The stock market is thriving. Many indexes are setting new all-time highs including the S&P 500 and Nasdaq 100. But the euphoria is not limited to the US. World markets are also moving higher and setting records. All the equity world is in celebration mode except one place. Chiner, um, I mean China. In a world of new highs the Shanghai Composite is no where near its record. In fact it may be the only major world market that is falling.

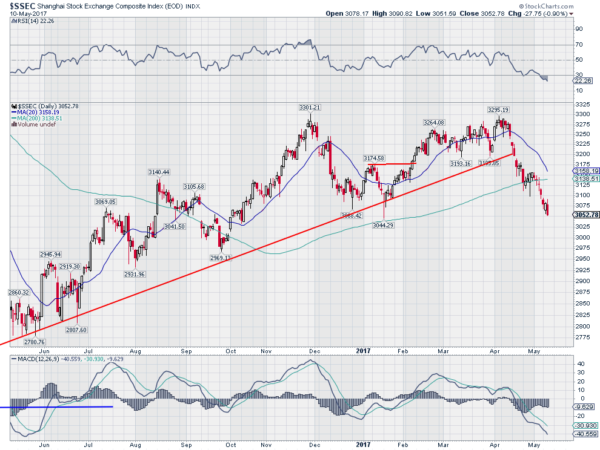

The chart below shows he Shanghai composite over the past 2 years. Falling from a peak over 5000 in mid-2015, the Composite retraced 78.6% of its move higher before finding support at the same time as world markets in February 2016. It moved higher from there in a long slow uptrend for the next 15 months. That move of 25% was impressive, but still left it more than 35% below its peak valuation. And then it did something other markets did not. It started moving lower.

It broke the rising trend support in the middle of April and reached the 200 day SMA a week later. It paused there for a week before resuming the move lower. The next few weeks could prove critical for the Composite. It is less than 60 points from 3000 and what has been a support area in September 2016 and January 2017. A break below this level could open the flood gates for a move lower.

But if it holds above there it is still not great news. A hold would suggest a sideways range is forming between 3000 and 3300. Not horrible but also not good in a world of rising markets. The Shanghai Composite is in trouble again until it can get back over 3300. Until then it is at beast a range bound market and at worst it has blinked and is dead money.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.