Dow falls eighth session in a row

US stocks erased previous day gains on Thursday led by energy stocks, down 1.9%. The S&P 500 lost 0.6% to 2749.76. Dow Jones industrial average fell 0.8% to 24461.70. The Nasdaq composite dropped 0.9% to 7712.95. The dollar weakened despite a 3000 drop in initial jobless claims to 218000, while the Philadelphia FED’s manufacturing index slowed sharply to 19.9 in June from 34.4: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.3% to 94.812 and is lower currently. Stock index futures indicate higher openings today.

Upbeat economic data supported the market sentiment after market pullback following hawkish Federal Reserve statement the previous day. Stocks reversed earlier gains after technology shares sold off. Retail sales jumped by 0.8% in May, twice as high as expected. Initial jobless claims dropped by 4,000 to 218,000 last week. Also, the import price index in May rose by 0.6% for the second straight month, further evidence of building inflation. Separately, business inventories in the US rose 0.3% in May to rebound from a decline in the prior month.

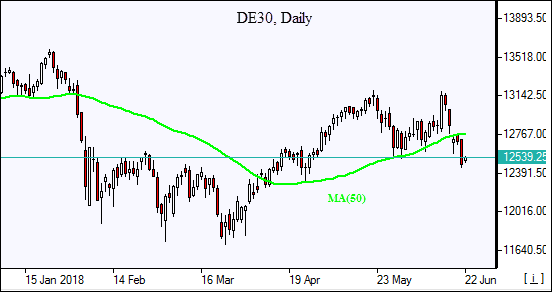

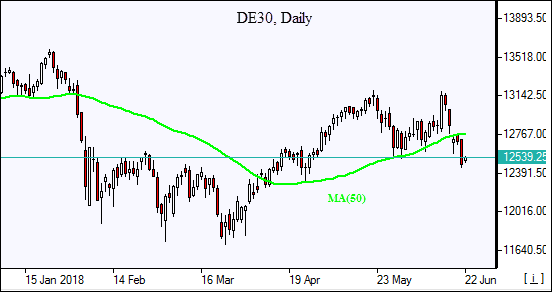

DAX leads European indices losses

European stock indices pulled back on Thursday. Both the British Pound and euro turned higher against the dollar and are up currently. The Bank of England kept rates on hold, but three out of the nine policy makers voted in favor of higher rates, up from two at the May meeting. The Stoxx Europe 600 index fell 0.9%. Germany’s DAX 30 dropped 1.4% to 12511.91 led by automaker stocks. France’s CAC 40 lost 1.1% and UK’s FTSE 100 fell 0.9% to 7556.44. Indices opened mixed today.

The European Central Bank said it would continue buying 30 billion euros a month of bonds through September, as planned, reducing the purchase amount in October to 15 billion euros a month and running purchases through the end of December. The purchases will end in December. The ECB said rates will remain at their present lows “at least through the summer of 2019.”

Chinese stocks recover

Asian stock indices are mixed today as traders contemplate trade war tensions after President Trump enacted $50 billion tariffs on Chinese goods. Nikkei ended 0.8% lower at 22516.83 led by automakers despite yen reversal lower against the dollar. Chinese stocks are recovering: the Shanghai Composite Index is 0.5% higher and Hong Kong’s Hang Seng Index is up 0.4%. Australia’s All Ordinaries Index is down 0.1% as Australian dollar accelerated gains against the greenback.

Brent recovers as Iran resists calls to expand output

Brent futures prices are rising today as Iran says doesn't think OPEC can reach a deal at meeting in Vienna to increase output. Saudi Arabia proposes raising output by 1 million barrels per day, Prices ended lower yesterday: Brent for August settlement closed 2.3% lower at $73.05 a barrel on Thursday.

US stocks erased previous day gains on Thursday led by energy stocks, down 1.9%. The S&P 500 lost 0.6% to 2749.76. Dow Jones industrial average fell 0.8% to 24461.70. The Nasdaq composite dropped 0.9% to 7712.95. The dollar weakened despite a 3000 drop in initial jobless claims to 218000, while the Philadelphia FED’s manufacturing index slowed sharply to 19.9 in June from 34.4: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.3% to 94.812 and is lower currently. Stock index futures indicate higher openings today.

Upbeat economic data supported the market sentiment after market pullback following hawkish Federal Reserve statement the previous day. Stocks reversed earlier gains after technology shares sold off. Retail sales jumped by 0.8% in May, twice as high as expected. Initial jobless claims dropped by 4,000 to 218,000 last week. Also, the import price index in May rose by 0.6% for the second straight month, further evidence of building inflation. Separately, business inventories in the US rose 0.3% in May to rebound from a decline in the prior month.

DAX leads European indices losses

European stock indices pulled back on Thursday. Both the British Pound and euro turned higher against the dollar and are up currently. The Bank of England kept rates on hold, but three out of the nine policy makers voted in favor of higher rates, up from two at the May meeting. The Stoxx Europe 600 index fell 0.9%. Germany’s DAX 30 dropped 1.4% to 12511.91 led by automaker stocks. France’s CAC 40 lost 1.1% and UK’s FTSE 100 fell 0.9% to 7556.44. Indices opened mixed today.

The European Central Bank said it would continue buying 30 billion euros a month of bonds through September, as planned, reducing the purchase amount in October to 15 billion euros a month and running purchases through the end of December. The purchases will end in December. The ECB said rates will remain at their present lows “at least through the summer of 2019.”

Chinese stocks recover

Asian stock indices are mixed today as traders contemplate trade war tensions after President Trump enacted $50 billion tariffs on Chinese goods. Nikkei ended 0.8% lower at 22516.83 led by automakers despite yen reversal lower against the dollar. Chinese stocks are recovering: the Shanghai Composite Index is 0.5% higher and Hong Kong’s Hang Seng Index is up 0.4%. Australia’s All Ordinaries Index is down 0.1% as Australian dollar accelerated gains against the greenback.

Brent recovers as Iran resists calls to expand output

Brent futures prices are rising today as Iran says doesn't think OPEC can reach a deal at meeting in Vienna to increase output. Saudi Arabia proposes raising output by 1 million barrels per day, Prices ended lower yesterday: Brent for August settlement closed 2.3% lower at $73.05 a barrel on Thursday.