Forex News and Events

Risk of more easing bias in RBA (by Peter Rosenstreich)

Overnight, Australian February retail sales m/m disappointed, coming in unchanged against 0.4% expected. These weaker sales figures highlight the risks building in domestic data downside expectations given the tightening in monetary and fiscal conditions. At tomorrow’s RBA policy meeting we expect the committee to "stand pat", yet the risk towards more easing has increased. Traders will be watching for clues on understanding recent volatility in commodity prices. With better-than-expected GDP in Q4 at 3.0% y/y and the stabilisation of Chinese economic data, the RBA has accepted AUD strength. However, this passive behaviour may soon come to an end. From the FX trader's point of view, the RBA has not meaningfully talked down the AUD given the currency's 3-month bull-run (supported rally in iron ore), suggesting that we could soon hear more explicit comments on AUD overvaluations and easing bias. With a full rate hike only priced in by November meeting strong dovish comments could have the markets quickly bringing forward rate cut expectations. That said, political considerations revolving around the federal budget and early elections on 2nd July could force the central banks to delay in order to evaluate the fiscal environment. We remain bearish on AUD/USD ahead of the RBA meeting, yet the pair needs a solid break of 21d MA (0.7560 support) to confirm downside. Barring any knee jerk reaction, risk / yield seeking behaviors by investors should keep this commodity linked currency supported.

Limited USD upside on hike expectations (by Peter Rosenstreich)

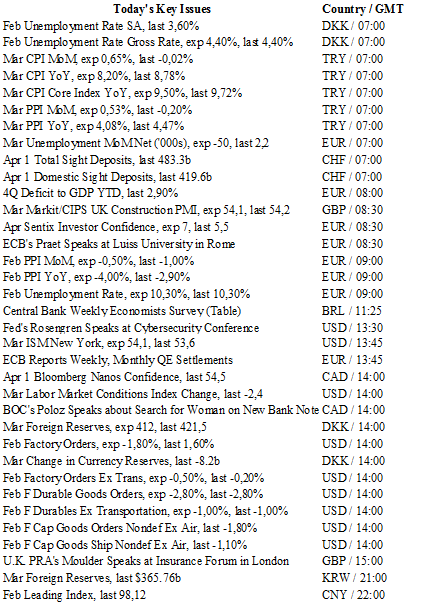

Asian regional equity markets were broadly strong in thin trading following Friday’s solid US payroll report. FX trading was choppy today with JPY gaining (sending Nikkei -.25% lower) against the USD, yet high-beta currencies improved. Equity markets in China and Hong Kong are closed today for holiday. On Friday, March US labor reports came in at 215k (marginally higher than expectations), while data showed steady wage growth and significant increase in labor force participation, which initially had traders pricing in a higher potential for an interest rate hike in June. Elsewhere, manufacturing PMI unexpectedly surprised to the upside as the global outlook, led by China, improved. The firm US data helped USD marginally rally yet demand quickly faded. Importantly, US front-end yields failed to adjust to the stronger US data, indicating that the markets remain unconvinced about a June hike. We remain slightly confident that the Fed will not hike rates in June, suggesting that the currency rally in emerging markets (search for high yields) and commodity linked currencies should continue. We favor long positions in ZAR, MXN, BRL, KRW against JPY and USD. We suspect that Chair Yellen's dovish communication still represents the dominant feeling within the Fed, international conditions remain soft (distinct downside risks) and the pace of domestic inflation is no immediate threat (despite US economy remains on track). This week, March FOMC meeting minutes are scheduled to be released, which should echo Yellen’s cautious tone. Traders will be focused on member’s emphasis on international developments and external risk factors, which should support Yellen’s vigilant stance. Barring a catalyst from Europe there is no fundamental justification for a sustained USD rally at this point as the market is over positioned for a Fed June rate hike. That said the conflicting communications from the Fed makes deciphering the message more complex and will likely drive volatility.

BRL takes advantage of political mess (by Arnaud Masset)

The Brazilian real ended up last week on a positive note with market participants still viewing the current political mess in a favourable light. USD/BRL fell 3.40% last week, stabilizing below the 3.56 threshold; as traders rushed into a short USD/BRL position, wagering that the chaos would result in a political shake-up that might relieve the situation. Last week, President Dilma Rousseff lost the support of her party’s main coalition partner, the Brazilian Democratic Movement Party (PMBD), putting her in a tough situation as an impeachment vote draws closer. The equity market also had to weather the global equity sell-off as the Bovespa Index rose 1.75% last week.

A week ago, the latest BCB’s weekly survey showed that economists are becoming increasingly optimistic about Brazil’s inflation outlook as they revised their inflation forecast down to 7.31% for 2016 from 7.43%. The USD/BRL forecast was also lowered to 4.15, compared to 4.20 the previous week. However, on a positive note, industrial production, released last Friday, printed at -9.8%y/y, beating consensus of -10.5%, while the previous month’s reading was revised to -13.6% from -13.8%. On Monday, emerging-market currencies started the week on a back foot with most commodity prices heading South; the real will therefore most likely lose a bit of steam today.

AUD/USD - Failed To Go Any Higher.

The Risk Today

Yann Quelenn

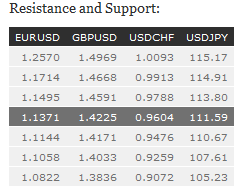

EUR/USD keeps on pushing higher and is now lying around former resistance at 1.1376 (11/02/2016 high). Hourly support is given at 1.1144 (24/03/2016 low). Stronger support is located a 1.1058 (16/03/2016 low). Expected to show further consolidation. In the longer term, the technical structure favours a bearish bias as long as resistance at 1.1746 ( holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deterioration implies a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD is still trading without direction despite the medium-term technical structure is clearly bearish. Hourly resistance is given at 1.4591 (05/02/2016 high) while hourly support can be found at 1.4171 (01/04/2016 low). A break of stronger resistance at 1.4668 (04/02/2016) is nonetheless needed to show a reverse in the medium-term momentum. The long-term technical pattern is negative and favours a further decline towards key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY's medium term momentum is negative. Yet, the pair has traded in range over the last two months. On the short-term, selling pressures are increasing. Hourly support is given at 110.67 (17/03/2016 low). Hourly resistance is given at 113.80 (29/03/2016 high) while stronger resistance is given at 114.91 (16/02/2016 high). Expected to further weaken. We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) is on target. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Another key support can be found at 105.23 (15/10/2014 low).

USD/CHF has weakened over the last month which confirms increasing selling pressures. Yet, the pair is now consolidating. Hourly support can be found at 0.9556 (01/04/2016 low) while hourly resistance is located at 0.9788 (25/03/2016 high). Stronger resistance can be found at 0.9913 (16/03/2016 high). Expected to show continued weakness. In the long-term, the pair is setting highs since mid-2015. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias.