Dow closes above 23000

US stock indices closed at fresh record highs on Wednesday as corporate reports kept beating expectations. The dollar weakened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, slipped 0.1% to 93.407. The S&P 500 added 0.1% settling at a record 2561.26. The Dow Jones Industrial Average rose 0.2% to new record high 23157.60 led by 8.9% jump in IBM (NYSE:IBM) a day after it posted better than expected quarterly results. Nasdaq composite ended fractionally higher at fresh record high 6624.22.

European markets recover

European stocks resumed advances on Wednesday on euro weakness during the session. Both the euro and British Pound ended higher against the dollar. The Stoxx Europe 600 index added 0.3% reversing previous session loss. Germany’s DAX 30 rose 0.4% to 13043.03. France’s CAC 40 gained 0.4% and UK’s FTSE 100 climbed 0.4% to 7542.87. Indices opened lower today.

Asian indices mixed as China growth slows

Asian stock indices are mixed today after the report China’s third-quarter GDP slowed to 6.8% from 6.9% growth in second quarter. Nikkei rose 0.4% to 21448.52 supported by continued yen weakness against the dollar and data showing Japanese exports rose for the 10th straight month in September. Chinese stocks are mixed: the Shanghai Composite Index is 0.5% lower while Hong Kong’s Hang Seng Index is down 0.6%. Australia’s ASX All Ordinaries added 0.1% despite stronger Australian dollar against the greenback.

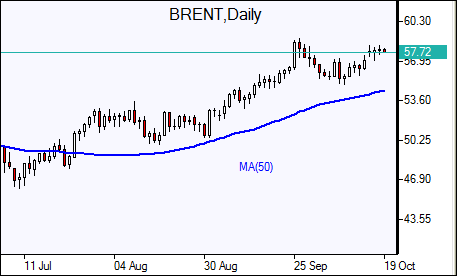

Oil slips

Oil futures prices are edging lower today. Prices ended higher yesterday after US Energy Information Administration report domestic crude supplies fell by 5.7 million barrels last week. That was below the 7.1 million barrel decline reported by the American Petroleum Institute late Tuesday. Brent crude rose 0.5% to $58.15 a barrel on Wednesday.