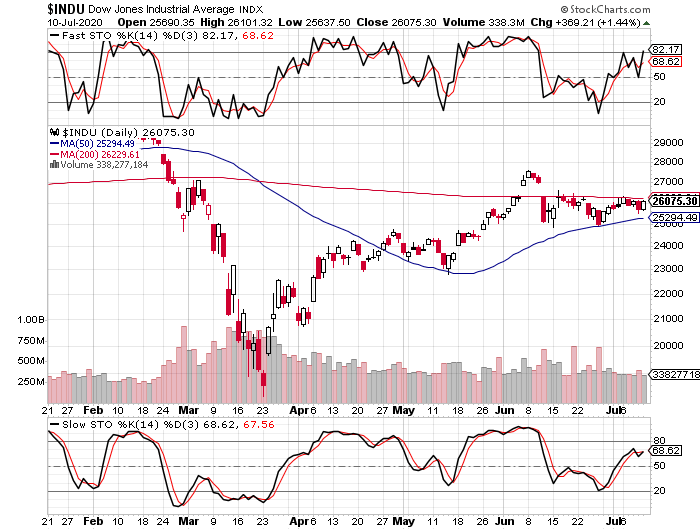

DOW

The four reports written from Dec 2, 2019 – Feb 6, 2020 underscored the same basic point, namely, that the Dow would peak at some number just below 30,000, before falling $10,000 in 2020.

I did not foresee that the latter would occur in this year’s 1st quarter but, here; I stress and remind of the principal argument that multiple reports since August of 2019 have made. Specifically, there is a point in time when the “authorities,” faceless or otherwise, WANT dramatically lower stock prices so as to acquire strategically vital assets, such as telecommunications, key natural resources, etc.

The “CONCLUSION” section of the June 16, 2020 report wrote:

“A top-to-bottom market collapse of 50% might still occur as early as the 3rd quarter.”

Therefore, as with almost all of the reports since August 2019, the “STRATEGY” section of the here-linked June 16 report holds true, and is reiterated today.

Ideally, the Dow would double-top around 27,500 this week.

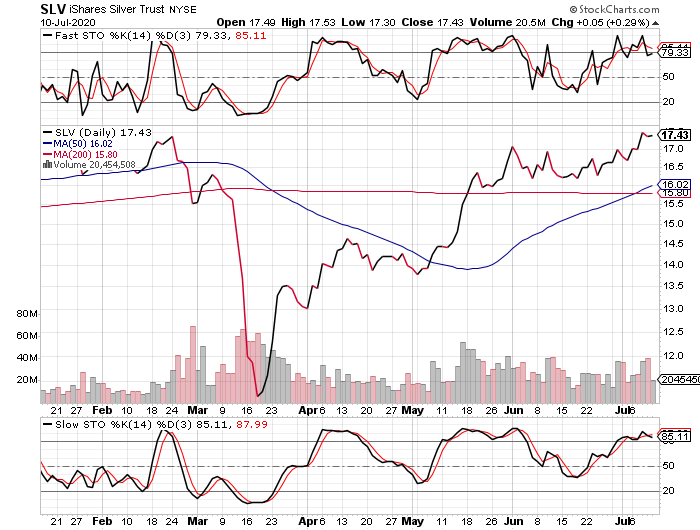

SILVER

The reports referenced in the first sentence above included a forecast for a bottom-to-top silver move of $10 from the 2019 low.

The June 18, 2020 report analyzed that the relationship between silver and the VXSLV, which is the gauge of the SLV's option time premiums, would likely not regain a sense of normalcy until the metal would attain the $21 – 24 zone.

Having targeted this option index’s levels this year, including its relationship to forecasting the metal’s turning points, this was an observation that was more important than what I had realized.

Though silver is admittedly at an acceleration breakout point under one scenario, given the extreme risk in options if silver were to at all stumble, and given the extreme heights to which the stochastic in both the daily and weekly charts have attained (daily shown below), I will no longer contemplate anything other than holding silver for the long term.

While I believe that silver will not see new lows, even if the Dow were to again decline 10,000 points, there is far too much risk in the metal at this time. I only recommend a buy and hold strategy. A potential decline toward $14 should be used to accumulate if it were to indeed decline that far.

This report was completed on July 11, 2020 9:00 PM EST.