Investing.com’s stocks of the week

Friday's action was a case of status quo, but Monday pushed things more toward the bear's favor; the series of doji and one gravestone doji are more in line with a swing highs. It does give the bulls a chance to negate what are typically bearish signals, particularly as these rallies are still relatively young.

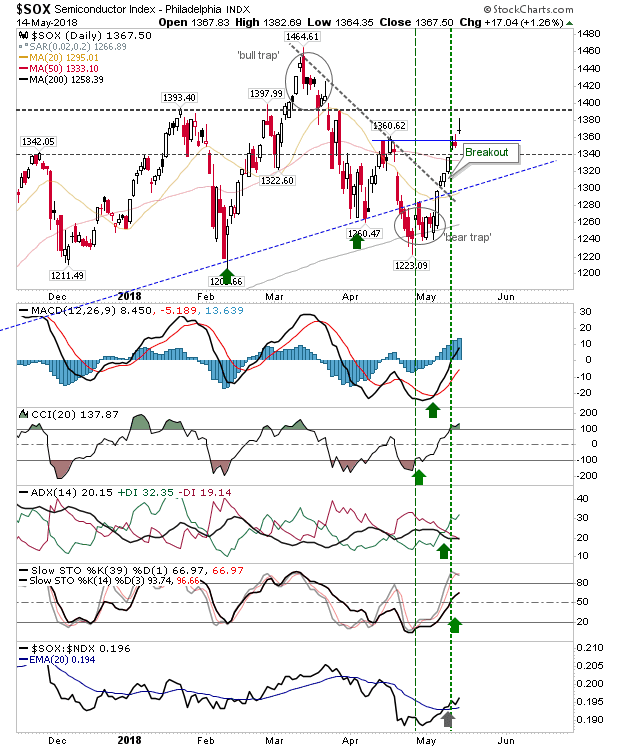

The gravestone doji manifested itself in the Semiconductor Index. While yesterday's action also marks a short-term breakout, it's looking more likely to be a swing high; look for a gap down today (to leave a potential bearish 'evening star').

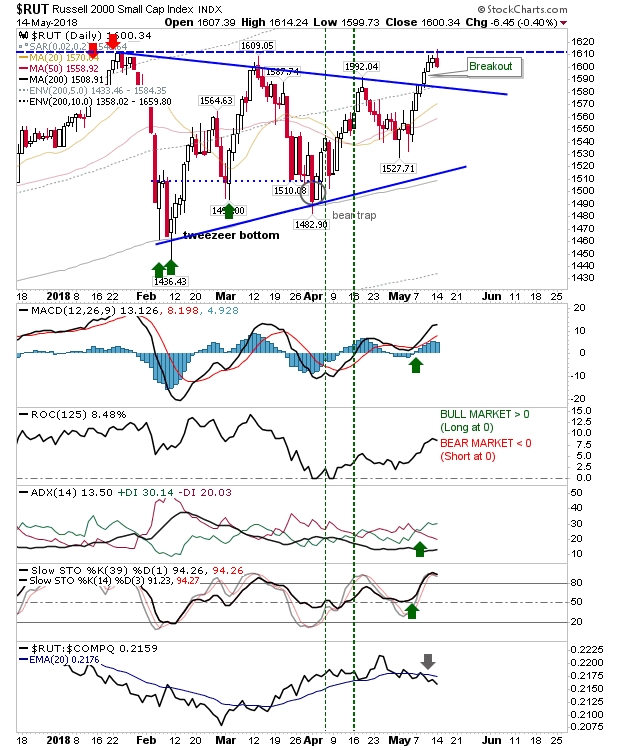

The Russell 2000 had a more bearish close (not quite an engulfing pattern), enough to confirm resistance at the last swing high in January. A push back to the 20-day or 50-day MA would be welcome. Technicals are all net bullish so the expectation is for an eventual breakout to new all-time highs.

