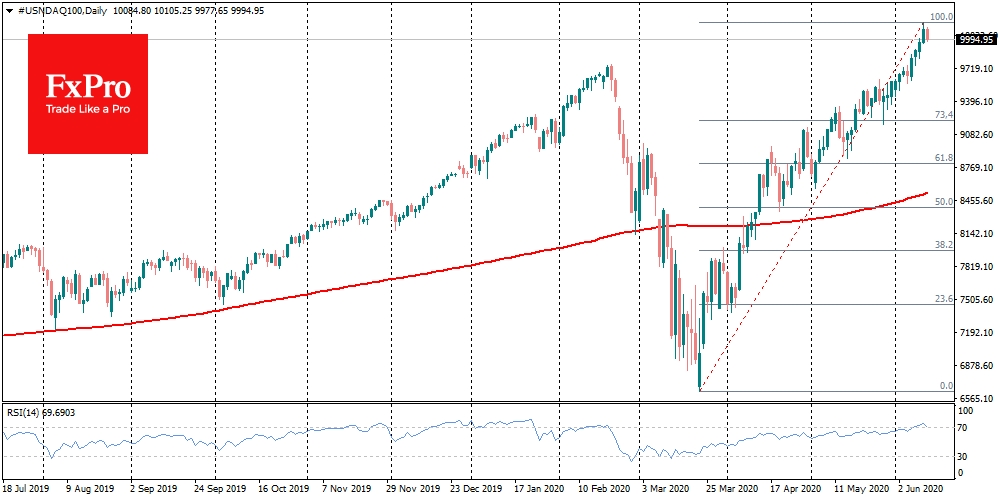

On Thursday morning, financial markets saw an increasing demand for safe assets. Investors seem to be taking profits on an increasingly wide range of assets. American NASDAQ fell back to 10,000, losing 1.5% of its peak levels after the Fed meeting.

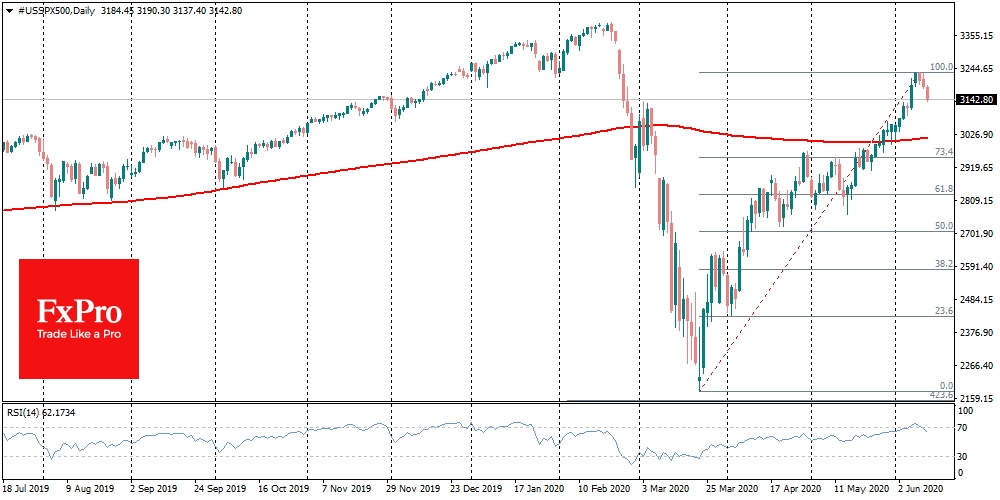

Among other indices, the reversal to decline occurred a little earlier, with the S&P 500 and Dow Jones falling for the third consecutive day. This change in sentiment wasn’t sudden and unforeseen. Against the highs of the beginning of the week, the Dow Jones fell more than 1000 points or 4%, while the S&P 500 dropped by 85 points or 2.5%.

Earlier, we mentioned that the major indices have gone into the overbought zone, which made them vulnerable to a correction rollback. Nasdaq was least affected by the lockdown, having been pushed up by shares of high-tech companies.

There were signs that the rally had gone too far in the currency market as well. Investors were already buying yen and franc against the dollar this week, while the US currency itself looked extremely oversold.

The full correction pullback could send Nasdaq to 9200 (-10%) area or even deeper, to 8800 (-13.3%). For the S&P500, the closest support is 3020, where the 200-day average passes. However, 2950 (-9%) and 2830 (-12.5%) may become more attractive levels for correction.

The markets may not stop there and continue the decline due to the sad state of the economy. We have previously talked about such a scenario, but so far, it is hardly worth trying to look so deeply. It would be much more reasonable to cautiously look at market dynamics after the current technical decline.

The same goes for the currency market. EUR/USD, which showed almost 5% rally in the last weeks, looks overbought and vulnerable to a pullback. After another unsuccessful attempt to climb above 1.1400, the euro might not find support until 1.1200. However, the more significant attraction level for the bears can be level 1.1000, the psychologically crucial round level.

Fundamentally, dollar purchases are now supported by the Fed’s forecasts of keeping the Fed’s rates around zero in the next two years, with no risk of moving into negative territory. At the same time, the US Treasury announced its intention to launch new “helicopter money”. This will require new borrowings on debt markets. Higher placement volumes of the US Treasury often support the dollar, as investors buy these bonds first and only then pay attention to other assets.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

As Correction Starts, Indices May Lose More Than 10%

Published 06/11/2020, 04:52 AM

Updated 03/21/2024, 07:45 AM

As Correction Starts, Indices May Lose More Than 10%

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.