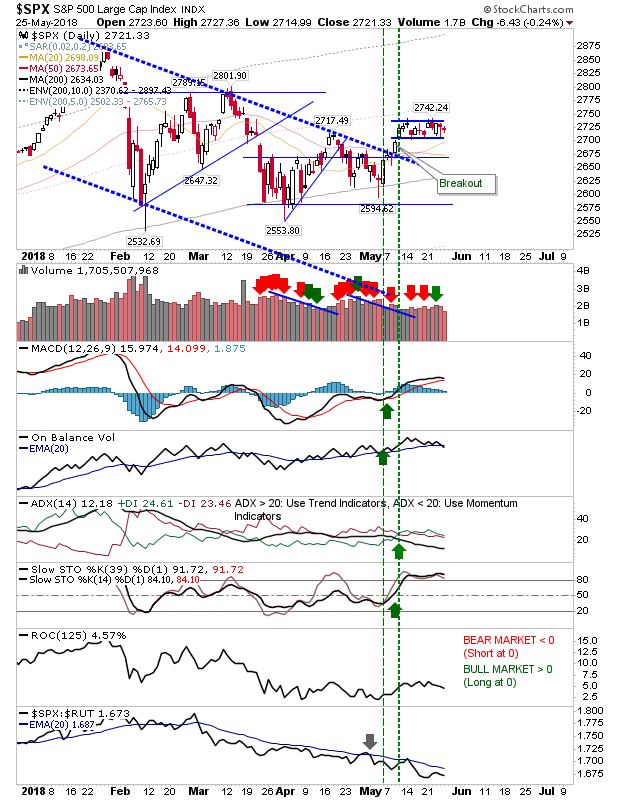

Not a whole lot to say about this past Friday. Another day inside the trading range, another day of waiting. The S&P remained tightly bound and confined to a narrow horizontal range. On-Balance-Volume switched to a 'sell trigger' as other technicals remained positive. The preferred trade is still an upside breakout from the handle.

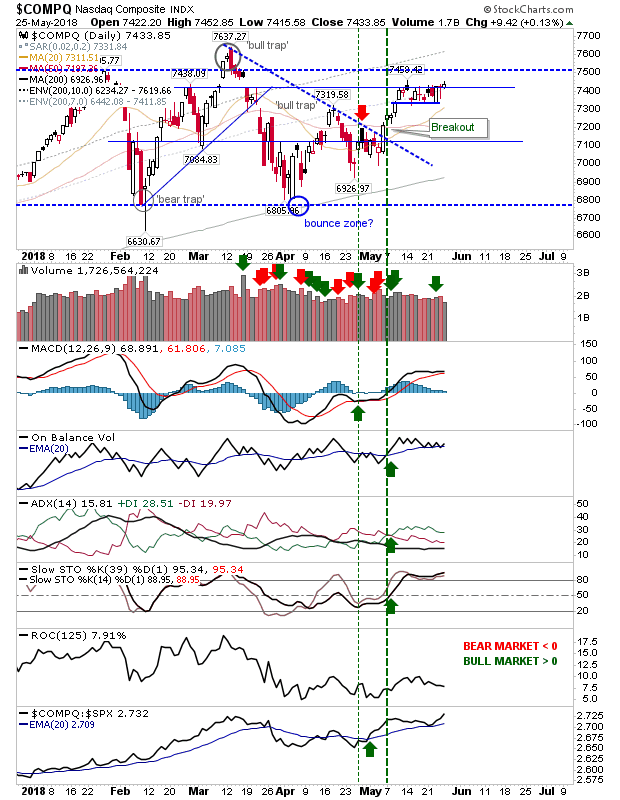

The NASDAQ almost delivered a handle 'breakout' but wasn't able to put some distance from the handle. Any additional upside should be enough to deliver the breakout. Unlike the S&P, supporting technicals are all positive.

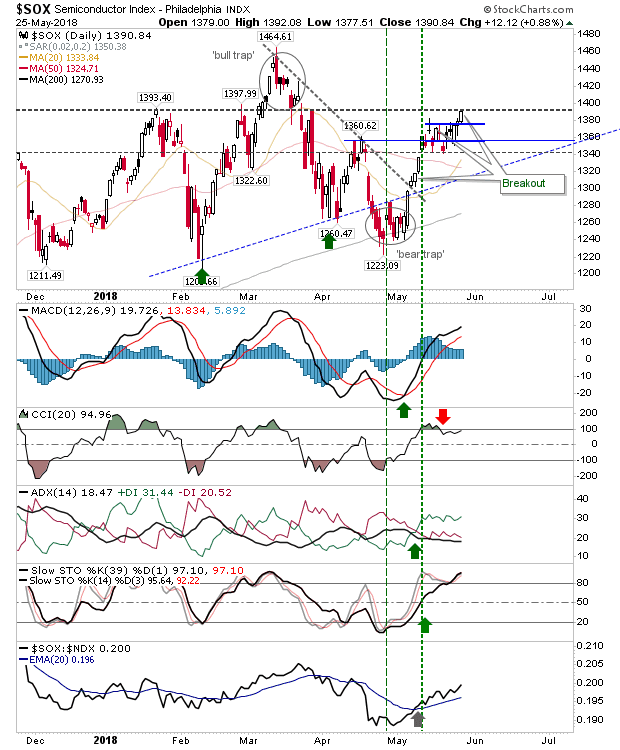

Contributing to NASDAQ strength is the near 1% gain in the Semiconductor Index. It's close to challenging the 'bull trap' as it delivered the handle breakout the NASDAQ was so close to creating.