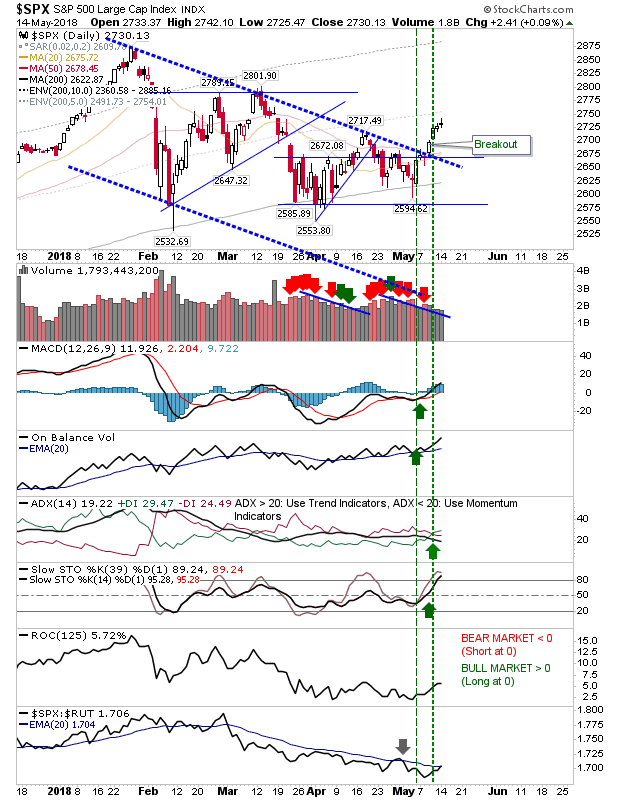

The S&P 500 expressed a narrow doji just above the April Spring high on bullish net technicals. The picture still looks good for bulls even if yesterday was a bit of a non-event for the index.

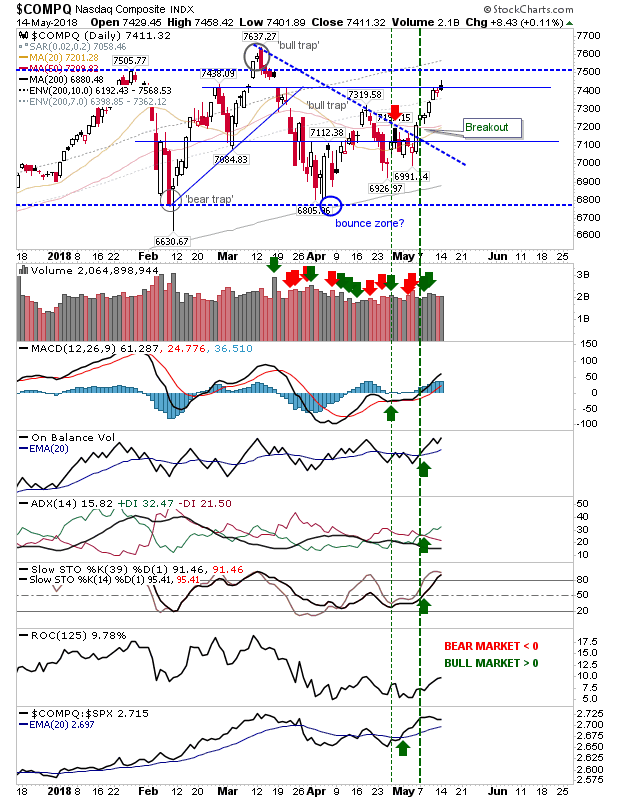

The NASDAQ tagged resistance but was unable to break through; it tagged a minor resistance level but a move to challenge the 'bull trap' would bring the index in line with the Russell 2000.

For today, indices have work to do to negate yesterday's generally bearish setups and break out out higher. Bulls can be aggressive in working for a breakout but even if today sees a lower finish it won't take long before a support level is hit.