As I sit here on Halloween night (yes, this show was pre-recorded), waiting to dole out candy to the kids of the neighborhood, I thought I’d thumb through a few my-God-when-will-they-stop-climbing index charts. So here goes………

In the year since Trump was elected, the Dow has climbed nearly six THOUSAND points. What’s surprising is that not once has Trump ever mentioned the strength of equity markets during his tenure. He’s been too focused on the job at hand, and doing it superbly. And no matter what your political point of view, you’ve got to respect that.

Now we have Korea KOSPI. It seems comic to think that only weeks ago the whole world was holding its breath, waiting for nuclear war to break out. What a freakin’ job. Just take one good look at the Kospi index from Korea and tell me how petrified they are about the apocalypse.

The {{27569|Mid-Caps}} are of particular importance to me, because they, like the small caps, have what I consider the cleanest and most interesting pattern. I want to be clear, however, that just because the price is mashed up against resistance doesn’t mean that, blammo, it can’t possibly get above it. On the contrary, it can, as quite a few international markets have done recently.

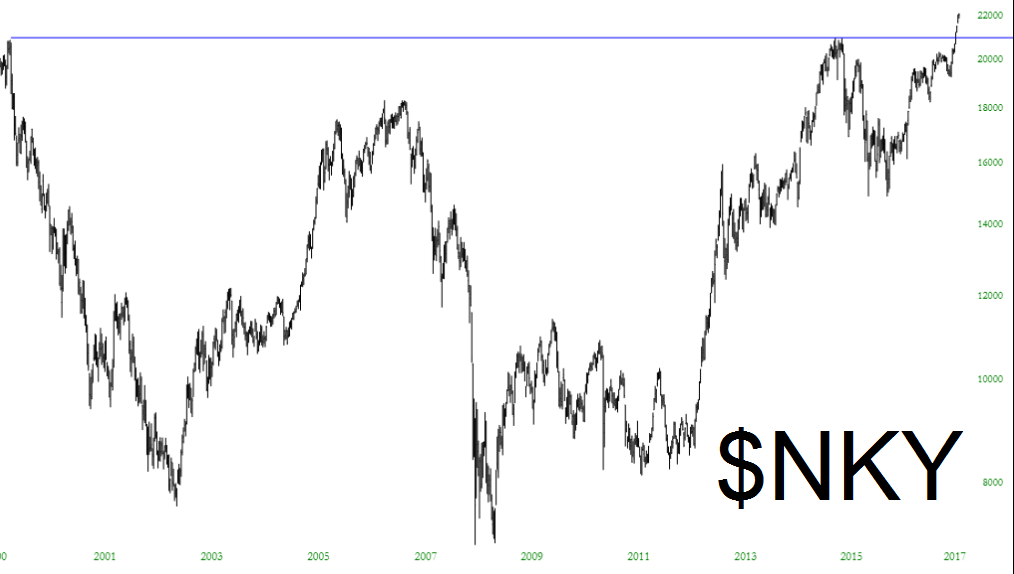

Indeed, the Japanese Nikkei 225 is a good example. It hasn’t been this high in decades.

Even though the S&P 500 is reaching lifetime highs pretty much every day, its own path has become a little more placid (when viewed over many years). It simply keeps crawling higher, little by little, within the tight confines of the channel-within-a-channel I’ve drawn below.

Now that we’re past the seasonally weak period (HA! What a joke THAT was) of September and October, it’ll be interesting to see if the bulls accelerate their gains. To my eyes, seasonality, just like price discovery, has been pretty much obliterated. It’s all about steady, relentless appreciate at this point. Only Saturdays and Sundays are exempt.