Market Brief

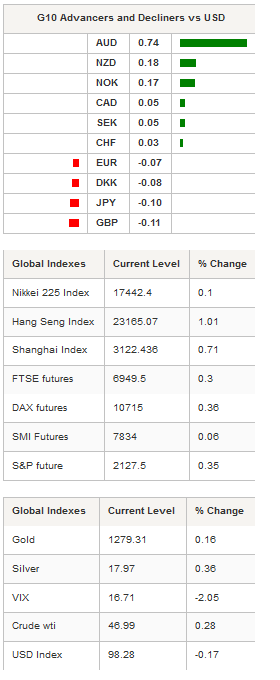

The Australian dollar surged 0.74% against the greenback on Tuesday after the Reserve Bank of Australia left the official cash rate target unchanged at record low 1.5%. The decision has been broadly anticipated by market participants. However, the market wasn’t expecting such a statement from Philip Lowe. Indeed, RBA Governor seems ready to keep inflation below the 2% to 3% target band in order to avoid putting pressure on an overheating real estate market.

Moreover, the strong job market and solid growth figure mean there is no urgent need to provide more stimulus. AUD/USD hit 0.7670 in overnight trading, up from 0.76 in late US session. The currency pair is currently testing a key resistance area, both on the short and long-term, as traders wonder whether further Aussie gains as sustainable.

In Japan, the BoJ left its monetary policy unchanged and will let it unchanged unless it is absolutely necessary. The Japanese central bank also delayed the timing for reaching its 2% inflation target to around fiscal year 2018. Inflationary pressures started to ease again recently with the headline CPI contracting 0.5%y/y in September, for a second straight month.

The Japanese yen edged down in Tokyo with USD/JPY ticking up to 104.95, compared to 104.78 in late US session. Overall, this BoJ meeting was a non-event as expected as many central banks rather wait on the Federal decision in December before making any move.

The New Zealand dollar was the second best performer within the G10 complex as NZD rose 0.18% against the greenback. Commodity currencies have struggling to keep the pace up recently as falling crude oil prices and upcoming rate hike in the US keep investors on the back foot. On the medium-term, NZD/USD has been holding ground above the bottom line of its uptrend channel that currently stands at around 0.7070. On the upside, the 0.73 area (multi highs) will act as resistance.

After a bad start into the week, the mood was rather good in the equity market. In Japan, the Nikkei and Topix Indices were up 0.10% and 0.01% respectively. In mainland China, the CSI 300 rose 0.68%, while offshore Hong Kong’s Hang Seng rose 1.02%. In Europe, equity futures followed the Asian lead with the DAX up 0.34% and the Footsie rising 0.31%. In Switzerland, SMI futures were up 0.09%.

Currency Tech

EUR/USD

R 2: 1.1352

R 1: 1.1058

CURRENT: 1.0986

S 1: 1.0822

S 2: 1.0711

GBP/USD

R 2: 1.2857

R 1: 1.2477

CURRENT: 1.2268

S 1: 1.2083

S 2: 1.1841

USD/JPY

R 2: 111.45

R 1: 107.49

CURRENT: 105.08

S 1: 102.80

S 2: 100.09

USD/CHF

R 2: 1.0093

R 1: 0.9999

CURRENT: 0.9879

S 1: 0.9843

S 2: 0.9632