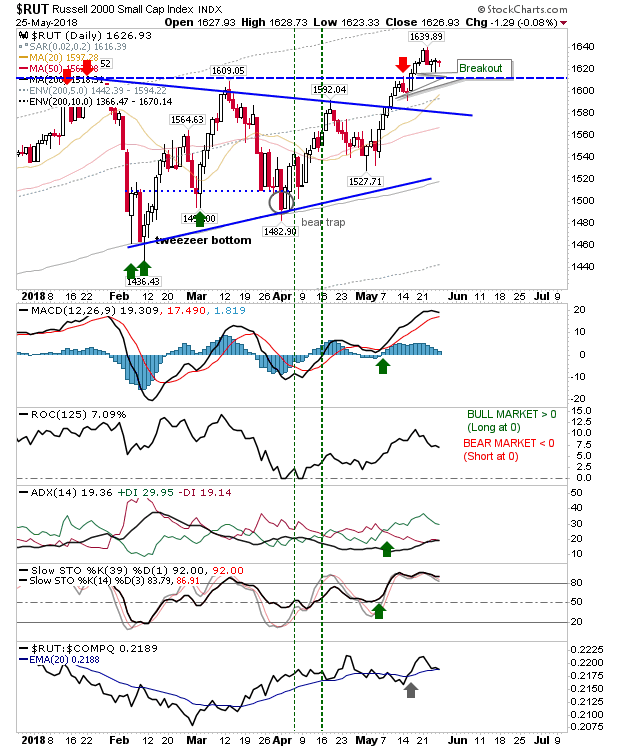

The Russell 2000 is still protecting its breakout and is the index best placed to reward momentum traders. Look for further upside.

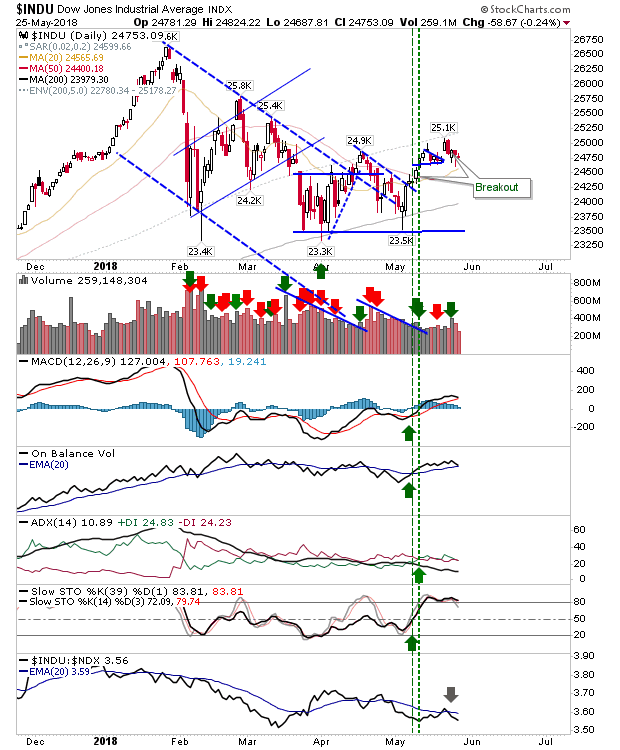

The Dow Industrial Average is also working a minor breakout of its own. This is a better value play as it looks to shape a right-hand-side base up to January's highs.

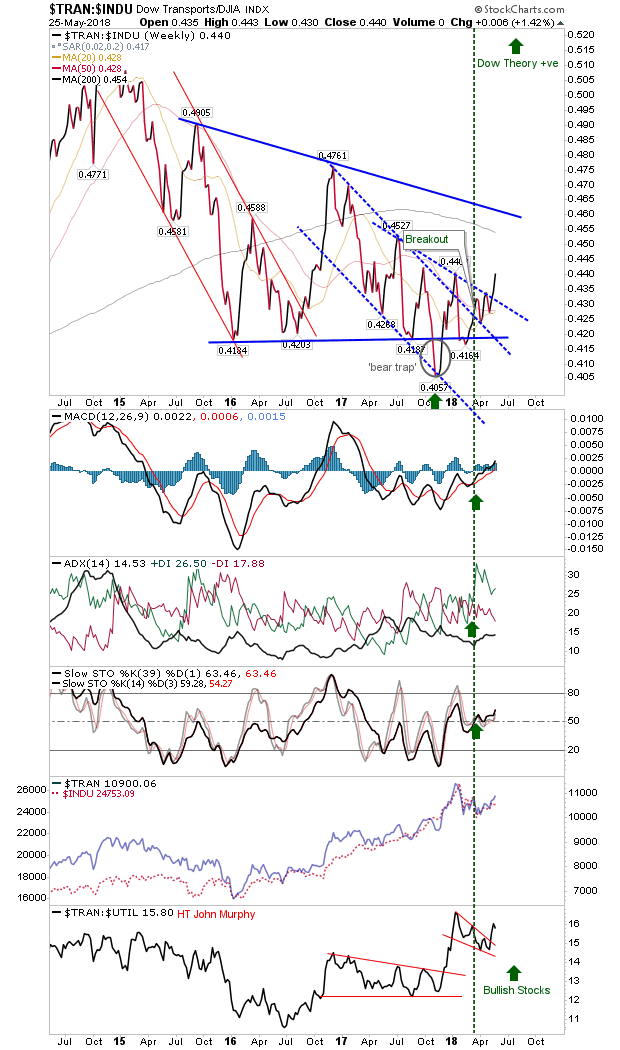

The relationship to the Transports also looks positive, with a fresh breakout in the ratio; buy the strength.

For tomorrow, continue to look for bullish handle breakouts from indices which have yet to deliver.