The dollar was almost unchanged against most major currencies in subdued trade on Thursday, as markets showed no reaction to the release of disappointing U.S. jobless claims data.

EUR/USD held steady trading around the 1.1160 level.

The dollar showed no reaction to a report by the U.S. Department of Labor saying that initial jobless claims in the week ending June 17 increased by 3,000 to 241,000 from the previous week’s total of 238,000. Analysts expected jobless claims to rise by 2,000 to 240,000 last week.

Meanwhile, USD/CAD dropped 0.86% to trade at 1.3219 after Statistics Canada said retail sales rose 0.8% in April, beating expectations for a 0.2% rise.

Core retail sales, which exclude automobiles, increased by 1.5% in April, compared to expectations for a 0.7% gain.

For today, the euro zone is to publish preliminary data on manufacturing and service sector activity. Ahead of the euro zone surveys, France and Germany will release their own PMI reports.

Later in the day, Canada is to produce data on consumer price inflation and the U.S. will close the week with official data on new home sales.

USD/CAD

Commodity-linked currencies posted significant gains made overnight following a rebound in crude oil prices from 10-month lows.

The Canadian dollar was flat trading around $1.3223 per dollar after rallying 0.75 percent on Thursday.

The USD/CAD also received support from solid domestic retail sales which boosted expectations for an interest rate hike in July from the Bank of Canada.

Later in the day, Canada is to produce data on consumer price inflation and the U.S. will close the week with official data on new home sales.

Pivot: 1.328

Support: 1.3205 1.316 1.3125

Resistance: 1.328 1.3315 1.3345

Scenario 1: short positions below 1.3280 with targets at 1.3205 & 1.3160 in extension.

Scenario 2: above 1.3280 look for further upside with 1.3315 & 1.3345 as targets.

Comment: a break below 1.3205 would trigger a drop towards 1.3160.

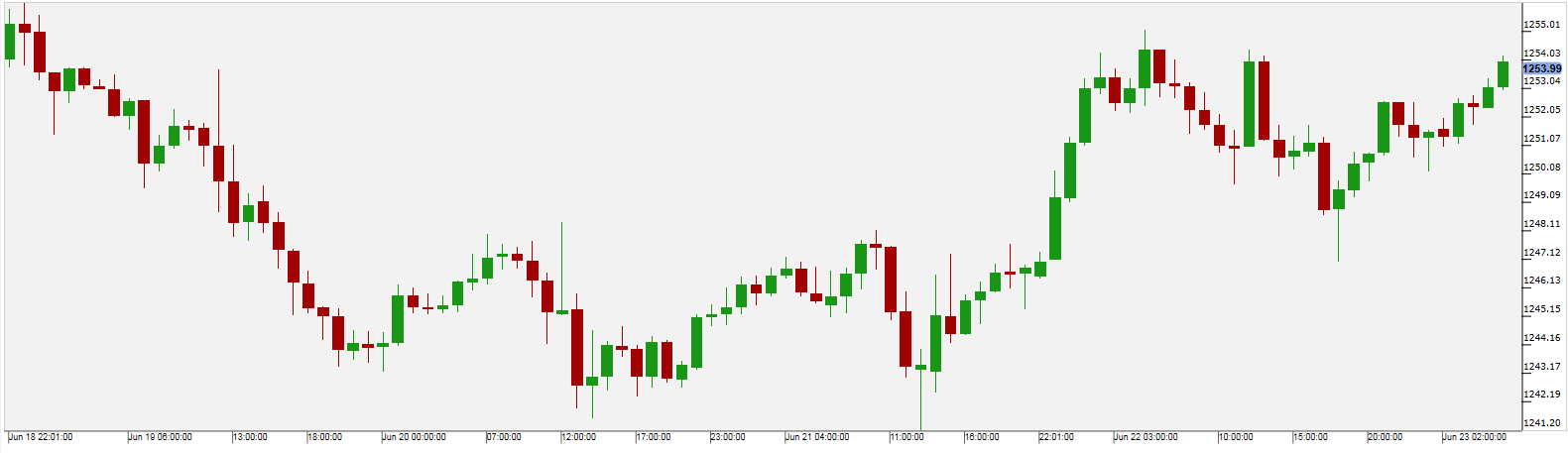

Gold

Gold prices continued to trade higher on Thursday, as the recent strength in the dollar seems to fade, as subdued weekly initial jobless claims data undershot expectations, helping the precious metal shrug off expectations that the Federal Reserve may hike rates later this year.

The latest weekly update on initial jobless claims failed to impress market participants, showing that the number of Americans filing for unemployment benefits increased slightly last week.

Gold prices are trading around $1252 per ounce early on Friday with market participants focusing on today’s housing data from the U.S. as well as some speeches from several Fed members.

