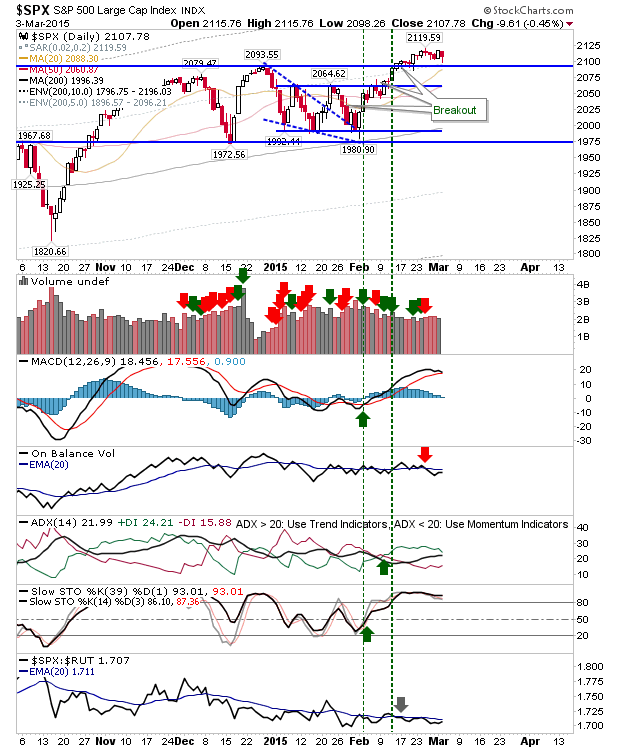

It was looking good for bears yesterday, until the late recovery put a bit of a gloss on proceedings. The first half hour of trading (and premarket) will be important today.

The S&P 500 is trading close to breakout support, and the 20-day MA is fast approaching to lend a hand. If bears were able to break both these levels it would open up for some downside. Although, fresh support would quickly emerge at converged 2064 support and the 50-day MA, but beyond that there is room down to 2000/1990.

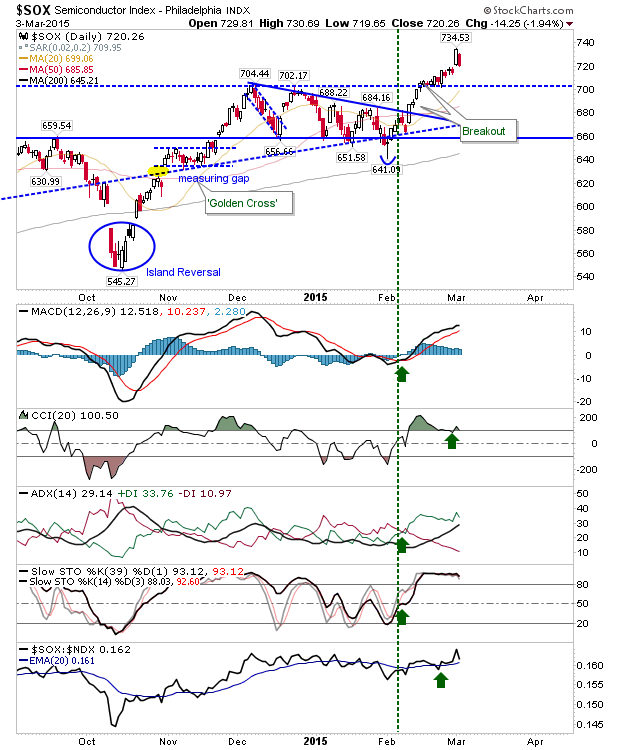

Perhaps more disappointing was the loss in the Philadelphia Semiconductor Index. It effectively gave back nearly all of Monday's gains, bar the gap. There is room down to 702 support. A spike low would be the ideal bullish riposte; a strong end-of-day finish today would help shore up confidence after yesterday action.

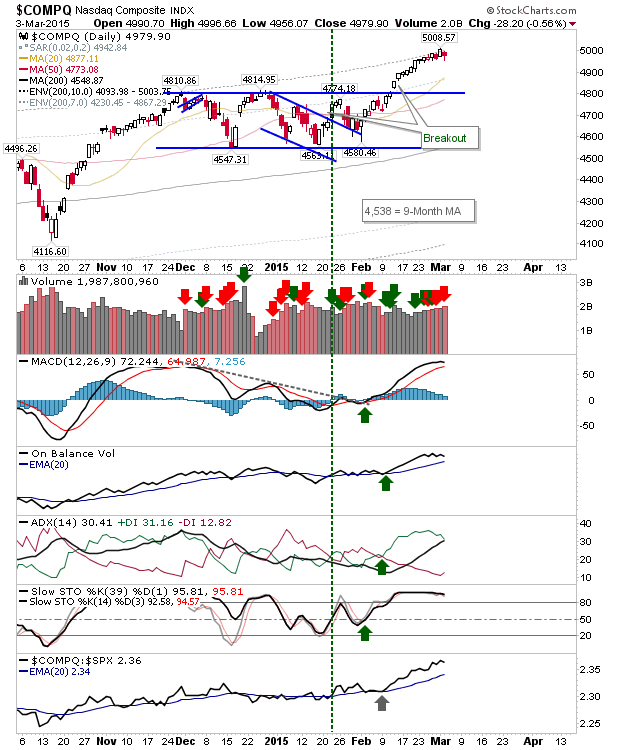

The NASDAQ experienced selling distribution, but did enough by the close to give bulls something to work with tomorrow.

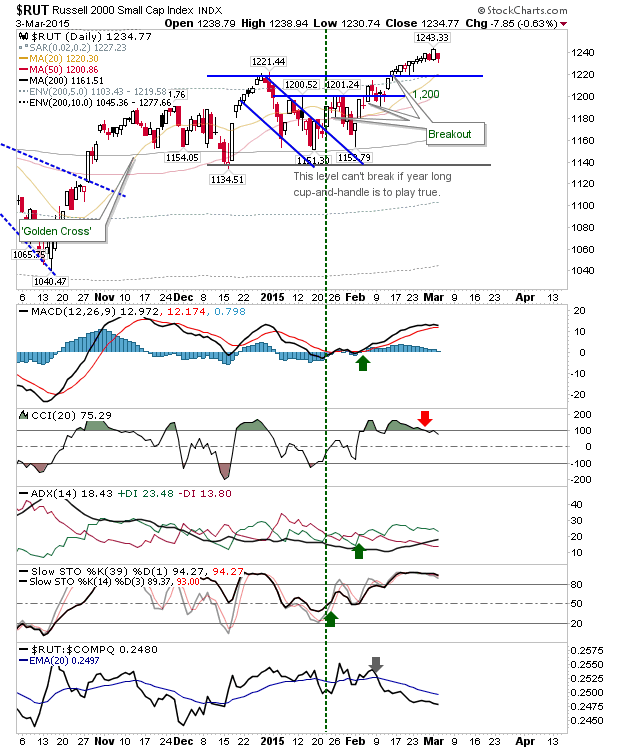

The Russell 2000 also clawed back its losses yesterday, and is well protected against weakness, with the 20-day MA creeping above 1220 support.

The big picture hasn't changed much. Rallies are still in play and indices close to support, like the S&P 500, successfully defended such support.