Market Brief

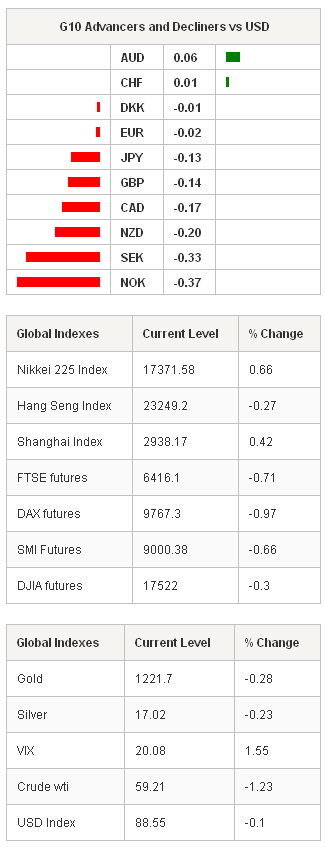

Trading in the forex markets were choppy as we move toward the end-of-year and volatility increases as liquidity thins. From a macro view, the fall in oil prices and political instability emulating from Greece has pushed volatility higher. These mid-term drivers suggest that sustained risk-taking heading into the new year is unlikely and downside probable. Overnight, risk appetite marginally returned to the equity markets (thin demand) but has a mixed follow through into other assets classes. Regional equity indices were mixed as the Nikkei 225 rose 0.66% and Shanghai composite continued to recover up 0.42%, yet the Hang Seng fell -0.13%. S&P futures are lower by 0.1% (pointing to a lower European open). Oil prices continues to fall, pulling down oil currencies. USD/NOK rose to 7.345 (new five-year high) while USD/CAD rose to 1.155. The rest of the FX G10 was unchanged, trading in a sideways pattern. EUR/USD bounced around 1.2385 to 1.2400 as chatter around a “Grexit” declined.

USD/JPY rebounded to 119.00 following Abe calls for a snap lower house election. Following a drop on RBA Stevens interview AUD/USD consolidated around 0.8270. In EM Asia FX, USD/IDR gapped abruptly higher to 12441 from 12340 at the open. On the data front Australia, ANZ consumer confidence index rose +3.9% m/m to 126.5 in December, recovering from a 14-month low of 121.8 in November. Japanese Oct industrial output climbed +0.4% m/m verse a preliminary read of +0.2%. Elsewhere, Prime Minister Abe has called for a snap lower house election to be held on December 14th. While the LDPs approval ratings have dropped slightly there is still a chance Abe will add seats and reaffirm the populace support of “Abenomics”. We suspect that outcome of the vote is more predictable then current media hype, therefore traders should be long USD/JPY.

In an interview with the Australian Financial Review, RBAs Governor Stevens dropped his fair value for the AUD to 75 US cents. From the transcript the Governor stated, "it's quite likely that it (AUD/USD) will a year from now be lower than it is today, on the basis of the facts that we presently have. And, yes, a year ago I said probably 85 US cents was better than 95. And if I had to pick a figure now, I would say probably 75 is better than 85." Today was his strongest and most direct comment yet regarding currency pricing. We remains against cutting rates, yet he added that “if at some point we can be more helpful for confidence by doing something different, then obviously that will be on the table, and we will take a fresh look at all these things in the new year.” While the benefits of falling terms of trade might be larger than anticipated, we still see the Australian growing economic momentum as shaky and see further downside to AUD/USD (even without additional interest rate easing).

With the concerns of the US debt, no longer an issue to the American public and unlikely the Republicans would push for cuts under their watch, the House easily passed a $1.1 trillion spending bill just hours before government funding ran out. The Senate now needs to vote although we suspect that the spending measure will pass with now incident (avoiding a government shutdown). All-in-all an non-event for financial markets.

Swissquote SQORE Trade Idea:

G10 Currency Trend Model: Buy USDJPY at 118.888

| Today's Calendar | Estimates | Previous | Country / GMT |

|---|---|---|---|

| GE Nov Wholesale Price Index MoM | - | -0.60% | EUR / 07:00 |

| GE Nov Wholesale Price Index YoY | - | -0.70% | EUR / 07:00 |

| FR 3Q F Wages QoQ | - | 0.20% | EUR / 07:45 |

| FR Oct Current Account Balance | - | -1.2B | EUR / 07:45 |

| UK Oct Construction Output SA MoM | 0.70% | 1.80% | GBP / 09:30 |

| UK Oct Construction Output SA YoY | 1.30% | 3.50% | GBP / 09:30 |

| EC Oct Industrial Production SA MoM | 0.20% | 0.60% | EUR / 10:00 |

| EC Oct Industrial Production WDA YoY | 0.70% | 0.60% | EUR / 10:00 |

| EC 3Q Employment QoQ | - | 0.20% | EUR / 10:00 |

| US Nov PPI Final Demand MoM | -0.10% | 0.20% | USD / 13:30 |

| CA Nov Teranet/National Bank HPI YoY | - | 5.40% | CAD / 13:30 |

| US Nov PPI Ex Food and Energy MoM | 0.10% | 0.40% | USD / 13:30 |

| CA Nov Teranet/National Bank HP Index | - | 167.99 | CAD / 13:30 |

| US Nov PPI Ex Food, Energy, Trade MoM | 0.10% | 0.10% | USD / 13:30 |

| US Nov PPI Final Demand YoY | 1.40% | 1.50% | USD / 13:30 |

| US Nov PPI Ex Food and Energy YoY | 1.80% | 1.80% | USD / 13:30 |

| US Nov PPI Ex Food, Energy, Trade YoY | 1.70% | 1.60% | USD / 13:30 |

| CA Bloomberg Dec. Canada Economic Survey | - | - | CAD / 14:00 |

| US Dec P Univ. of Michigan Confidence | 89.5 | 88.8 | USD / 14:55 |

Currency Tech

EUR/USD

R 2: 1.2600

R 1: 1.2532

CURRENT: 1.2474

S 1: 1.2360

S 2: 1.2248

GBP/USD

R 2: 1.5826

R 1: 1.5763

CURRENT: 1.5721

S 1: 1.5683

S 2: 1.5590

USD/JPY

R 2: 121.85

R 1: 119.05

CURRENT: 118.05

S 1: 117.24

S 2: 115.46

USD/CHF

R 2: 0.9839

R 1: 0.9725

CURRENT: 0.9649

S 1: 0.9595

S 2: 0.9531