Pivot: 1246

Support: 1246 1241 1237.5

Resistance: 1257 1260 1265

Scenario 1: long positions above 1246.00 with targets at 1257.00 & 1260.00 in extension.

Scenario 2: below 1246.00 look for further downside with 1241.00 & 1237.50 as targets.

Comment: the RSI is mixed with a bullish bias

WTI Oil

Oil rose on Thursday, a day after hitting 10-month lows, but market sentiment remained negative because the global oversupply has persisted despite OPEC attempts to cut production.

U.S. crude futures ended up 21 cents a barrel at $42.74 a barrel. On Wednesday, they hit a low of $42.05, their lowest intraday level since August 2016.

Oil prices have fallen about 20 percent this year despite an effort led by the Organization of the Petroleum Exporting Countries (OPEC) to cut production by 1.8 million barrels per day that has been in place since January.

For the remaining of the week, market focus will be shifted towards Friday’s oil rigs data by Baker Hughes.

Pivot: 43.25

Support: 42.3 42.6 41.6

Resistance: 43.25 43.75 44.2

Scenario 1: short positions below 43.25 with targets at 42.30 & 42.00 in extension.

Scenario 2: above 43.25 look for further upside with 43.75 & 44.20 as targets.

Comment: the RSI lacks upward momentum.

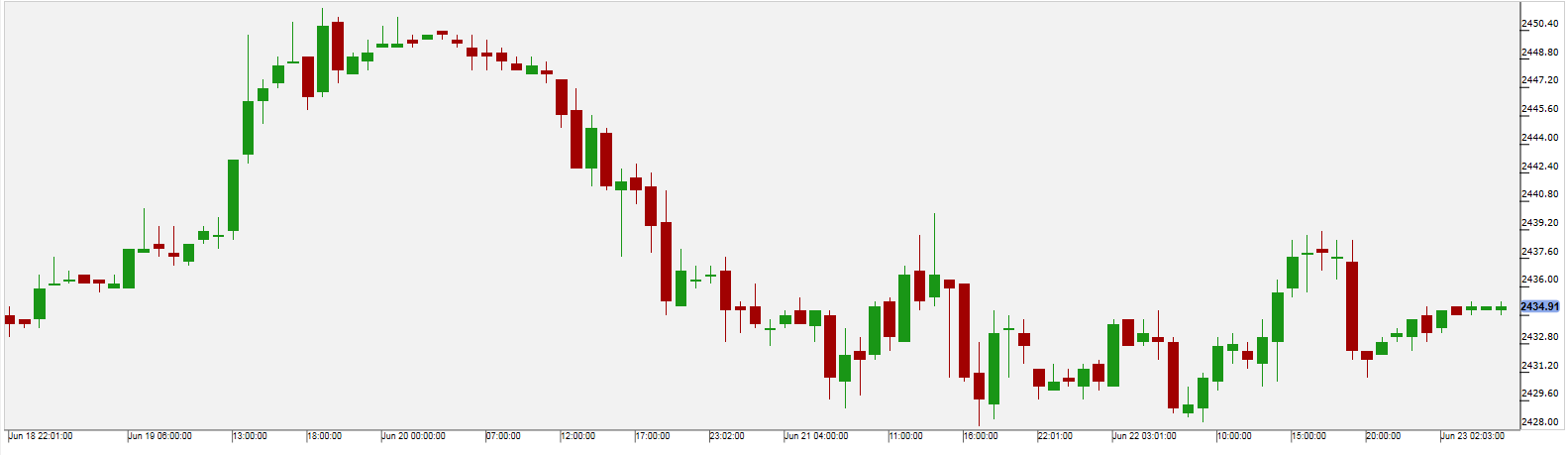

US 500

The main U.S. indices closed mixed on Thursday as a surge in health care stocks was offset by a slump in financials, as banks prepared to release their latest stress test results.

Health stocks extended gains from the previous session, as investors look ahead to the unveiling of Senate’s health care bill, which aims to repeal and replace Obamacare.

The Senate is expected to vote on the bill next week.

Financials, mostly banks, came under pressure during the session, weighing on the broader market as investors braced for the results of 34 banks that were subject to the Fed’s stress tests. Shares of Goldman Sachs (NYSE:GS) closed more than 1% lower.

The Dow Jones closed at 21,397.29, the S&P 500 closed 0.05% lower while the Nasdaq Composite closed at higher by 0.04%.

Pivot: 2439

Support: 2428 2425 2421

Resistance: 2439 2442 2445

Scenario 1: short positions below 2439.00 with targets at 2428.00 & 2425.00 in extension.

Scenario 2: above 2439.00 look for further upside with 2442.00 & 2445.00 as targets.

Comment: the RSI is mixed with a bearish bias.