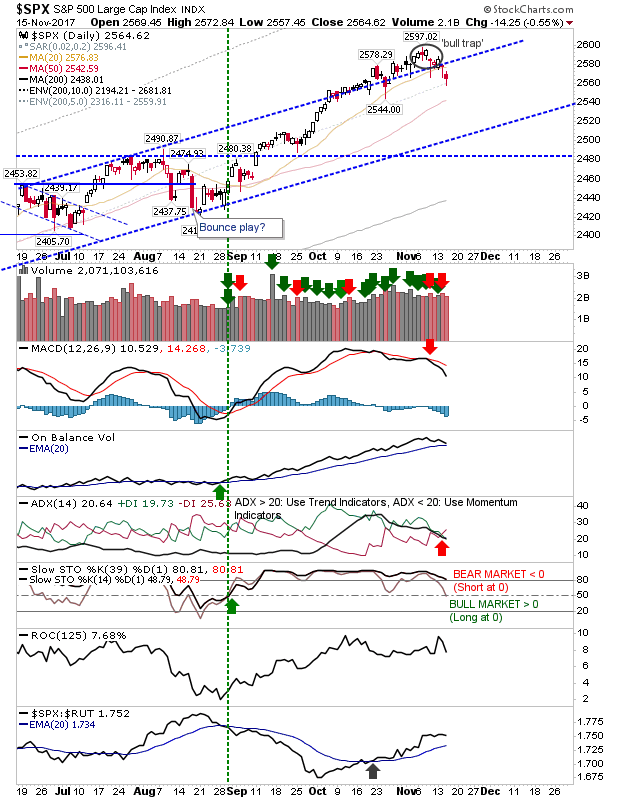

The S&P looks to have confirmed a 'bull trap' with a return inside the prior rising channel. Such action typically results in a move back to rising channel support. First port of call will be the 50-day MA.

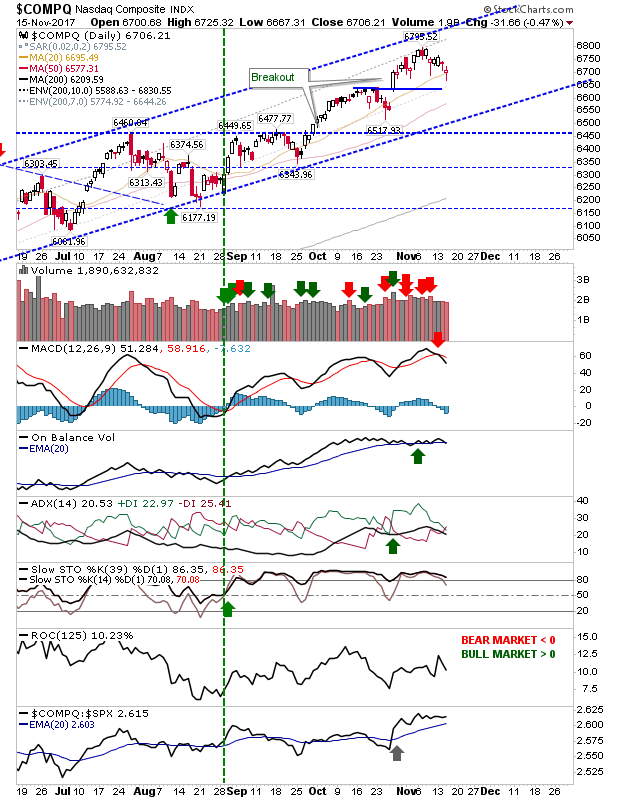

The NASDAQ is holding up better than either Small and Large Caps with relative performance ahead of the curve although it has a MACD trigger 'sell' to work off.

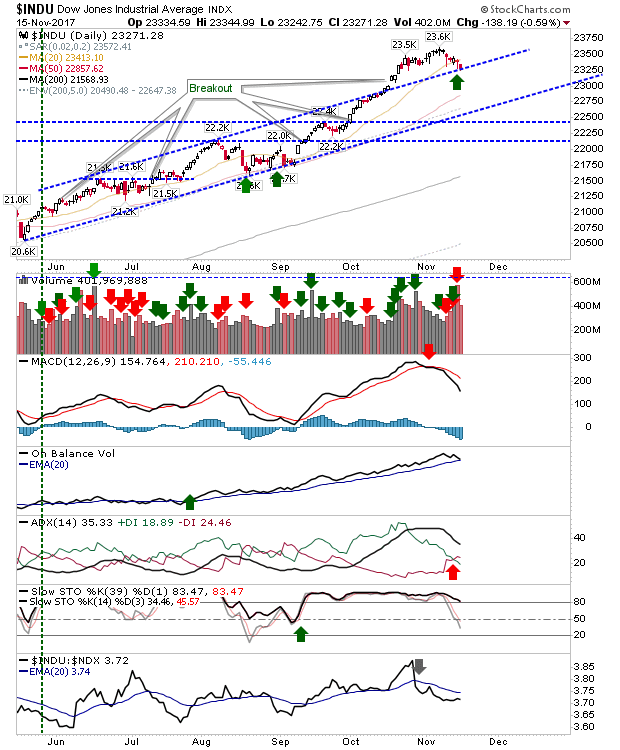

The aggressive long in the Dow Jones isn't looking so great. It's still hanging on to support but after a day like Tuesday it really should have closed higher. With the S&P already back inside its former rising channel I would be looking for the Dow Jones Index to do the same.

For today, look for an acceleration of selling in the Russell 2000, a drop inside the former channel for the Dow Jones and drip losses in the S&P. If premarket suggests bulls are going to be in control (e.g. a gap higher) then the NASDAQ may be the better index to trade. However, if the S&P can gain enough to bring itself to challenge the 'bull trap' then it will also be a good long trade (in essence, switching from a current 'bull trap' to a 'bear trap').