Market Brief

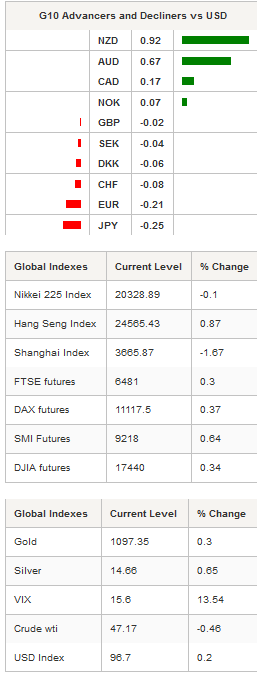

Relative calm has returned to the equity markets. Yesterday, the collapse of the Chinese stock prices sent tremors across European and US equities prices. There was also substantial capitation in the commodity markets. China Securities Regulatory Commission spokesman Zhang Xiaojun stated that regulators would continue to “stabilize” the stock market in order to “prevent systemic risk.” These comments were in response to rumors that China government would retract hastily engaged support measures. As investors digested the stronger German IFO and with the Fed releasing its revised 2015 GDP growth forecast of 1.55% cooler heads have prevailed. Risk appetite remains weak but there is not the sense of panic perceived earlier. Asia's regional indices are mixed with the Nikkei 225 and the Hang Seng higher by 0.12% and 0.83% respectively, while the Shanghai Composite is sharply lower by -3.25% (at time of writing). In the FX markets, USD clawed back some of yesterday’s losses. EUR/USD traded down marginally to 1.1065 from 1.1100 while USD/JPY rallied to 123.60 from 123.10. Commodity currencies traded slightly higher as investors remained cautious ahead of the FOMC. AUD/USD rose to 0.7327 from 0.7240. With downtrend in commodity prices undamaged and risk the RBA cuts rates increasing, AUD/USD traders remain focus on bearish target 0.7185. U.S. 10-Year treasuries was able to increase 2bps to 2.24% despite weakness in commodity prices that has weighed on US inflation expectations.

In the European, session the much delayed talks between creditors and Greece is expected to begin. The core topic will be the reforms Greece must implement in order to access the additional €86bn in the third bailout package. On the data front, July Italian consumer confidence is expected to fall from 109.5 to 109.0 and business confidence is expected to dip to 103.9 to 103.7. In the UK, 2Q GDP is likely to rise sharply from 0.4% q/q to 0.7% q/q. This solid read should increase the likelihood that BoE members Weale and McCafferty vote for policy tightening at the August meeting. As the monetary policy divergence theme strengthen, GBP should become one of the primary beneficiaries as expectations for a February 2016 rate hike increase. Currently the BoE seems not really concerned by the GBP strength which should allow GBP to trade higher against EUR and USD. GBP/USD should be supported by 1.5483 uptrend channel with a target of range to at 1.5732. Swedish retail sales are anticipated to rise from -0.1%m/m to 0.7% m/m in June. The Riksbanks heavy handed policy actions has not really effect the EUR/SEK but as traders refocus on central bank’s policy SEK should come under selling pressure.

In the US, consumer confidence for July to fall from 101.4 to 100.0. The FOMC will start its two-day policy setting meeting. At this point the market has fully priced in a September rate hike. There is significant risk that at tomorrows FOMC meeting Chair Yellen will provide a dovish view that disappoints the USD bulls. However, our view is that we are on track for a September hike (growth and inflation data remains firm) and any real USD positioning will wait (i.e. range trading till September or a sudden shift in data).

Currency Tech

EUR/USD

R 2: 1.1436

R 1: 1.1278

CURRENT: 1.0980

S 1: 1.0819

S 2: 1.0660

GBP/USD

R 2: 1.5930

R 1: 1.5803

CURRENT: 1.5511

S 1: 1.5330

S 2: 1.5171

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 123.89

S 1: 120.41

S 2: 118.89

USD/CHF

R 2: 1.0129

R 1: 0.9719

CURRENT: 0.9599

S 1: 0.9151

S 2: 0.9072