Investing.com’s stocks of the week

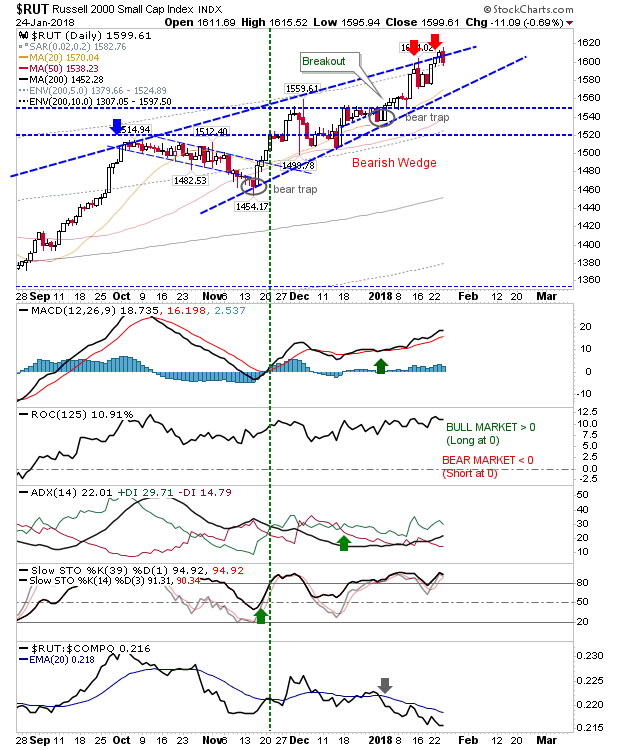

It's a bit of a grasp given strength across markets but the Russell 2000 may be shaping a bearish wedge. There are three tags of resistance but it's rising support anchored by the two 'bear traps' which suggests a possible wedge. Yesterday's bearish engulfing pattern also contributes.

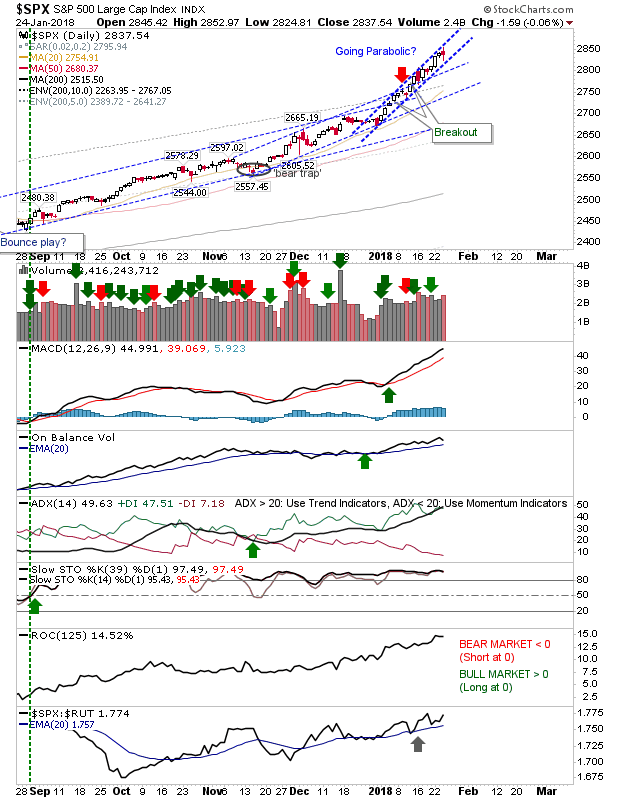

The S&P remains inside its narrow ascending channel. Yesterday's losses didn't change that even though the day registered as a distribution day.

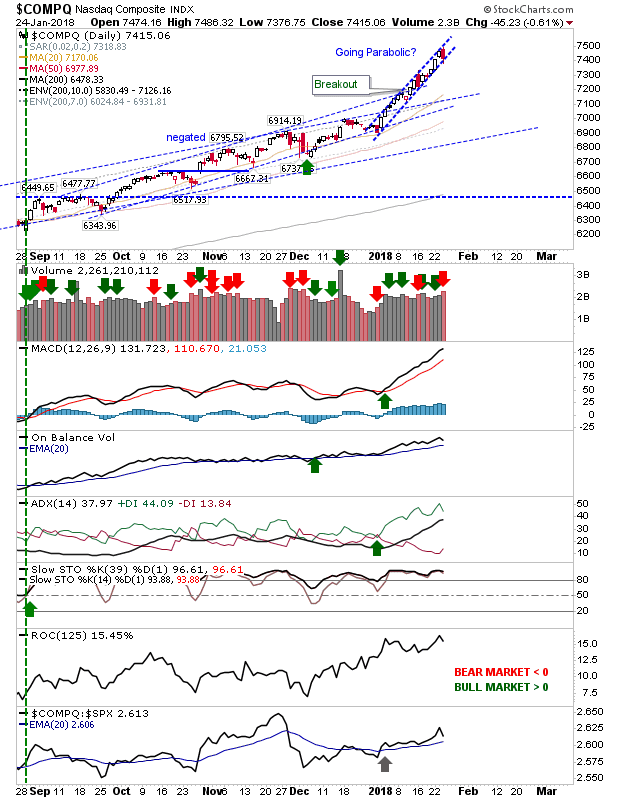

Ditto for the NASDAQ:

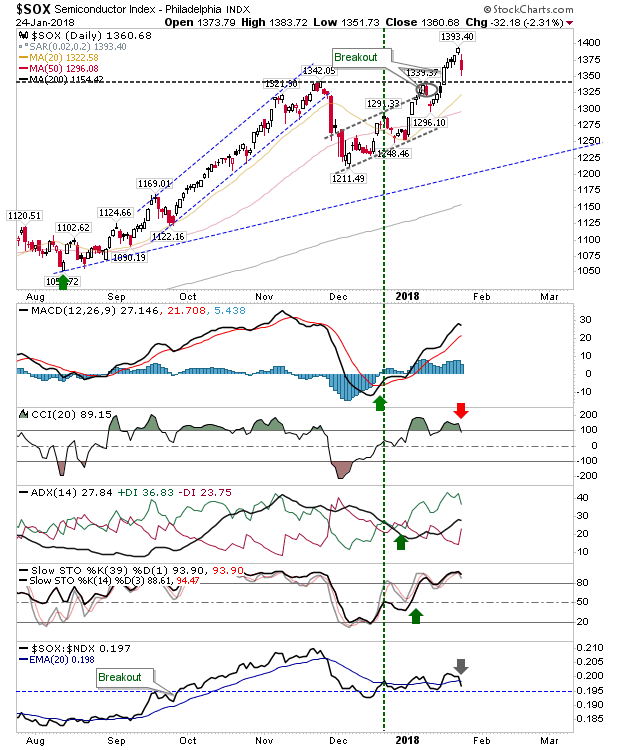

The Semiconductor Index gapped lower, opening the possibility for a bearish 'shooting star' top; for this to be true yesterday's breakdown gap can't be challenged or closed (short-stops go above Monday's high).

Yesterday's selling is a warning sign but not any reason for undue concern. Shorts may get the best of the action from the Russell 2000 or Semiconductor Index. It's too late to be buying anything here so a solid bout of weakness would be welcome for wannabe longs.