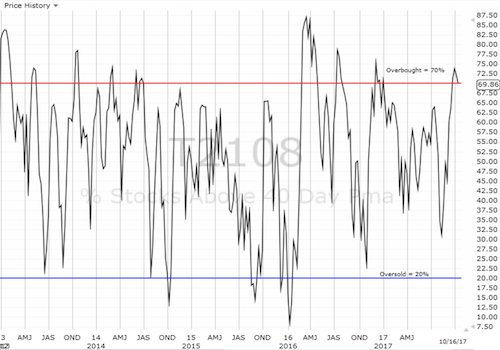

AT40 = 69.9% of stocks are trading above their respective 40-day moving averages (DMAs) – ended 12 straight days overbought

AT200 = 59.7% of stocks are trading above their respective 200DMAs

VIX = 9.9

Short-term Trading Call: bullish (see caveats below)

Commentary

AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), slipped below the overbought threshold at 70%. The overbought period ended at 12 days. Yet the trading action in general did not confirm the bearish implications of this drop.

The S&P 500 (SPDR S&P 500 (NYSE:SPY)) and the NASDAQ printed a new marginal all-time high yesterday. Largely thanks to Apple (NASDAQ:AAPL), the PowerShares QQQ ETF (NASDAQ:QQQ) gapped up to a new all-time high with a 0.3% gain.

Financials continued a strong rebound with a 0.7% gain from the Financial Select Sector SPDR ETF (NYSE:XLF). From these moves alone, I would have guessed that the stock market is ready to leave its drift behind and begin a fresh lift-off.

Small caps in the form of the iShares Russell 2000 ETF (NYSE:IWM) slipped ever so slightly, but the move hardly qualified as a source of alarm. The Energy Select Sector SPDR ETF (NYSE:XLE) faded from its highs to gain 0.2%. The smallest hint of trouble came from the volatility index, the VIX, which actually managed to hold onto the gain from a gap up to 9.9. Still, this move was well within the realm of noise.

The retail sector provided some truly bearish news, but SPDR S&P Retail ETF (NYSE:XRT) has been in a bearish mood for most of 2017. Last week, XRT confirmed resistance at its 200DMA and yesterday confirmed 50DMA resistance with a lower close since last Thursday’s breakdown.

The SPDR S&P Retail ETF (XRT) is back to confirming its bearish momentum for 2017.

So while AT40 formed a bearish divergence from the market, I think the move was far too subtle to ring my alarm bells. However, if the S&P 500 closes below the previous breakout on October 5th (below 2540) while AT40 continues to descend, then I will at least switch the trading call to cautiously bullish. Until then, I am keeping the bias on bullish and am looking for AT40 to quickly return to overbought territory.

As a reminder, given earnings season is in full swing, market conditions and technicals can change on a dime!

STOCK CHART REVIEWS

If I only had the chart of Apple (AAPL), I would not have guessed that the market’s technicals took a potentially bearish turn.

Presumably helped by an upgrade, Monday proved magical for AAPL once again. The stock gained 1.8% after gapping up and over 50DMA resistance. This breakout confirmed support from the bottom of August’s post-earnings gap up. AAPL neatly tested this support last month.

Apple (AAPL) broke out on a small increase in trading volume.

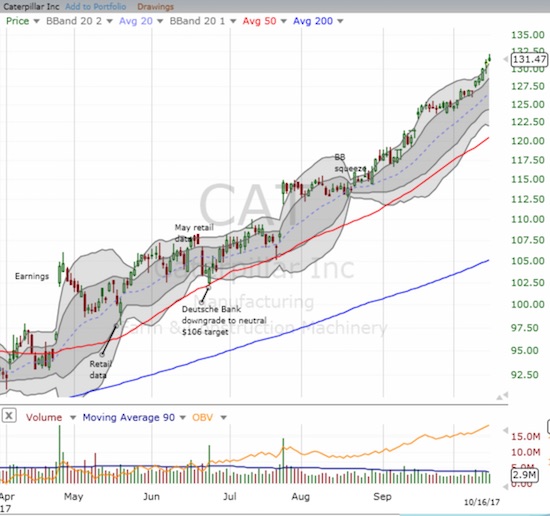

Caterpillar (NYSE:CAT)

CAT is one of my favorite indicators for market bullishness. Like AAPL, CAT alone tells me the market is back to lift-off mode. CAT gained 0.6% and closed above its upper-Bollinger® Band (BB) for the second day in a row.

It is hard to find a chart more bullish than Caterpillar’s (CAT) recent momentum.

iShares MSCI Turkey ETF (NASDAQ:TUR)

You can’t make this stuff up…buyers stepped into the sell-off in TUR right at 200DMA support. A picture-perfect bounce quickly erased the losses driven by a fresh diplomatic dispute between the U.S. and Turkey.

The iShares MSCI Turkey ETF (TUR) delivered a picture-perfect test of 200DMA support.

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Be careful out there!

Full disclosure: long UVXY calls, long AAPL call option

*Charting notes: FreeStockCharts.com uses midnight U.S. Eastern time as the close for currencies. Stock prices are not adjusted for dividends.