Investing.com’s stocks of the week

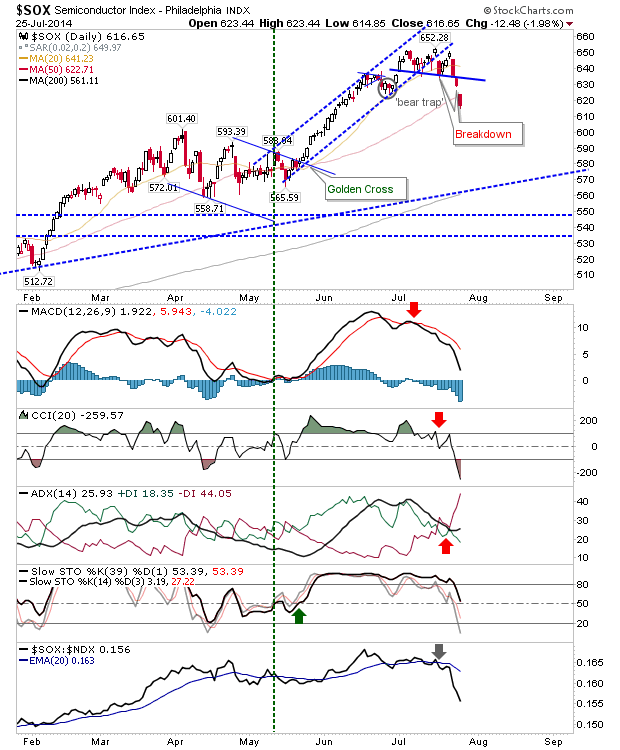

Bears made further inroads to the Semiconductor Index, and Russell 2000 on Friday, which delivered knock on results elsewhere. The Semiconductor index had the worst of the action, slicing through its 50-day MA with a near 2% loss. If bulls wanted value, a quick return above the 50-day MA would set up a 'bear trap' and may generate enough juice for a challenge of 650.

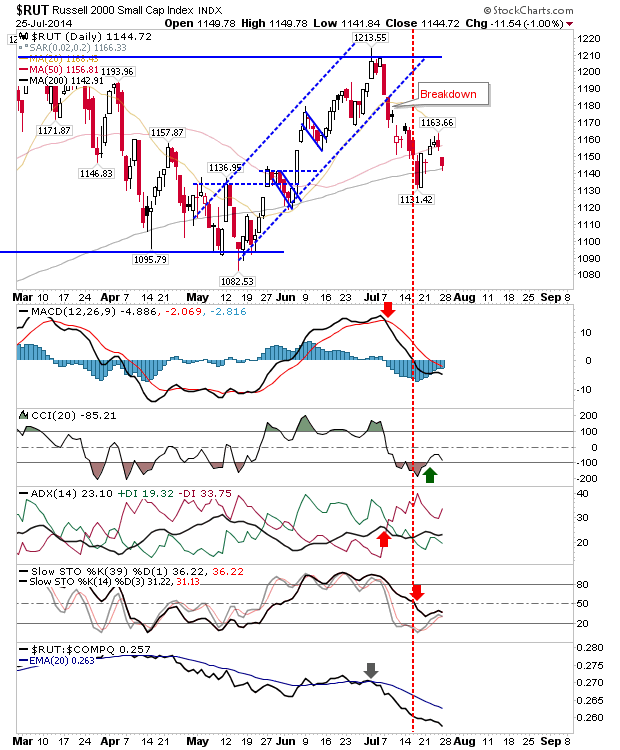

The Russell 2000 is playing for a swing low retest, although the 200-day MA may provide a long opportunity (stops on loss of 1,131). Technicals with the bears, but not oversold.

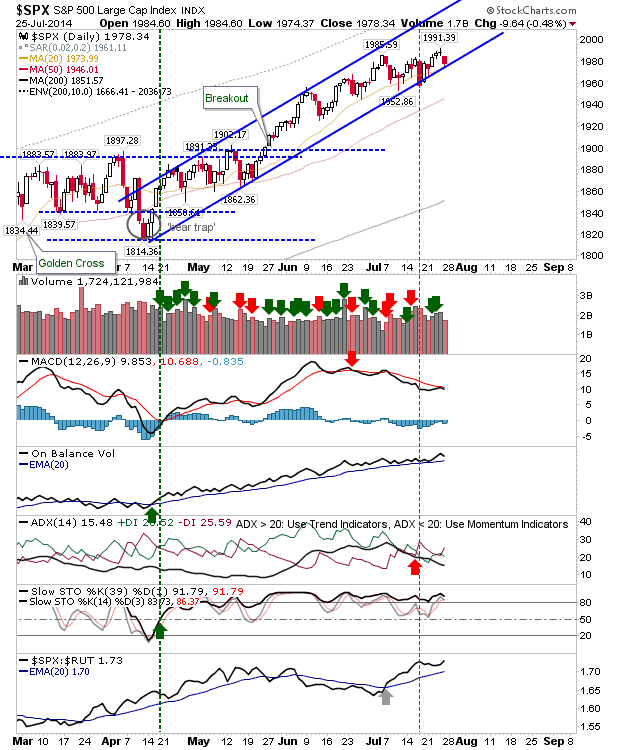

The S&P 500 did lose some ground, but not enough to take it out of its bullish channel. Aggressive buyers may look to buy this support test.

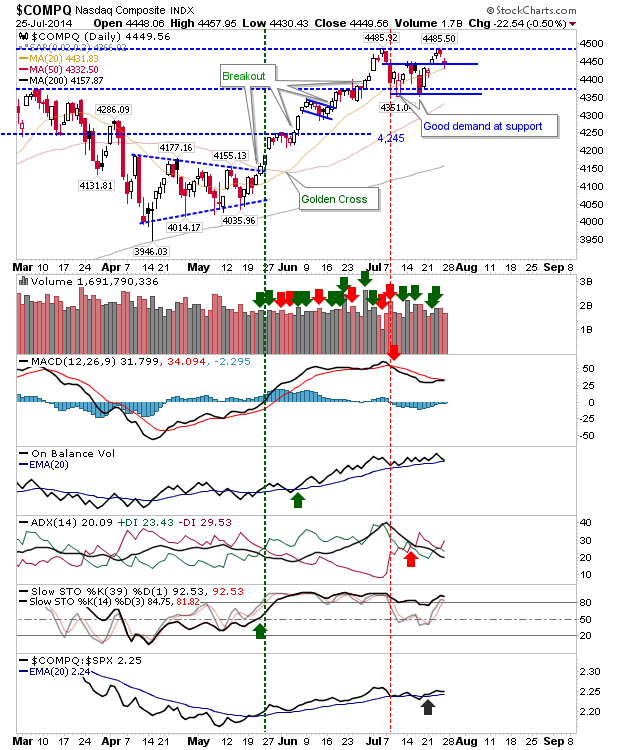

Weakness in the Semiconductor Index translated to the NASDAQ with a gap down to the 20-day MA. Luckily, this is also a neckline for a small double bottom which had been built off the 20-day MA. The doji marks the fine balance between bulls and bears; weakness in the Semiconductor Index is not having the expected effect - which is bullish for the Nasdaq.

While bears edged Friday, there is still enough for bulls to work with. The S&P, Russell 2000 and Nasdaq all have viable support levels from which to to work long positions.