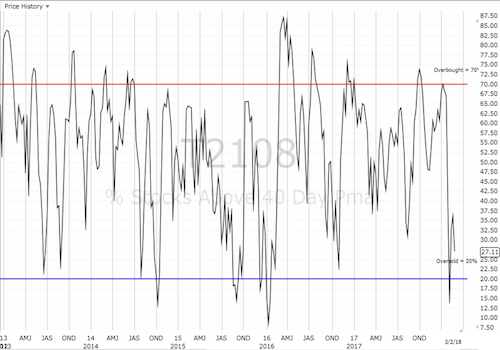

AT40 = 39.3% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 49.7% of stocks are trading above their respective 200DMAs

VIX = 17.8%

Short-term Trading Call: neutral

Commentary

“Dear President Trump:

We are writing to express deep concern about the prospect of broad, global tariffs on aluminum and steel imports. Because tariffs are taxes that make U.S. businesses less competitive and U.S. consumers poorer, any tariffs that are imposed should be designed to address specific distortions caused by unfair trade practices.” – letter to POTUS signed by 100 House Republicans.

This quote is from the beginning of a short letter 100 House Republicans sent to President Trump urging him to reconsider what initially appeared to be a willingness to launch a broad scale trade war against countries with whom the U.S. has trade deficits. The letter ended with specific recommendations for very limited and constrained conditions for implementing tariffs. With this letter, and other developments, the tripwire that the President pulled on a trade war is gradually getting defused. Accordingly, the risk to the stock market is fading. Of course, the President reserves the opportunity to upset the apple cart at any time for any reason, but for now, it seems very likely that the President will be constrained by multiple political and economic forces.

On the economic side, there is evidence that prices are already soaring in anticipation of tariffs. In a brief but fascinating interview on Marketplace, Delaware Steel CEO Lisa Goldenberg talked about how the price of steel her company delivers into the non-residential construction market spiked 30% in immediate response to Trump’s declaration of trade war. Goldenberg also emphatically predicted that Trump will rein in the most heated part of his rhetoric on tariffs; she is running her business as if the sudden windfall from tariff-inspired price gains will not last.

“This is once in a lifetime, this is where you make money. The question is, when this ‘falls apart,’ when this changes, I don’t want to be left with extraordinarily high-priced inventory. So I need to be extra, extra cautious. Let’s remember, there are no new tariffs. This is a conversation…

Of course they’re going to be pulled back, and they may be pulled back before they even happen. We will have tariffs….Do I think they will look like what’s proposed? No, I do not.”

This extended preamble sets the stage for a market that is ready to confirm its post oversold recovery. The S&P 500 (via SPDR S&P 500 (NYSE:SPY)) has yet to pass a critical test of resistance at its 50-day moving average (DMA) and needs just one more nudge…

The S&P 500 (SPY) has stopped short of 50DMA resistance the last three days.

The NASDAQ and the PowerShares QQQ ETF (NASDAQ:QQQ) managed to eke out the smallest of gains on the day. The big surprise was the Shares Russell 2000 ETF (NYSE:IWM). IWM went from laggard to leader – its 0.9% gain on Wednesday confirmed a 50DMA breakout.

The iShares Russell 2000 ETF (IWM) suddenly looks ready to challenge its all-time high.

The volatility index, the VIX, nudged downward for the fourth straight day. The VIX closed at 17.8. It went as high as 26.2 last Friday. The VIX will surely plunge below the 15.35 pivot if the market confirms its bullishness with an S&P 500 breaking out. The jobs report on Friday is a huge wildcard.

AT40 (T2108), the percentage of stocks trading above their respective 40DMAs, closed at 39.3%. The closing high since the last oversold period was 39.8%. So, like the S&P 500, AT40 is just one rally day away from a breakout that would signal the official return of control of the market to the buyers and bulls. Once (if?) that happens, I can flip my short-term trading call from neutral and back to (cautiously?) bullish.

CHART REVIEWS

Twilio (NYSE:TWLO)

TWLO is back.

In mid-February, TWLO soared 16.2% after reporting well-received earnings. I was VERY late to catch on to the implications and only bought back into a position last week. TWLO has barely taken a breather on its way to a 4-month high. The stock took the scenic route, but it seems finally the CEO’s purchase almost a year ago is truly validated.

Twilio (TWLO) is now up 48.4% since reporting earnings as the market scrambles to reprice the company’s prospects.

Twitter (NYSE:TWTR)

I have yet to get a position going again in TWTR. I tried to get a good price on a call spread, but the stock failed to come back intraday. The stock made a new breakout to a new 2-year and 7-month high. Notice the first signs of a Bollinger Band (BB) squeeze forming around the price action.

A new post-earnings high for Twitter (TWTR) means it is closing on a 3-year high.

Walmart (NYSE:WMT)

WMT is still moving opposite the post-oversold recovery story. The stock bounced off 200DMA support last Friday, but on Wednesday retested that critical support line. A confirmed breakdown below this support would officially end my 2018 retail trade thesis. That thesis would shrivel to a recovery story for just a few select promising stocks.

Walmart (WMT) is on the edge of a bearish breakdown. The stock is already in “bear” territory with a 20.0% pullback from its all-time high set at the end of January.

Amazon.com (NASDAQ:AMZN)

AMZN is still showing off and is likely part of the reason WMT has yet to recover from its disastrous post-earnings response. On Wednesday, AMZN made a new marginal all-time high.

Amazon.com (AMZN) was barely scathed by the latest market angst. Each day this week has closed on a new all-time high.

Trades related to previous posts past 3 trading days: flipped QQQ calls twice, bought CAT puts and shorted shares, flipped CAT calls, bought MCD calendar call spread, opened pairs trade long iShares Silver (NYSE:SLV) calls and SPDR Gold Shares (NYSE:GLD) puts, bought fresh Apple Inc (NASDAQ:AAPL) call expiring next week as it appears last week’s calendar spread will end in a loss.

“Above the 40” uses the percentage of stocks trading above their respective 40-day moving averages (DMAs) to assess the technical health of the stock market and to identify extremes in market sentiment that are likely to reverse. Abbreviated as AT40, Above the 40 is an alternative label for “T2108” which was created by Worden. Learn more about T2108 on my T2108 Resource Page. AT200, or T2107, measures the percentage of stocks trading above their respective 200DMAs.

Active AT40 (T2108) periods: Day #14 over 20% (overperiod), Day #3 over 30%, Day #21 under 40%, Day #21 under 50%, Day #22 under 60%, Day #28 under 70%

Daily AT40 (T2108)

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Weekly AT40 (T2108)

Be careful out there!

Full disclosure: short VXX, long UVXY calls, long SPY call, long CAT call