The traders of the CME Group have always been a lively bunch. When the markets are moving they are too, but after the credit crisis, MF Global and Principal Financial Group Inc (NYSE:PFG) there is another crisis brewing this summer.

There is no comparison to what’s going on in the S&P right now. In the past I made references to the similarities to the runs up before the 1987 crash and the 1999-2000 tech bubble, but the current rally does not resemble either.

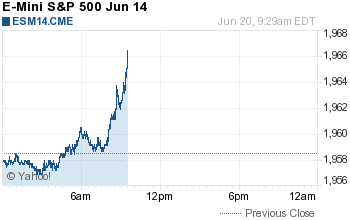

In fact, I don’t think there has ever been a time that the stock market has gone up so much with so little pullback. One aspect of the push higher over the last few weeks has been the low volume, but the daily trading ranges are shrinking too. Yesterday, despite closing down only 9.8 handles the ESU14 sold off 20.25 handles from high to low, and when it did, the bears came out of hibernation.

1% Drops

Yesterday the Dow saw its largest drop in a month, down -0.70%. The Dow was up 32.5 points at its high and down 119 points on the close.

The S&P fell 12.63 points, or -0.60%. The S&P futures made an all-time new high of 1960.00 midmorning and then reversed lower. The S&P has now gone 47 sessions without a 1% up or down move, the longest streak since 1995.

According to MKM Partners, in the last 20 years there has only been one time that the S&P has traded in a narrower range than it did on last Friday’s June quadruple witching. Last Friday’s was the 2nd lowest at 0.24% and the lowest was set back on Dec. 30, 2013. The NASDAQ Composite lost 18.32 points or -0.40% down to 43,50.36 and the Russell 2000 closed down 1% for the second session in a row.

Despite the drop and all the clamoring about another selloff, it has been our feeling that after so many days up in the last 3 weeks, the march to the end of Q2 would not go without a little downside. That said, we think some stocks will be marked up as we head into T+3 and the end of the quarter rebalance.

The Asian and European markets closed lower across the board. Today’s economic schedule starts with MBA purchase applications, durable goods orders, GDP, corporate profits, PMI services flash, EIA petroleum status report, 5-year note auction and earnings from Bed Bath & Beyond (NASDAQ:BBBY), General Mills (NYSE:GIS), Monsanto (NYSE:MON), and Barnes & Noble (NYSE:BKS).

Asia and Europe Down Across the Board

Our view: The E-mini S&P 500 futures (CME:ESU14) took out Sunday night’s new high by 1 tick. After making the high the ESU chopped around the 1958.00-1958.50 level and eventually sold off through 1957 down and then down to support at the 1953.00 area. After breaking through the 1950 level it was all sell stops and sell programs down to the low of the day.

As of today there are 4 trading days left in the quarter. As we go into today and Friday you can’t forget about T+3.

Our view was right on yesterday: buy the lower open and sell the rally. Today’s view is to buy the early weakness and sell the rallies in the first part of the day but to start looking for the quarter-end bounce.

Turn Around Tuesday Gets A Spanking

Below you may find the video

As always, please make sure to use protective stops when trading futures…

- In Asia, 11 of 11 markets closed lower: Shanghai Comp. -0.41%, Hang Seng -0.06%, Nikkei -0.71%.

- In Europe, 12 of 12 markets are trading lower: DAX -0.45%, FTSE -0.72% at 5:30 am

- Morning headline: “S&P Unchanged Ahead of U.S First Quarter GDP”

- Fair value: S&P-8.41 , NASDAQ -9.46 , Dow Jones -86.06

- Total volume: 1.52mil ESU and 4.3k SPU traded

- Economic calendar: MBA purchase applications, durable goods orders, GDP, corporate profits, PMI services flash, EIA petroleum status report, 5-year note auction and earnings from Bed Bath & Beyond. General Mills, Monsanto, and Barnes & Noble.

- E-mini S&P 500 1968.00+9.50 - +0.49%

- Crude 102.15+0.02 - +0.02%

- Shanghai Composite 0.00N/A - N/A

- Hang Seng 23074.33+207.631 - +0.91%

- Nikkei 225 15311.82+45.21 - +0.30%

- DAX 9867.75-70.33 - -0.71%

- FTSE 100 6733.62-53.45 - -0.79%

- Euro 1.3634