Momentum Failure Can Be Positive

It is counterintuitive to think a “momentum failure” set-up in stocks could have bullish implications. In this case, the description from stockcharts.com is helpful:

Momentum Failure: The failure to move back into overbought or oversold territory signals a change in momentum that can foreshadow a significant price move. The ability to consistently move above -20 is a show of strength. After all, it takes buying pressure to push %R into overbought territory. Once a security shows strength by pushing into overbought territory more than once, a subsequent failure to exceed this level shows weakening momentum that can foreshadow a decline.

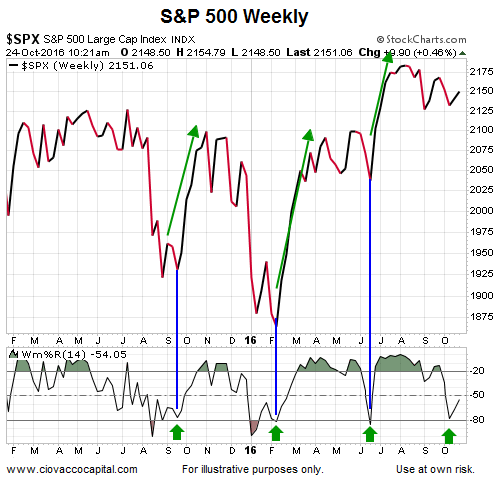

The present day weekly chart of the S&P 500 below shows an example of the case where momentum fails “to move back into oversold territory” (below -80). It is important to understand the difference between a set-up and a confirmed set-up. The chart below illustrates the first step or a set-up. In order for the set-up to be confirmed, the momentum indicator (Wm%R) needs to experience a weekly close above the center line (-50).

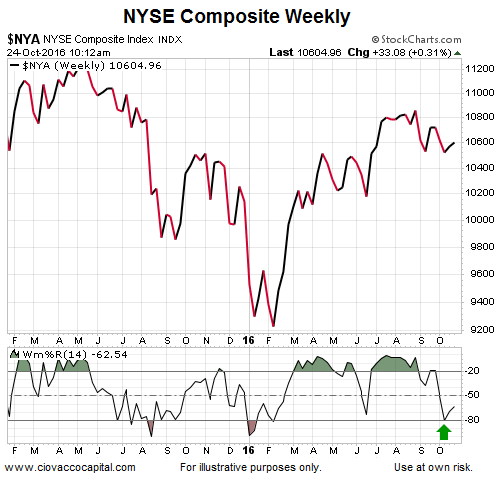

A similar set-up can be found on the chart of the NYSE Composite, telling us if the set-up is confirmed, it may have broad implications above and beyond the S&P 500.

Have Numerous ETFs Broken Below Important Retracements?

This week’s video puts some context around recent weakness in numerous ETFs, including technology (NASDAQ:QQQ), metals (NYSE:DBB), REITS (NYSE:IYR), emerging markets (NYSE:EEM), oil (NYSE:USO), mid-caps (NYSE:MDY) and dividend stocks (NYSE:DVY).

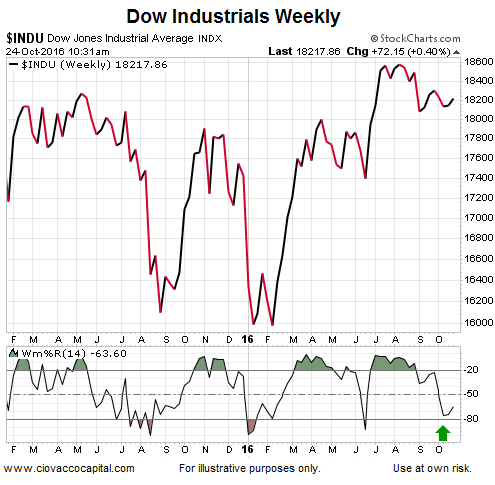

Although the industrial sector (NYSE:DIA) has been lagging the S&P 500 (NYSE:IVV) for several months, the same potentially bullish set-up appears on the chart of the Dow Jones Industrial Average.

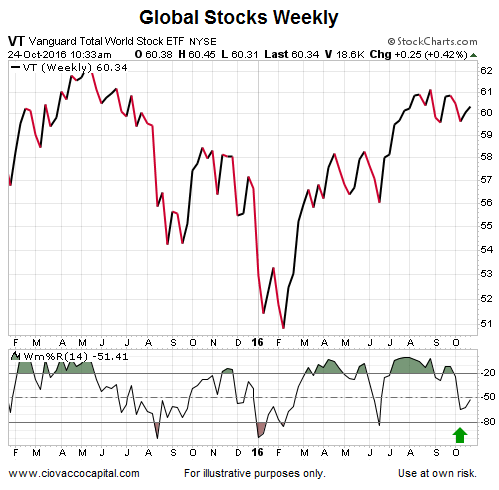

The set-up is broad and extends outside the United States, as illustrated with the weekly chart of global stocks (NYSE:VT) below.

Set-ups mean very little until a confirmation is in place, something that may happen on either Friday, October 28 or Friday, November 4. However, this set-up aligns with information covered on October 10, September 6 and in August.