It’s amazing to think Janet Yellen speaks tonight in front of the Senate Banking Panel as part of her two-day semi-annual testimony, in what has to be the most pointless speech for a Fed Chairman in recent memory. The markets have a myopic focus on one thing: The UK referendum vote.

In the overnight session the S&P 500 found buyers on open, going on to test the 2100 area, but has been faded consistently through the day to finish 0.8% from the high. Aussie SPI futures came along for the ride and are now effectively unchanged from the cash market close, so we are expecting a flat open for the ASX 200, and all the euphoria of yesterday has seemingly abated and we hit the refresh button. We almost need to take this week one day at a time, such is the nervousness around trading.

With regards to the S&P 500, I question whether the move lower in US stocks was simply a concern about holding risk for too long and traders happy to take even the smallest of profits. On the other hand there is a genuine belief that if the UK referendum proves to be a market positive event, then being invested in European stocks (over US stocks) is clearly the way to be positioned. The US has outperformed in such a dramatic fashion, which we can see best in ratio analysis.

It really is all about European markets, be it fixed income, credit or equity, and this is where we should be looking this week for inspiration. Naturally, the polls still play a big part, and there are a few big ones tonight with the ORB (phone), YouGov (online), National Centre and IG’s Survation poll.

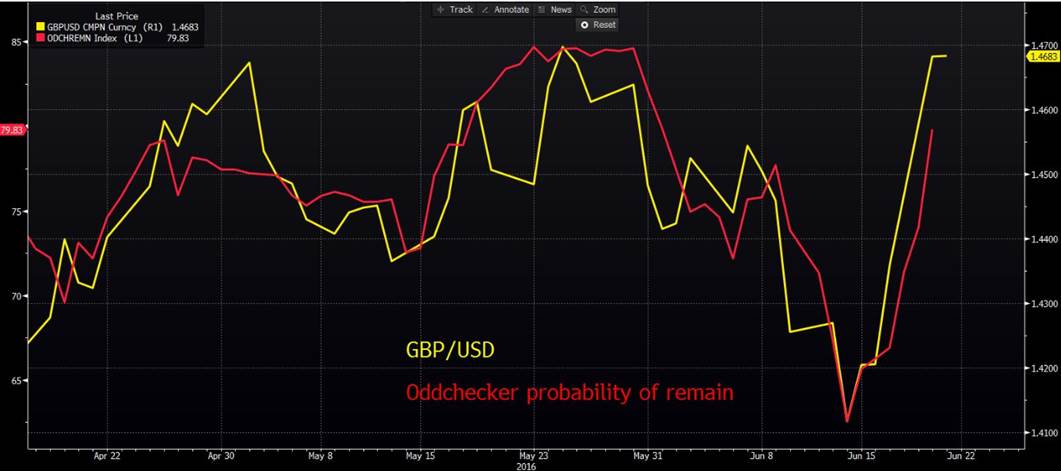

For GBP/USD watchers, the Oddchecker probability of a ‘Remain’ vote has risen to 79% (IG’s own referendum probability of remain has risen to 76%), and it’s interesting to see the startling correlation between these odds and GBP/USD.

The polls were not supposed to influence as much as they have, but overnight we have seen a rampant positon adjustment and an unwind of ‘Brexit’ hedges. 1-week GBP/USD implied volatility has fallen from 47% to 39%, the Italian and German 10-year bond yield spread has narrowed a huge 11 basis points, and sub-investment grade credit default swaps index over European corporate credit collapsed by a massive 28 basis points – the biggest move since 11 March.

This has driven a strong move higher in the European banking sector and in turn this should support the Australian banking sector today, as this should provide a positive influence on the funding markets.

I listed yesterday a number of contrarian indicators that one could extrapolate to suggest this Friday will not see the sort of crazy price action that will happen in illiquid times. These included the European Commission President Donald Tusk warning that a UK vote to leave could ‘threaten Western political civilization’ and much talk in social media of the new ‘Lehman’s’ moment.

We are now also hearing that UK Chancellor George Osborne is not ruling out suspending trade on the LSE on Friday if things get out of hand. Personally I am not sure how this would be a positive, in fact this would be a huge negative and all this would do is push traders to hedge their FTSE equity exposure through other equity or futures markets which have which similar correlation.

All that happens is you push the problem to another market. Do all exchanges then shut at once? It all reminds me of the Russian experiment in 2008 when they closed their equity market to avoid the pandemonium, only to open when we saw global markets having a strong rally.