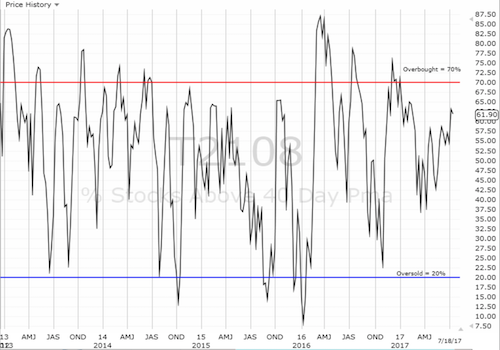

AT40 = 61.9% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 59.8% of stocks are trading above their respective 200DMAs

VIX = 9.9 (volatility index)

Short-term Trading Call: cautiously bullish

Commentary

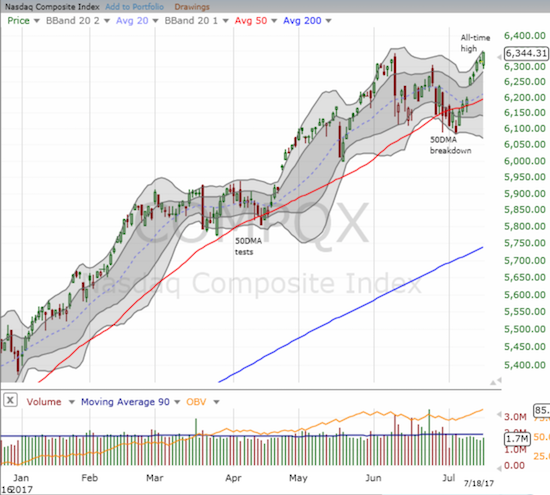

The S&P 500 (SPY (NYSE:SPY)) closed effectively flatline with a point and a half gain. The NASDAQ returned to the new-high business with a 0.5% gain. The PowerShares QQQ ETF (NASDAQ:QQQ) did not quite reach a new all-time high with its 0.7% gain on the day.

The S&P 500 (SPY) made a marginal new all-time high.

The NASDAQ rejoined the new all-time high crew with a small yet convincing rally.

The PowerShares QQQ ETF (QQQ) out-performed the NASDAQ but could not quite reach a new all-time high.

AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), failed to benefit from the gains in tech and closed DOWN to 61.9% from 65.4%. This retreat was right on the border of a bearish fade from the overbought threshold (70%). My short-term trading call survived at cautiously bullish. I even chose to buy call options on QQQ after it recovered from the day’s small loss. I did the same on Apple (NASDAQ:AAPL). I also bought call options on ProShares Short VIX Short-Term Futures (NYSE:SVXY) (SVXY) for (hopefully) a quick flip.

Now for some action in individual stocks…

Chipotle Mexican Grill (NYSE:CMG)

Sometimes it really pays to follow a stock very closely.

As regular readers know, I have periodically followed CMG for weekly trades. For a number of weeks earlier in the year I was focused on buying weekly call options. I switched to buying put options after the stock broke down below 200DMA support in the wake of the company’s updated guidance. On Monday, July 17, 2017, I noticed the put options were unusually expensive, yet I found no upcoming news for the week like earnings (which are next week). I almost decided to drop my regular purchase of put options for the week. However it occurred to me that the market just might be saying it expected some bad news to come.

On Tuesday morning, Maxim Group upgraded CMG from hold to buy and upped its price target from $440 to $470. As the stock gapped up, I thought the trade was already over. I prepared to get stopped out of my position. Instead, the stock soon began to weaken. Within an hour, the selling accelerated into news about an outbreak of food-borne illness at a Chipotle restaurant in Sterling, VA in the larger DC metro area. CMG ended up closing the day with 4.3% loss and was down as much as 7.5% at its low of the day.

Chipotle Mexican Grill (CMG) plunged in the wake of news of another food-borne illness at a restaurant.

After the news broke, I was not fast enough in changing my preset sell order. While I captured over 3x on the value of the put, it got as high as 9x! Still, I should not complain. In a report that provided more details, Bloomberg revealed that news of potential illness first broke on Monday. While I saw no such news at the time, certainly some traders and/or market makers bid up the value of those puts fearing a pullback: such is the power of the market’s message.

From Bloomberg (emphasis mine):

“Virginia’s Loudoun County health department, which is investigating the matter, said that reports of illnesses first surfaced Monday morning, with local doctors, Chipotle customers and the company itself contacting the agency. The likely source of the illnesses is norovirus, but it will take a few days to get tests back to confirm the cause, according to David Goodfriend, the department’s director.”

