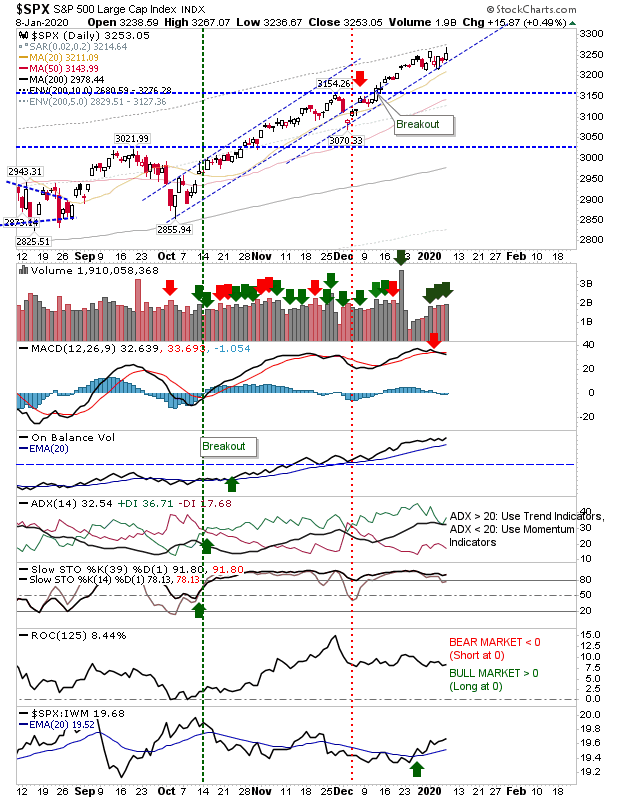

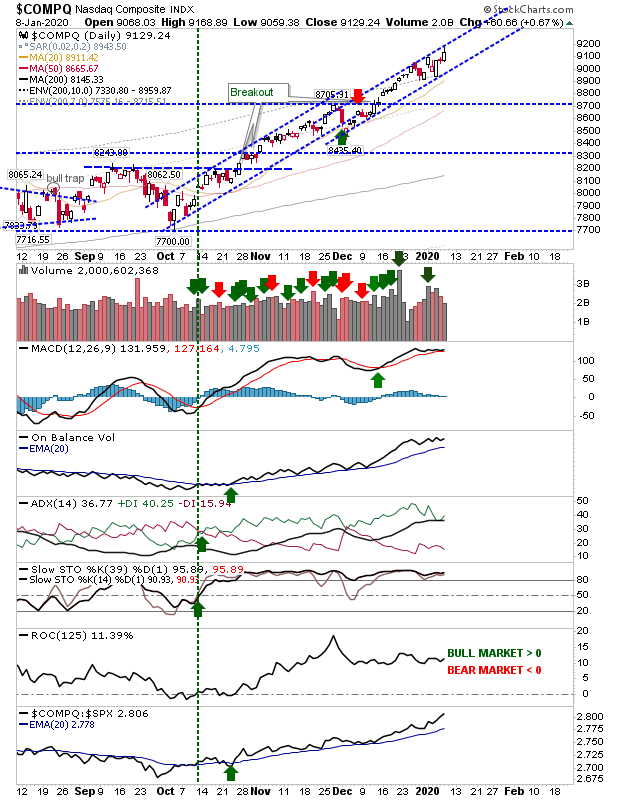

Overall, yesterday was a good day for indices despite Middle East tensions. The margins are small, but the S&P 500 is moving nicely along rising trendline support, while the NASDAQ is running along upper resistance.

The S&P is enjoying a relative performance advantage although the MACD has drifted into a 'sell' trigger. Other technicals are good and price action is strong. Volume inched higher as accumulation.

The NASDAQ is doing a little better than S&P in that its rally is actually running up against resistance as part of a narrow channel. Technicals are all good with no conflicts although the MACD is trending towards a 'sell' trigger.

