The tone in Asia has generally been downbeat, with Japanese equities taking an absolute bath on volumes 120% above the 100-day average.

The focus from APAC clients has been on gold, oil, USD/JPY, Nikkei and we have seen buying in Hang Seng after a bounce off support at 18,000. Our flow on ASX 200 has been two-way, but the net position is held on the long side and therefore expecting a bounce of sorts.

I certainly think the Nifty 50 (India) is worth a look from the short side and recall this was supposed to be the place to be invested in 2016. The technical set-up is about as bearish as you will see.

(Daily chart of the Nifty 50)

Trading the ASX 200 has been tough as price action has been quite whippy and one has perhaps not had the same trends as the FTSE, European and other Asian markets. However, if we try and smooth out the trend (by applying a 10- or 20-day moving average) one can see the trend is down and this should define the path of least resistance. I would like to see the index closer to 4600 to 4650 before holding more conviction that we will see some sort of mean reversion, as this would coincide with both the techincals and market internals being oversold.

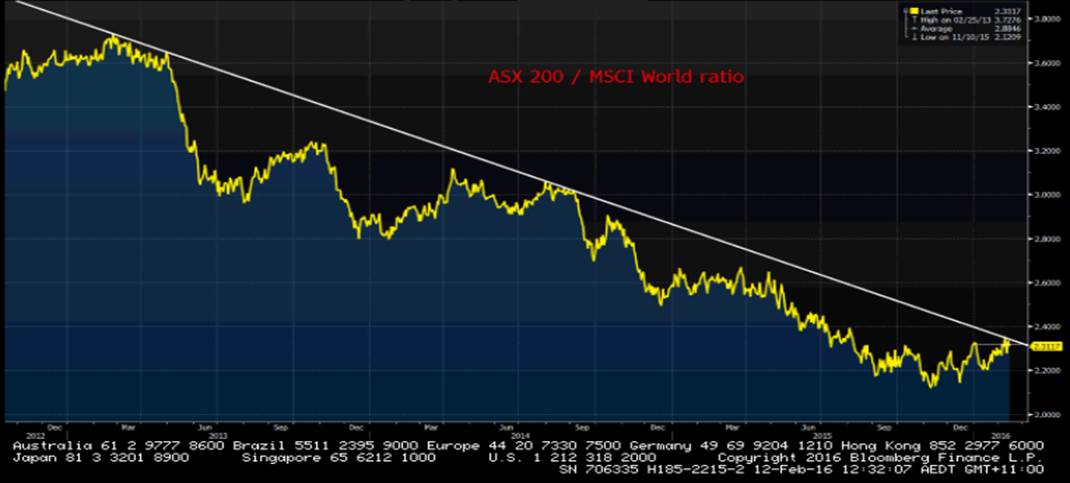

It’s amazing to think the ASX 200 is down 4.1% for the week and is still strongly outperforming other markets! If we look at the ASX 200/MSCI world index ratio (converting both legs into AUD) we can see this has turned up nicely of late and threatening to break the multi-year downtrend. I’ll be watching this ratio closely, as we could (another big ‘if’) be in for a period of sustained outperformance from the ASX 200.

In Japan, the Nikkei cash market has re-opened and is getting smashed taking the weekly loss to an outrageous 12.7%. We’ve seen some buying into the afternoon and perhaps that is a reflection that retail traders feel the Bank of Japan (BoJ) will be successful in waxing lyrical to stabilise the JPY and the equity market. This is a big ‘if’ as there is a world of pain out there and particularly for the domestic pension funds who literally have been forced to diversify into foreign assets; largely unhedged. The move into ¥112 would be causing some real pain and it’s certainly enough for Finance Minister Taro Aso to spend the early part of the trading session warning he is ‘watching markets’ and ‘will take necessary response if needed to market movements’. BoJ governor Kuroda went one further and suggested negative rates are not causing the risk off mentality of markets. I think you’ll find a few money managers who strongly disagree and the fact Nomura has lost 26% since negative rates were imposed suggest negative rates are NOT an equity positive.

If short USD/JPY be aware that at any stage the BoJ may come out and directly buy USD/JPY in the market potentially causing a 200 pip spike. To put the volatility into perspective USD/JPY has traded in a 1070 pip range in 2016, which is 70 pips wider than the entire range of 2015 and we are only in the middle of February!

Moves in oil have actually been quite encouraging with front month crude finding good buying from the $26 area and the market is eyeing a close above the 20 January low of $27.56. There is further banter about a more unified response from OPEC, while we may have seen some improvement in sentiment as world powers seem to be making strides on ceasefire in Syria. Price action in Europe and the US here will be key and a move higher in oil will certainly put a bid in equities and cause a narrowing of credit spreads.

Our European equity calls are starting to focus more heavily on Japan and Hong Kong, but are looking very lively indeed. S&P and FTSE futures are both up 0.9% respectively from the close of the European cash session and naturally our cash market calls reflect this. Client business has been edging on the sceptical side though and the bulk of orders has been to fade this strength as we get into the home straight prior to the UK/Euro open. The epi-centre of the markets remains the banks though and until we can see price stabilise, consolidate and we see some narrowing of credit-default swaps spreads will the hedge fund crowd will close out of a rather large short position.

Ahead of the open we are calling the FTSE at 5582 +111, DAX at 8863 +111 and CAC 3945 +49