If this bug is norovirus, CMG MIGHT get a pass. Norovirus is highly contagious and, unfortunately, all too common in public eating areas. CMG’s food supply is not suspect so far and as a result bargain hunters may quickly appear in CMG. Given my thinking, I turned around and speculated on a call option. The call finished the day with a 33% gain. I will be looking to close out this position as soon as possible.

Harley-Davidson Inc (NYSE:HOG)

It is earnings season, and I am now on the hunt for quick plays on surging market sentiment. One of my favorite plays is to buy call options on a stock that gaps down well below its lower-Bollinger Band (BB) and quickly starts to bounce. This is a great combination that suggests the stock is oversold for at least the very short-term. I quickly bought call options that I sold later in the day once they doubled.

Harley-Davidson, Inc. (HOG) bounced sharply off its post-earnings low but failed to reach its lower-BB.

The weekly chart of Harley-Davidson, Inc. (HOG) shows how the stock ended its uptrend recovery from the January, 2016 trough.

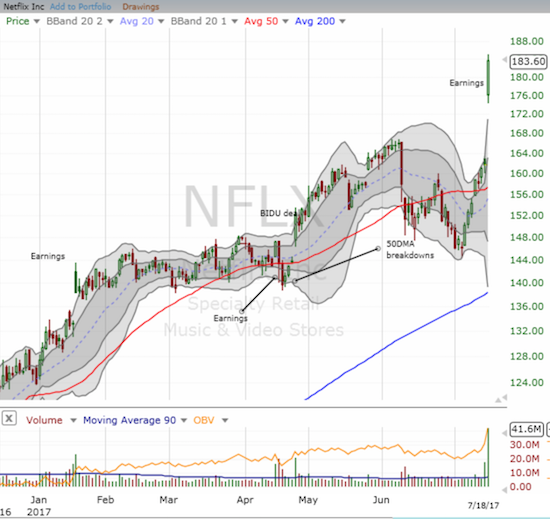

Netflix (NASDAQ:NFLX)

The play on NFLX is the mirror image of the likes of HOG. NFLX gapped up well above its upper-BB. There was a time when I would automatically try to fade such moves just because the stock traded well above the upper-BB. Now I wait for a bit. Informally, I tend to notice that strength begets strength when an earnings reaction sends a stock well above its upper-BB for at least 8%. NFLX opened just around that threshold.

However, I low-balled my offer on call options and missed the boat. Even as I watched the market come tantalizingly close to my offer and then begin to move away, I failed to budge. By the time NFLX closed for the day with a 13.5% gain, I missed out on a 4x play on the call options. Lesson learned on these strength-begets-strength post-earnings plays.

Netflix (NFLX) rides its post-earnings wave to a fresh all-time high.

Ulta Beauty (NASDAQ:ULTA)

ULTA has become a darling momentum stock where harried retail investors can hide from “Amazon (NASDAQ:AMZN) Panic.”

Last week, the stock broke down below 200DMA support for the first time since the spring of 2016. I automatically bought put options and did well as the stock plunged as a follow-up confirming the breakdown. The stock looks ready to continue riding the lower-BBs downward.

I finally came back to the play by fading today’s relief bounce. After the stock kept rising, I realized that a hedged play might be better here, and I added call options to the mix. If the relief rally continues, ULTA should easily test 200DMA resistance quite quickly.

However, I think this swoon that first erased all the gains from the last earnings and next produced 50 and 200DMA breakdowns could be signaling a fundamental change in the character of this stock. I have added ULTA to my short-list of stocks to check daily.

Ulta Beauty (ULTA) is breaking down.

“Above the 40” uses the percentage of stocks trading above their respective 40-day moving averages (DMAs) to assess the technical health of the stock market and to identify extremes in market sentiment that are likely to reverse. Abbreviated as AT40, Above the 40 is an alternative label for “T2108” which was created by Worden. Learn more about T2108 on my T2108 Resource Page. AT200, or T2107, measures the percentage of stocks trading above their respective 200DMAs.

Active AT40 (T2108) periods: Day #356 over 20%, Day #170 over 30%, Day #37 over 40%, Day #8 over 50%, Day #3 over 60% (overperiod), Day #116 under 70%

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Weekly AT40 (T2108)

Be careful out there!

Full disclosure: long AAPL calls, long ULTA calls and puts, long QQQ calls, long CMG calls, long SVXY call

*Charting notes: FreeStockCharts.com uses midnight U.S. Eastern time as the close for currencies.