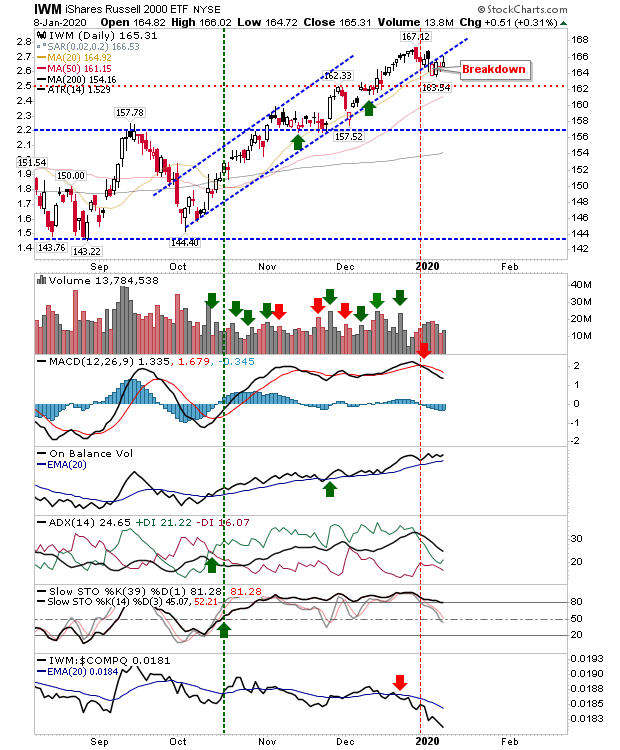

The Russell 2000 had broken from the rising channel as money rotated out of growth stocks into Technology sector stocks. The MACD trigger 'sell' confirmed a slowing of the rising trend - but the trend is continuing.

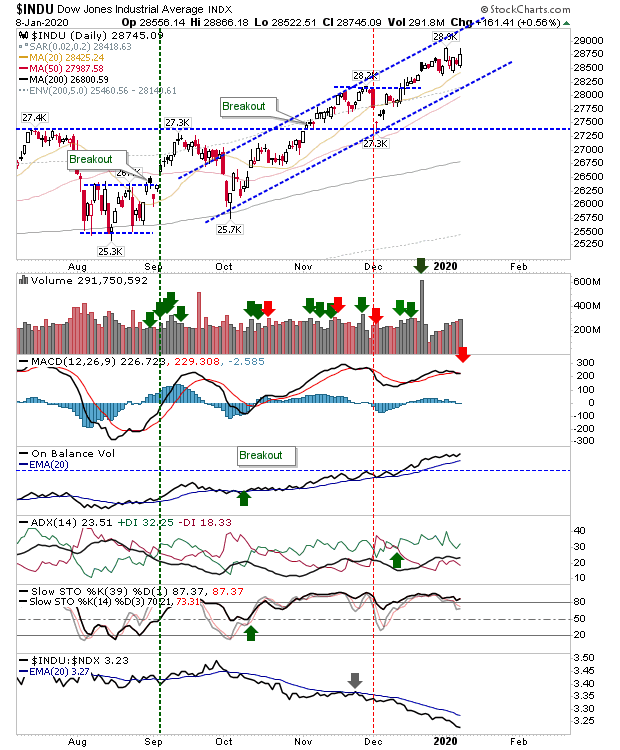

The Dow Jones Index is also trending higher on the back of a sustained relative underperformance against Tech Indices. Again, other technicals are positive and unlike the S&P is not riding along support.

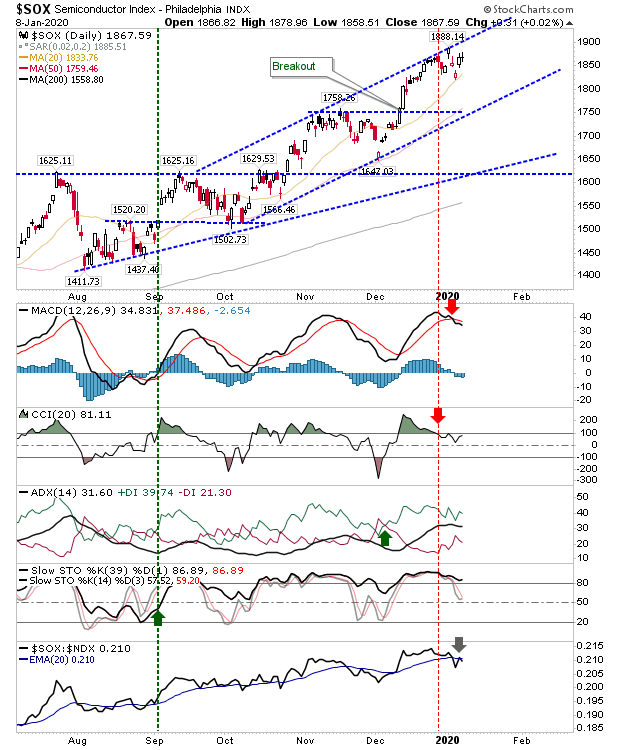

The Semiconductor Index is one of the strongest indices in relative performance having well surpassed the August/September swing highs; this is setting the early tone for 2020.

There is no reason for a change in the outlook as all lead indices chug higher.